A new regulatory climate (pun very much intended) is here – the dial is being turned up on mandatory climate disclosure for businesses.

Already large companies are legally required to submit sustainability reports in several countries across the world.

And it won’t be long before it’s mandatory for all businesses, of all sizes, in all sectors, in all countries to report on the environmental impact of their business, their plans for addressing it, and the climate risks and opportunities facing them.

There are currently many different regulations and rules for companies in different countries and sectors, and new legislation is happening all the time.

It can be hard to keep up.

So, to make climate disclosure easier, we’ve made this guide which gives a short summary of the most common regulations that will impact your business – and links to learn more.

So far, this article covers:

- Global standards for climate disclosure (including the TCFD and ISSB)

- The EU Corporate Sustainability Reporting Directive

- The EU Green Claims Directive

- The SEC proposed climate disclosure rule in the US

- The proposed Sustainability Disclosure Requirements in the UK

- IMO measures for ship owners – the Carbon Intensity Indicator and Energy Efficiency Existing Ship Index

We’ll keep this article updated with the latest climate disclosure legislation across the world – so make sure you bookmark it to find it easily later, and sign up to our newsletter to be the first to know when updates arise.

Subscribe for the latest insights into driving climate positivity

Global standards for best-practice climate disclosure

Various independent bodies are developing guidance and requirements to guide companies on best-practice sustainability reporting – what should be included, in what detail, in what format, and so on.

Currently the two major standards to be aware of are:

- Taskforce on Climate-related Financial Disclosures (TCFD). A set of recommendations for companies to disclose climate information across 4 main areas: governance, strategy, risk management, metrics and targets. The TCFD recommendations are being used as the basis of country-level legislation such as the EU Corporate Sustainability Reporting Directive.

- International Sustainability Standards Board (ISSB). An international standard-setting board for climate disclosure and reporting, which is currently building on the work of the TCFD to create a comprehensive global baseline of high-quality sustainability disclosure standards.

The guidance and requirements being developed to govern what companies should include in their sustainability reporting, including the TCFD and ISSB.

In the EU...

The EU is working on the European Green Deal, a a set of proposals which aim to align the EU’s policies with the need to reduce greenhouse gas emissions by at least 55% by 2030 (against 1990 levels). To do this, they’re making a lot of updates and new legislation.

This includes:

- The EU Corporate Sustainability Reporting Directive. Makes it mandatory for all large companies to report annually on the scope 1,2, and 3 carbon emissions, as well as the plans and targets in place to reduce this. It’s being phased in for different types of companies from 2024 onwards.

- The EU Green Claims Directive. Makes it mandatory for companies to substantiate any green environmental claims they make about their company or products e.g. carbon neutral, net zero etc – including disclosing the use of offsets towards any claim.

In the US...

The main piece of legislation to be aware of in the US is the SEC climate disclosure proposal. It’s currently a proposed update, and is expected to be released as a final piece of legislation in April 2023.

The draft rule makes it mandatory for all public companies (i.e. publicly-listed companies registered with the SEC) to report annually on the carbon emissions from company activities across scopes 1,2, and 3 as well as their climate action plans and performance towards those plans. It’s expected to come into force in a phased way, first large companies who will be required to submit their first report in 2024, based on data for 2023.

In the UK...

The main piece of legislation to be aware of in the UK are the proposed Sustainability Disclosure Requirements.

As it stands in the UK there are a few different pieces currently in place which causes confusion, so the SDRs are designed set to replace existing regulations on climate disclosure, including:

- FCA mandated TCFD-aligned disclosures: introduced in 2022 for UK listed commercial companies with a premium or standard listing, UK asset managers, life insurers and FCA-regulated pension providers. This represents around 1,300 companies.

- Streamlined Energy and Carbon Reporting (SECR): introduced in 2019, the SECR requires large UK companies to disclose their energy use, greenhouse gas (GHG) emissions, and progress on energy efficiency improvements in their annual financial reporting

- BEIS Climate-Related Financial Disclosure: introduced from April 2022, the UK Department for Business, Energy, and Industrial Strategy (BEIS) requires UK-registered companies with over 500+ employees or £500M+ in annual revenue to complete annual sustainability and climate-related disclosure reporting, using TCFD guidelines.

The Sustainability Disclosure Requirements aim to unify corporate sustainability reporting into one set of comprehensive rules on climate disclosure.

They’re still under development, but we do know that the recommendations of the Taskforce on Climate-related Financial Disclosures (outlined above) are being used as the basis of the SDRs – so it’s worth getting your head around these as a first step.

For ship owners – and businesses using ships in the supply chain...

