Fund climate projects

you can trust

The voluntary carbon markets are like the wild west — too often, good intentions can fall short. But when done correctly carbon credits are the single best mechanism to address climate change, biodiversity loss, and humanitarian crises.

Fund climate projects

you can trust

The voluntary carbon markets are like the wild west — too often, good intentions can fall short. But when done correctly carbon credits are the single best mechanism to address climate change, biodiversity loss, and humanitarian crises.

Fund climate projects

you can trust

The voluntary carbon markets are like the wild west — too often, good intentions can fall short. But when done correctly carbon credits are the single best mechanism to address climate change, biodiversity loss, and humanitarian crises.

Fund climate projects

you can trust

The voluntary carbon markets are like the wild west — too often, good intentions can fall short. But when done correctly carbon credits are the single best mechanism to address climate change, biodiversity loss, and humanitarian crises.

High quality and

peace of mind

Fund climate projects rigorously vetted by experts.

High quality and

peace of mind

Fund climate projects rigorously vetted by experts.

Transparency at every level

See where your contributions go.

Transparency at every level

See where your contributions go.

Easy-to-use platform

Cultivate authentic company-aligned climate project portfolios.

Easy-to-use platform

Cultivate authentic company-aligned climate project portfolios.

Shareable insights

Get stakeholder buy-in and enhance your sustainability report.

Shareable insights

Get stakeholder buy-in and enhance your sustainability report.

Eager to accelerate emissions reductions, Moomin budgeted €100,000 annually to fund high-impact carbon projects aligned to the Oxford Offsetting Principles.

This contribution-led approach let them maximize climate impact while they embarked on their road to decarbonisation.

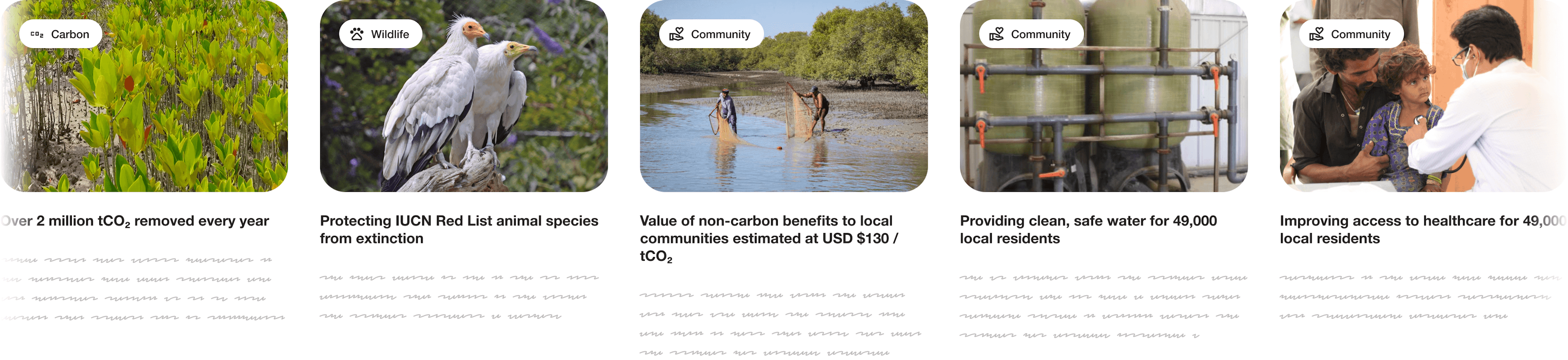

Deliver a positive global impact

Our experts leverage a rigorous vetting process and comprehensive six-point evaluation criteria

to connect you with climate projects that deliver measurable impact and peace of mind.

Out of the hundreds we vet,

only the top 10–20% of climate projects make the cut

Accelerate net zero goals

Meet standards set by the Science Based Target Initiative (SBTi) which expects companies to go beyond value chain mitigation by funding high quality climate projects that comply with the The Core Carbon Principles and Assessment Framework set out by the Integrity Council for the Voluntary Carbon Market (iCVCM).

Quality over quantity:

how we evaluate carbon projects at Lune

Explore our rigorous internal analysis, alignment with external frameworks like BeZero ratings and Oxford Offsetting Principles, and comprehensive six-point evaluation criteria.

See where your contributions go

We prioritise transparency at every level. Right down to our fees.

Dig deeper with climate project impact and quality assessment summaries, while getting the latest project news and updates delivered straight to your inbox. Gain visibility and take control of your climate legacy via our easy-to-use platform.

Project impact maps: A new window into nature-based projects

Learn moreCurate company-aligned portfolios

Secure stakeholder confidence with climate projects that align seamlessly with your company values. Nobody knows your business better than you. Whether your focus is innovation or tradition, or Europe to Australia, our portfolio curator builds portfolios that resonate authentically with your business based on your requirements.

After establishing its Net Zero strategy, Vestre wanted to neutralise unavoidable emissions.

They chose to purchase only permanent carbon removal, guaranteeing carbon will be safely stored for thousands of years.

Voluntary carbon buyers decarbonise 2× as fast as their peers

Learn more