Every. single. month. another article appears claiming that voluntary carbon credits are giving corporations a licence to pollute. And yes, sometimes carbon credits are used for greenwashing. But it’s usually just that. Selective stories highlighting a few anomalies. When in reality, market trends show that voluntary carbon credit buyers “are already climate leaders”.

But what is a climate leader? A climate leader has three distinct priorities: aggressive decarbonisation, going beyond the value chain by funding high quality climate projects, and transparent communication. Leading by example, they are embedding themselves in a climate positive world. And in doing so, inspire others to do the same.

So sit back, relax, and listen to a true story. One that’s based on facts, not fiction. About how voluntary carbon credit buyers are decarbonising twice as fast as their peers (Ecosystem Marketplace, 2023; Trove Research, 2023; Sylvera, 2023).

Carbon credit buyers decarbonise quicker

Myth: Companies greenwash by buying carbon credits instead of decarbonising.

These reports all agree on one thing. Companies funding climate projects are also decarbonising the fastest.

All in on Climate: The Role of Carbon Credits in Corporate Climate Strategies, Ecosystem Marketplace 2023

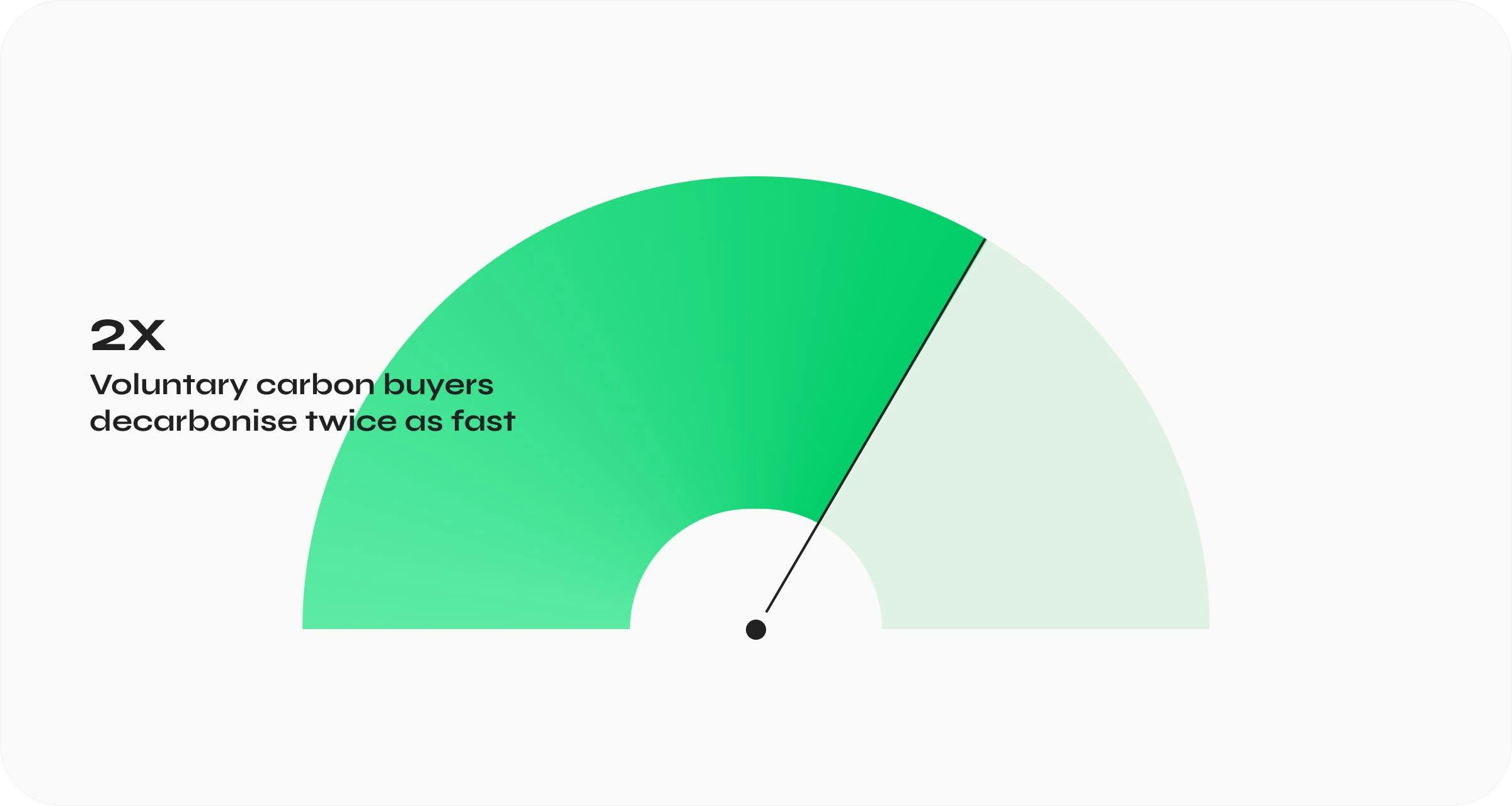

All in on Climate: The Role of Carbon Credits in Corporate Climate Strategies, Ecosystem Marketplace 2023Ecosystem Marketplace found that nearly 60% of carbon credit buyers reported faster year-on-year decarbonisation, compared with companies that do not participate in carbon markets.