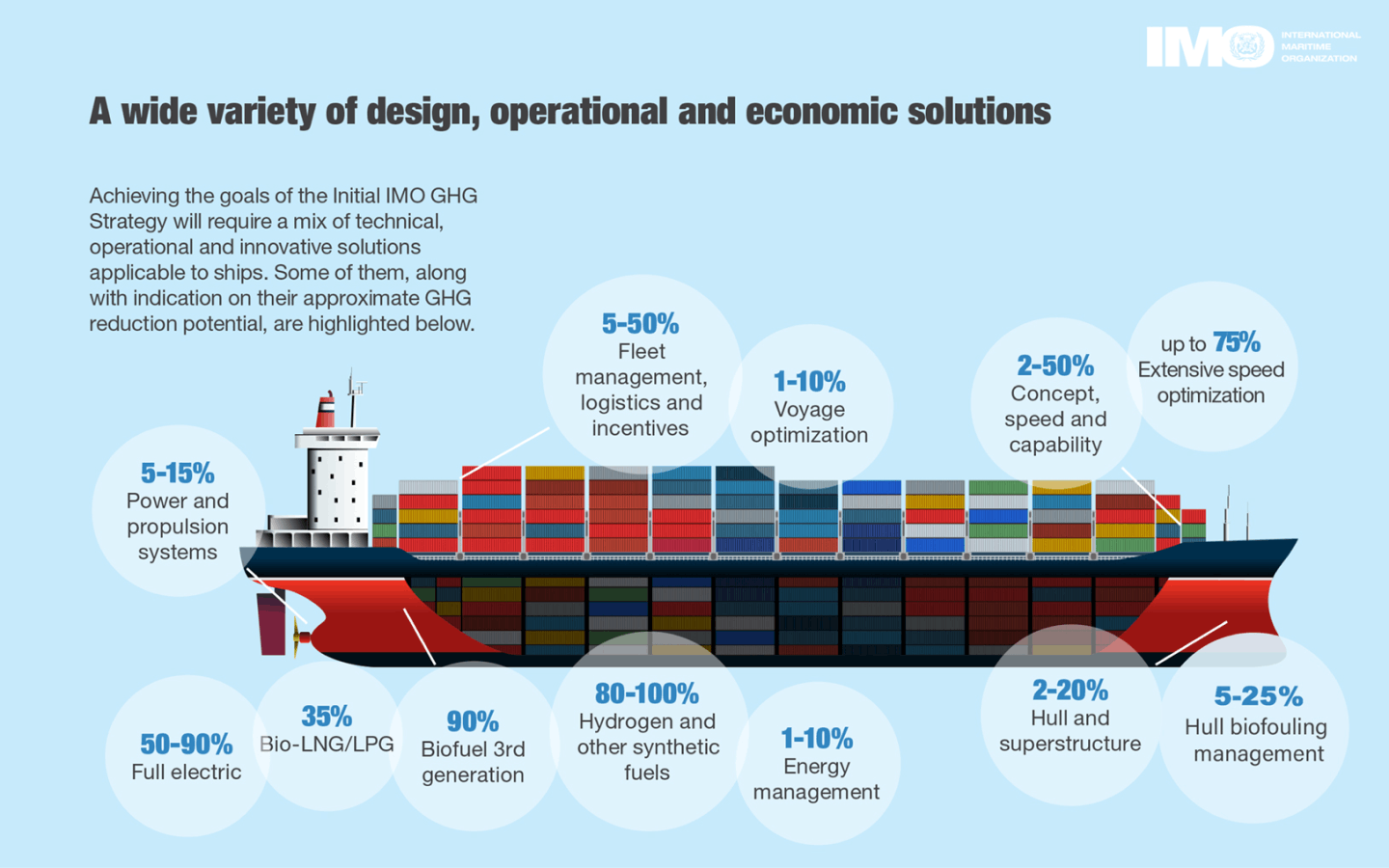

Regulations are also coming into force which are specific to different industries, and the supply chain is facing particular scrutiny due to its carbon intensity and its role in the scope 3 emissions of many other businesses.

For ship owners, two new International Maritime Organization (IMO) measures came into force on 1 January 2023:

- Energy Efficiency eXisting Ship Index (EEXI). All ships of 400 gross tonnage and above must disclose their EEXI annually, a measure of how energy efficient the ship itself is as a vehicle which uses the metric of carbon emissions per cargo ton and mile.

- Carbon Intensity Indicator (CII). All large ships of 5,000 gross tonnage and above must disclosure their CII annually, a measure of the efficiency of a ship’s transportation of goods or passengers, using the metric of carbon emissions per unit of nautical transport work (how much weight is transported, how far).

Credit: IMO

Credit: IMOReaders also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.