Think the Corporate Sustainability Reporting Directive (CSRD) being rolled out in the European Union won’t impact your non-EU business?

You might need to think again.

Research by the Wall Street Journal has estimated that at least 10,500 companies outside of the EU will need to comply with the regulation too.

The Corporate Sustainability Reporting Directive makes it mandatory for "all large companies" in the EU to disclose their environmental impact annually, as well as their progress on addressing this impact.

But, the specifics of which companies the CSRD actually applies to include the following parameters which mean that non-EU companies will also have to comply with the regulation:

- Companies that have listed securities, such as stocks or bonds, on a regulated market in the European Union

- Companies that have annual revenue within the EU of more than €150 million or an EU branch with net revenue of more than €40 million

- Companies with an EU subsidiary that is a large company, meaning it meets at least two of these three criteria: more than 250 EU-based employees, a balance sheet above €20 million, or local revenue of more than €40 million.

The European Commission had calculated that the CSRD would make it mandatory for around 50,000 companies in the EU to submit sustainability reporting, but they had not given a figure for the number of non-EU companies impacted.

Financial data firm Refinitiv has run the numbers, and has found that there are:

- 10,400 companies that have an EU stock listing

- 100 companies with more than €150 million revenue within the EU.

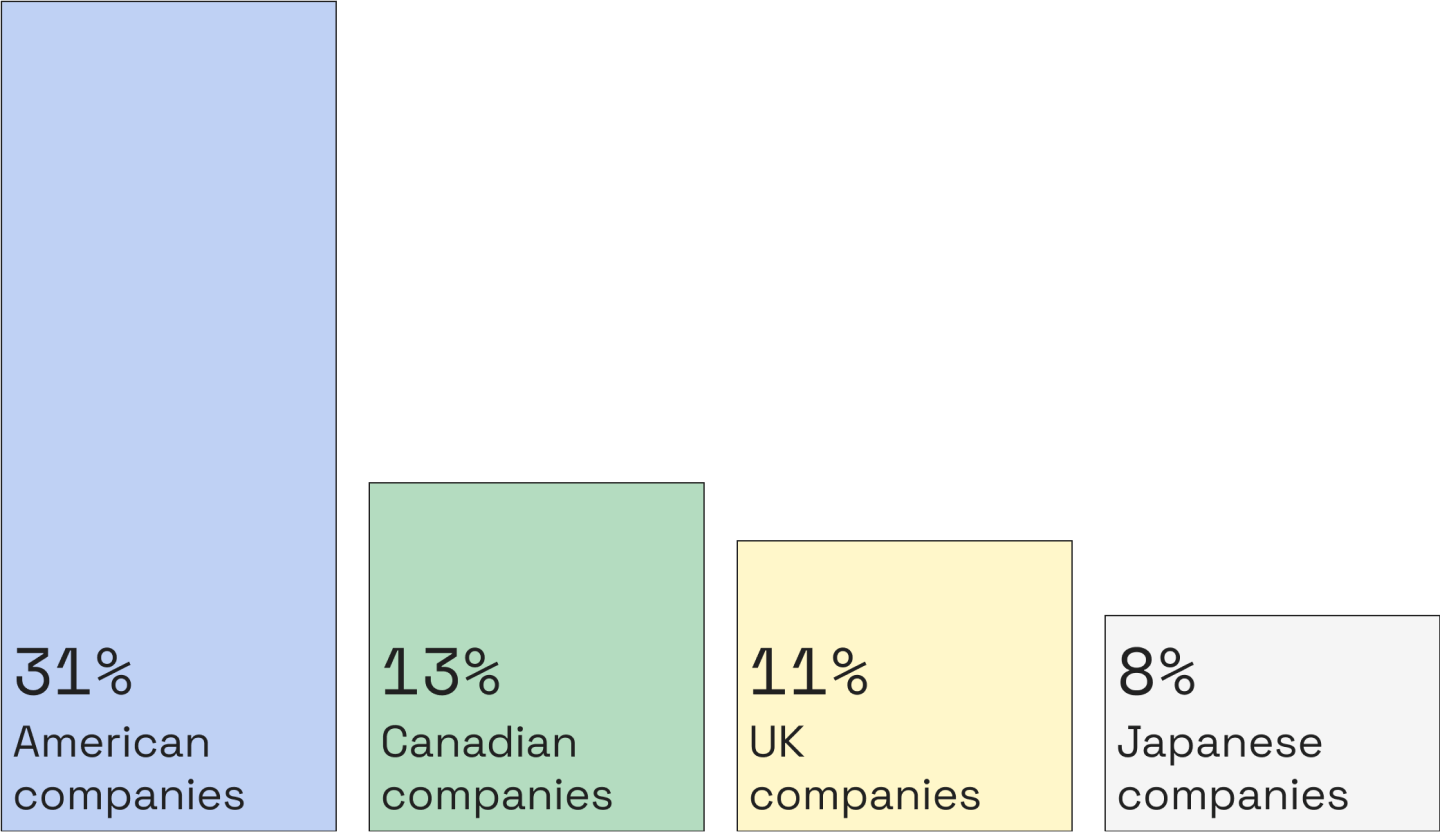

These companies are spread across the world – with a particularly high number of impacted companies in America, Canada, the United Kingdom, and Japan.

The CSRD is being rolled out in phases over the next few years, and for these non-EU companies that looks like:

- 2025 – foreign companies with EU stock listings and more than 500 employees in the EU will need to report on their 2024 impact

- 2026 – foreign companies with EU stock listings and 250 to 500 employees in the EU will need to report on their 2025 impact

- 2027 – foreign companies with EU stock listings and under 250 employees in the EU will need to report on their 2026 impact

- 2029 – foreign companies not listed in the EU but subject to other criteria will need to report on their 2028 impact.

How can companies prepare for the Corporate Sustainability Reporting Directive coming into effect?

If your company is included in those that will need to comply with the Corporate Sustainability Reporting Directive, we’d recommend starting to get everything in order sooner rather than later – there’s a lot of information to supply.

Plus, if you’re a B2B business you should also prepare for your business customers to be approaching you with requests for data on the scope 3 emissions from their supply chain activities.

These supply chain emissions are also notoriously difficult to abate, so you can also expect business customers to be looking for sustainable options and collaboration opportunities to reduce the environmental impact across the supply chain. If your company is able to offer sustainable solutions, there’s a chance to win big in this new legislative environment – and if you can’t, there’s a new risk of losing market share to competitors who can.

To learn more about what climate regulation could impact your customers, download our free infographic: climate regulation around the world in 2025.

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.