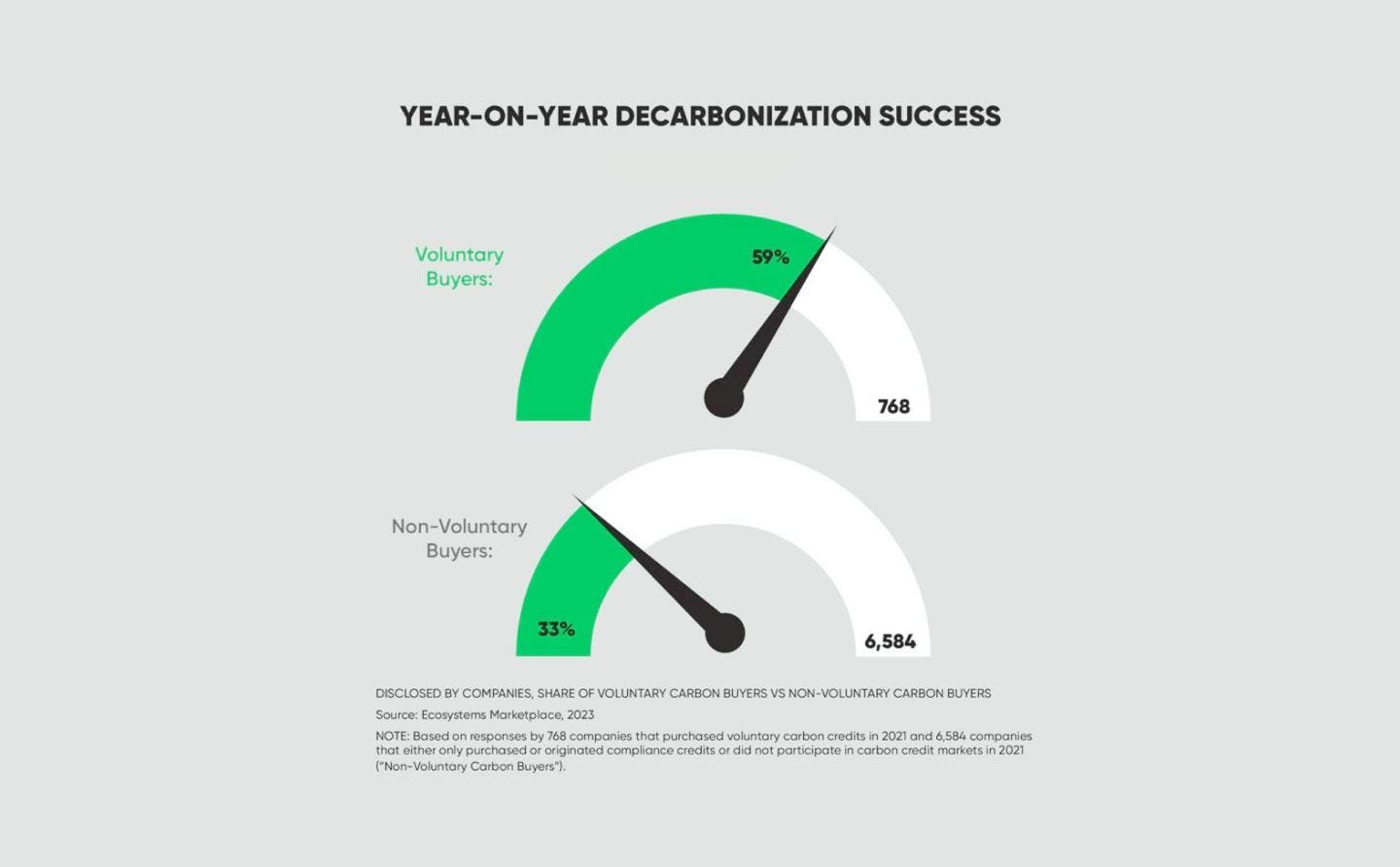

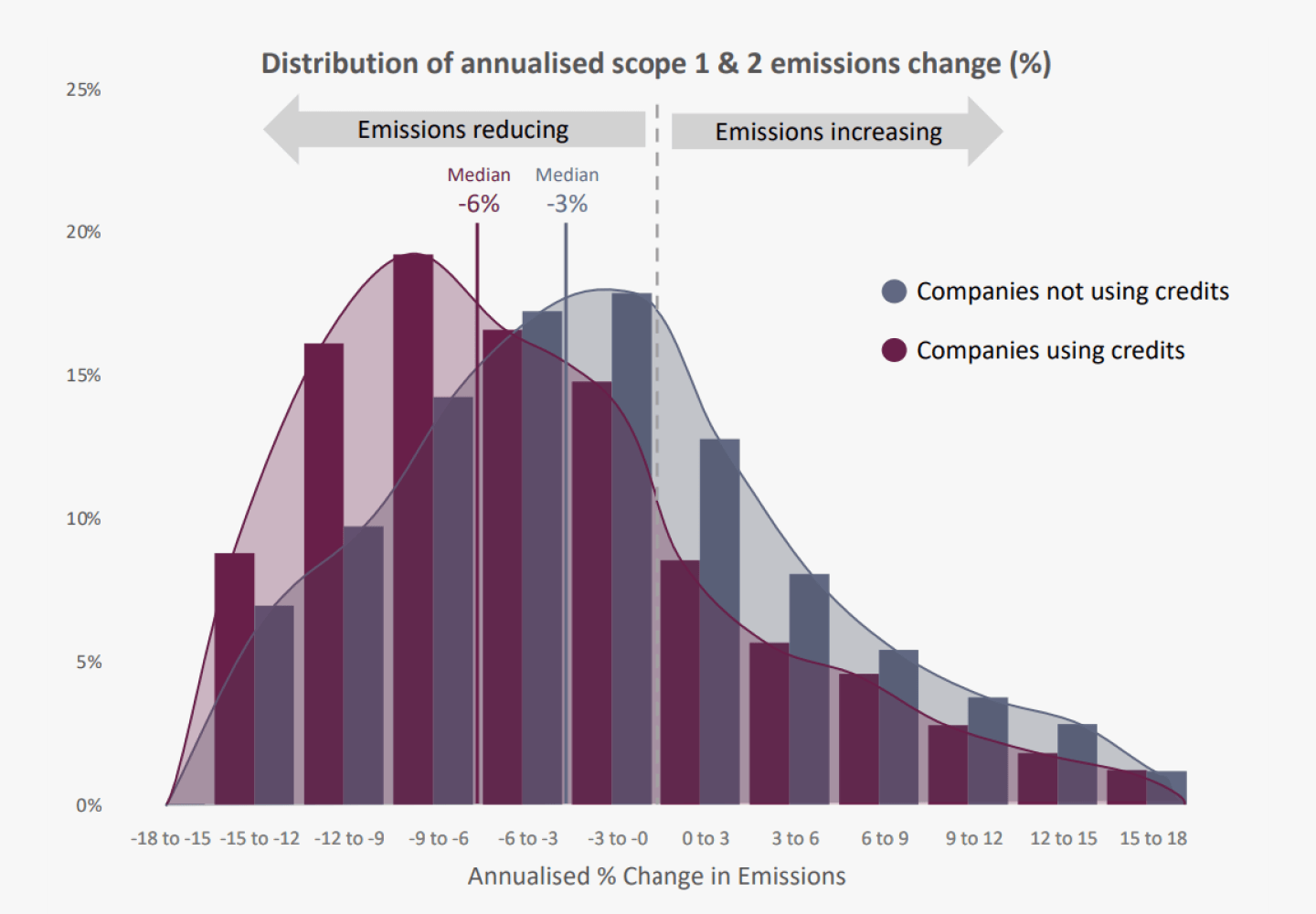

Sylvera found that on average, companies that buy carbon credits are simultaneously cutting their Scope 1 and 2 emissions by 6.2% per year. Meanwhile, companies that don’t use carbon credits are cutting emissions by only 3.4% per year. Demonstrating that purchasing carbon credits coincides with an almost 2x rate of emission reductions.

Finally, Trove Research unearthed that material users of carbon credits decarbonise scope one and two emissions twice as fast as those that don’t. It’s no coincidence that climate leaders are winning both races.

Corporate emission performance and the use of carbon credit, Trove Research, 2023

Corporate emission performance and the use of carbon credit, Trove Research, 2023Climate leaders choose quality and quantity

Myth: carbon credit buyers don’t care where the money goes.

Trove research dives a little deeper to investigate if there are any other variables in the rate of decarbonisation and carbon credit purchases. They found heavier users of credits are on average decarbonising more quickly than lighter users of credits. And further, users of high integrity/higher priced credits, are cutting emissions quicker than users of lower integrity credits.

Only high quality carbon projects provide a carbon buyer assurance that the project is having the positive impact on the planet that they claim to. For climate leaders, leaving this positive climate legacy is their north star.

That’s why at Lune we’ve curated the highest-quality, trusted projects in our library – to help streamline the evaluation process for businesses. Quality is always the primary factor in how we assess projects, always ensuring they have durable, additional, and measurable impact.

Download our quality assessment guide to discover how we vet carbon projects.

Carbon credit buyers are more accountable and transparent

Myth: companies are hiding behind carbon credits.

Transparency and accountability are foundational to climate action. Commonly surfaced through reporting, they enable stakeholders to track a company's progress and share their journey towards a climate positive world.

