When you decide to buy carbon credits to offset your company’s carbon emissions, there are a few different ways you can go about it:

- Spot purchase

- Forward purchase

- Multi-year purchase

- Investment into a carbon project

In this article we’ll explain these different ways to buy carbon credits, and the pros and cons of each.

What is a spot purchase of carbon credits?

A spot purchase is when carbon credits are bought and sold with immediate payment and delivery.

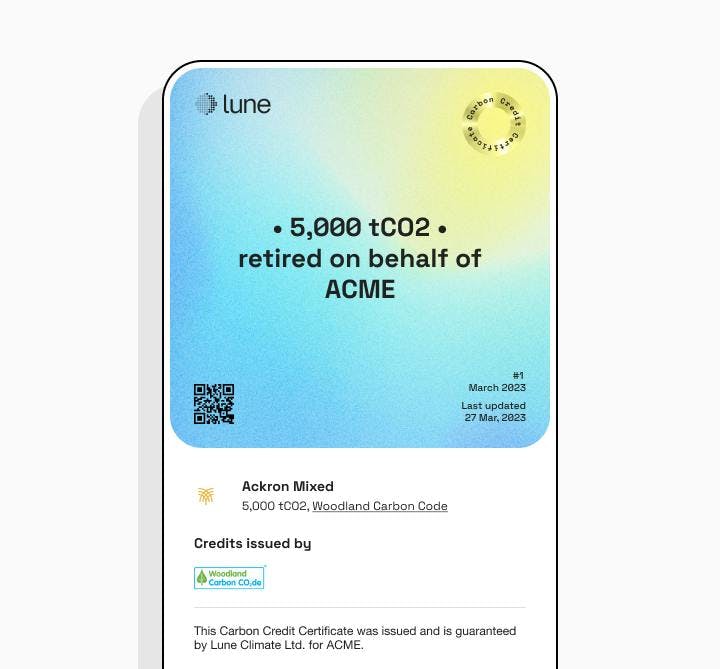

The buyer pays in full for the carbon credits at the time of purchase, and they are delivered and retired straight away (days or weeks at the most) – so this is only possible for carbon projects which are selling ex-post carbon credits (i.e. the emissions reduction or carbon removal has already taken place).

An example would be if a business bought ex-post carbon credits from a credible reforestation project such as Ackron Mixed in the UK. The buyer receives their carbon offset certificate and the credits would be retired immediately to prove their purchase.

The pros of a spot purchase of carbon credits are:

- Guaranteed price of carbon credits

- Certainty about availability of carbon credits

- Guaranteed level of impact – the carbon benefit is already verified and credits are retired immediately to prove this.

And the cons:

- Poor visibility for future budget planning: the price of the carbon credits for the project or project type you’ve bought from may change in the future, so if you want to repeat the purchase in a following year it may need a different budget

- Supply constraints: for larger purchases you may struggle to find carbon projects with enough availability of ex-post carbon credits to fulfil your offsetting needs.

For these reasons, spot purchases of carbon credits are optimal for small and medium purchases (up to $1 million), where forward budget planning is not a concern and so a one-off purchase makes sense.

What is a forward purchase of carbon credits?

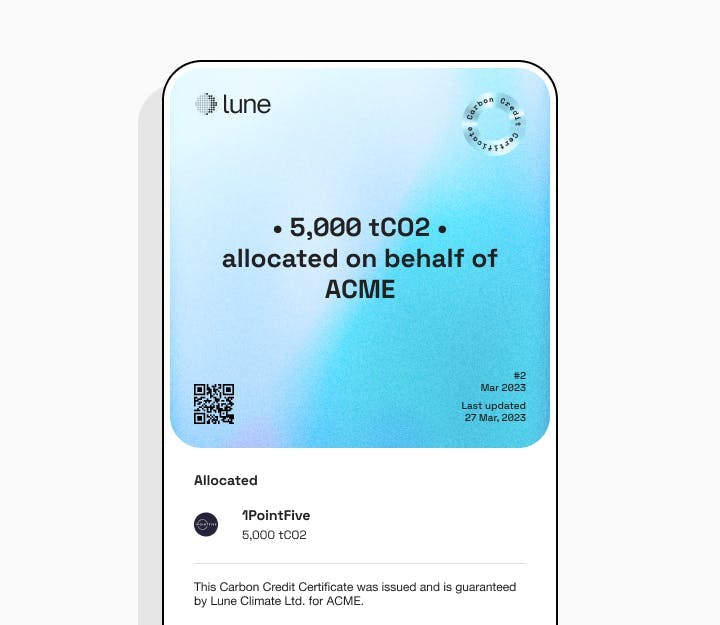

A forward purchase is when a price for a set amount of carbon credits is agreed upfront, and the credits are delivered and retired at an agreed future date. The buyer pays either in full or with a partial down payment at the point of purchase.