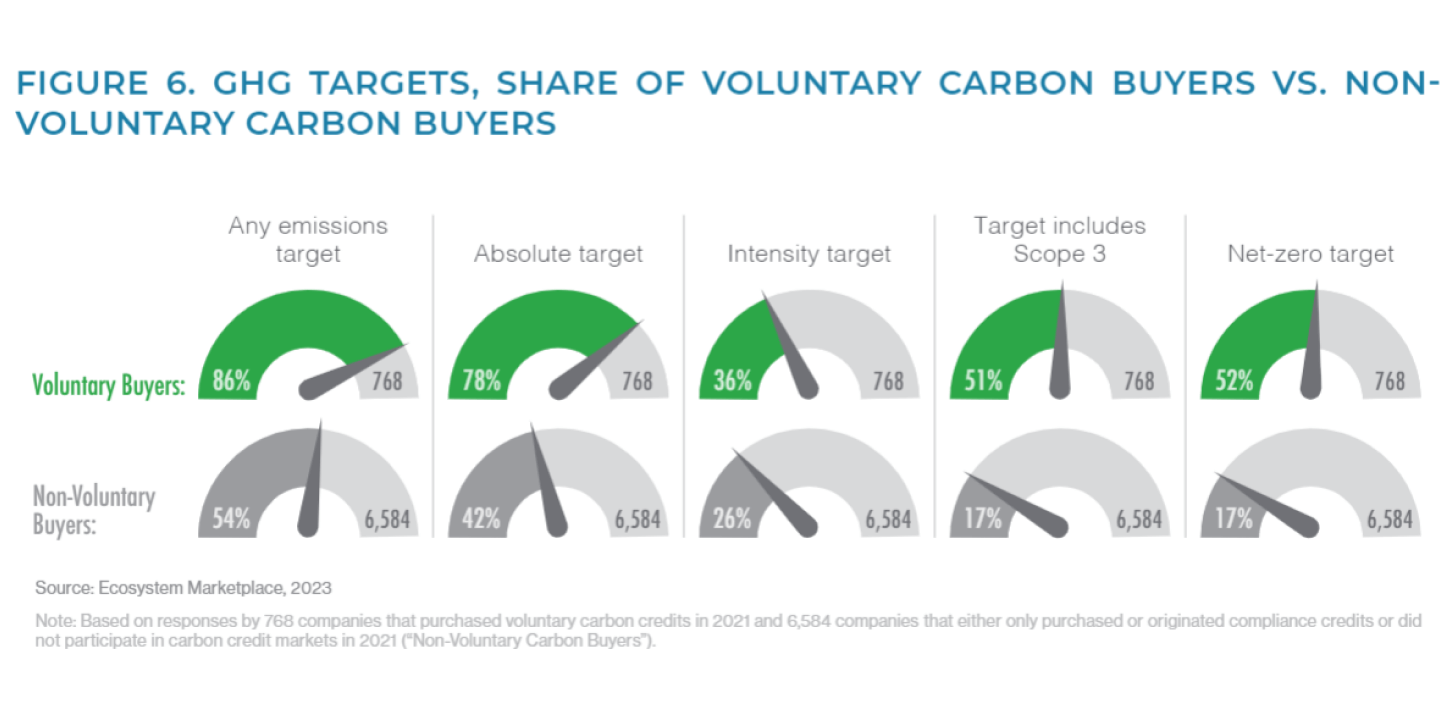

We all have to start somewhere. And climate leaders are not afraid to open their books. Voluntary carbon buyers are more likely to disclose their emissions than their non-buying counterparts by 1.2x (Ecosystem marketplace, 2023). They are determined to make progress, stepping up to the challenge by being three times more likely to include scope 3 in their emission reduction targets making for more ambitious goals.

This ambition is focused, precise, and part of a targeted climate strategy. Ecosystem Marketplace found that voluntary carbon buyers are 3.4x more likely to set approved science-based targets to address climate change. These climate leaders are seeking assurance they are progressing on credible claims.

All in on Climate: The Role of Carbon Credits in Corporate Climate Strategies, Ecosystem Marketplace 2023

All in on Climate: The Role of Carbon Credits in Corporate Climate Strategies, Ecosystem Marketplace 2023Climate champions know where they need to go, what’s the trajectory, and exactly how to get there. And funding climate projects is central to their journey.

Carbon credit buyers engage with their network

Myth: carbon credit buyers are short-sighted.

No single person, company, or government can combat climate change alone. It’s an interconnected problem. Either we all win, or we all lose. This is why it’s best practice to engage with your entire business network to drive holistic and cohesive climate action.

Voluntary carbon buyers are 1.3× more likely to engage their value chain than non-voluntary buyers. Indicating that climate leaders do not buy carbon credits without also working with upstream and downstream stakeholders to reduce negative environmental impacts.

Stakeholder alignment and buy-in overcome steep barriers to climate action. At Lune, we equip you with the knowledge and resources you need to take your climate strategies to the front line and unite company functions.

Companies are doing a terrible job of counterbalancing

Myth: voluntary carbon buyers are buying their way out of a problem.

If they are, they’re doing a terrible job of it.

Of the sample Ecosystem reviewed, credit purchases equated to just 2% of all emission scopes. Suggesting that these climate leaders are not using carbon credits to avoid responsibility for their missions, but mainly using them to offset evergreen emissions.

Subscribe for the latest insights into driving climate positivity

It’s a start. But this 2% must be scaled if we are to reach net zero. The Science-based Target Initiatives defines net zero companies as those who eliminate at least 90% of emissions created by their value chain. Meaning the final 10% of evergreen emissions must be counterbalanced.

True climate leaders go beyond the 10%. They see the opportunity to embed their business in a climate positive world. Building a legacy that leaves communities, ecosystems, and the planet a better place than they found it. Funding high-quality climate projects is the best way to realise this.

Why are companies that fund climate projects more likely to be climate leaders?

The relationship between purchasing carbon credits and being a climate leader is by no means causal. Funding projects certainly won’t mean your emissions disappear overnight. It’s a correlation.

Trove Research suggests that credits attach a price to a company's emissions. This creates an internal cost incentive. To reduce carbon emissions, businesses must now establish a strategy which requires a budget, buy-in from stakeholders, and embeds climate at the very heart of their organisation.

Add climate projects to your strategy

Separating fact from fiction, buying voluntary carbon market credits goes hand-in-hand with an integrated and comprehensive strategy to accelerate global climate action and decarbonise their business.

It’s not one or the other. To be a real climate leader, you have to both decarbonise fast and go beyond your value chain to buy high quality carbon credits. From the data, it's clear that climate leaders understand that climate change is a multifaceted problem that requires multifaceted solutions. We have to be open-minded. That’s why they decarbonise faster while simultaneously going beyond their value chain through funding high integrity climate projects.

- Carbon credit buyers are decarbonsing twice as fast as their peers (Ecosystem Marketplace, 2023; Trove Research, 2023; Sylvera, 2023).

- Nearly 60% of carbon credit buyers reported lower year-over-year carbon emissions (Ecosystem Marketplace, 2023)

- Buyers of high integrity credits credits are cutting emissions quicker than users of lower integrity credits (Trove Research, 2023)

- Voluntary carbon buyers are more likely to disclose their emissions than their non-buying counterparts by 1.2x (Ecosystem marketplace, 2023)

- 9. Voluntary buyers are 3x more likely to include scope 3 in their emission reduction targets making for more ambitious goals (Ecosystem Marketplace, 2023)

- Voluntary carbon buyers are 3.4x more likely to set approved science-based targets (Ecosystem Marketplace, 2023)

- Voluntary carbon buyers are 1.3X more likely to engage their value chain than non-voluntary buyers (Ecosystem Marketplace, 2023)

- Credit purchases equated to just 2% of all emission scopes (Ecosystem marketplace, 2023)

If you’d like to become a climate leader by adding climate projects to your climate strategy, download Lune’s free and complete guide to offsetting.

The data for this blog has been sourced from three different reports, conducted by three independent parties:

- All in on Climate: The Role of Carbon Credits in Corporate Climate Strategies Published October 2023 by Ecosystem Marketplace containing analysis of CDP (Carbon Disclosure Project) reports submitted in 2022 from 7k companies

- Corporate emission performance and the use of carbon credit Published June 2023 by Trove Research analysing 4k companies. The analysis was repeated 120 times using different parameters. T-tests were also run at a 95% confidence level to assess the statistical significance of the results.

- Carbon Credits: Permission to Pollute, or Pivotal for Progress? Published by Sylvera in May 2023, this report analysed data from 102 of the world’s most influential companies spanning nine years (2013-2021).

Popular insights

Popular insights