Forward purchases enable buyers to buy ex-ante or pre-purchase carbon credits from projects at a set purchase price – either as a one-off purchase to offset a company’s emissions for one year, or forward buying in bulk for future years too.

An example is if a business bought carbon credits from a Direct Air Capture project like 1PointFive, with a vintage of 2025. The DAC plant is still being developed and so the carbon credits the project is selling will be retired in 2025, once the plant is fully operational and the amount of carbon removal has taken place to fulfil the carbon credit purchase. The buyer receives a certificate confirming the purchase, and will be informed of the retirement at the agreed later date.

The pros of a forward purchase of carbon credits are:

- Guaranteed price of carbon credits: the agreed purchase price will always be honoured, even if the carbon credits have increased in price by the point of delivery and retirement

- No supply constraints: the voluntary carbon market is still in its infancy today, so forward purchasing enables access to the increased supply of the future

- Access to new, innovative projects: today there are many early-stage carbon projects with huge potential to exponentially increase carbon benefit (e.g. Direct Air Capture), which do not have ex-post carbon credits available for spot purchases, but do have availability for forward purchases – and buying them means you're actively enabling those vital carbon removal projects to develop and scale.

And the cons:

- Risk that credits cannot be delivered: because the carbon benefit that the credits represent has not already taken place, there is some risk that the project may fail to produce this carbon benefit and be unable to fulfil your purchase of carbon credits.

- Price could be inflated: it’s possible that the price of the carbon credits you buy may have decreased by the time your carbon credits are retired, in which case you’ll have paid a higher price than necessary.

If your priority is maximising the impact of your carbon offsetting, forward purchases are ideal, giving a mechanism to fund high potential, early-stage projects and enable them to scale.

What is a multi-year purchase of carbon credits?

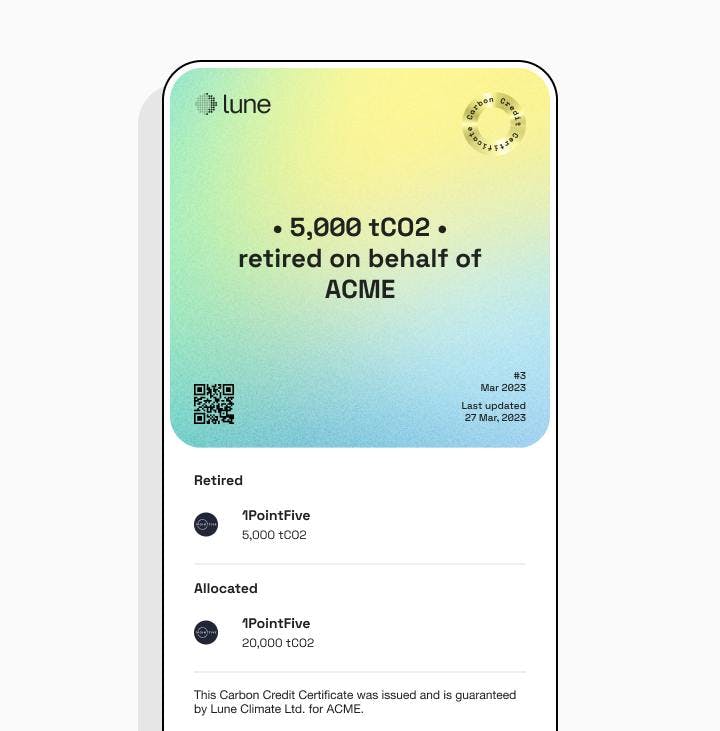

A multi-year purchase is when a price is agreed upfront for an ongoing annual purchase of carbon credits – and the credits are delivered and/or retired at agreed annual dates.

An example is if a business wanted to commit to buying 5,000 carbon credits (equal to 5,000 tCO2) every year for the next 5 years, so they agree an upfront purchase price with a project, which will stay the same for the next 5 years – and the credits are delivered and/or retired at an agreed date each year.

The pros of a multi-year purchase are:

- Guaranteed price of carbon credits: the agreed purchase price will be honoured, even if the carbon credits have increased in price by the point of delivery and retirement

- Guaranteed carbon credit volumes: the project makes a commitment to deliver to you, so there is no risk that there will not be availability in future years – and given that we expect to see a growing surge of carbon credit purchase as the market continues to develop and pressure rises from regulation, customer demand etc, this is a big plus.

- Price visibility for budgeting: your carbon offsetting costs are guaranteed for the next few years, making future budgeting simple.

- Access to new, innovative projects: as with forward purchases, multi-year purchases enable you to fund future carbon benefit by early-stage, high potential projects (e.g. Direct Air Capture).

- Project developer relationship and storytelling: committing to a long-term purchasing relationship means developing a close relationship with a specific project, which gives a strong story to tell about your climate actions and brings opportunities to collaborate with the project developer on e.g. marketing content or team visits to the project site.

And the cons:

- Risk that credits cannot be delivered: because the carbon benefit that the credits represent has not already taken place, there is some risk that the project may fail to produce this carbon benefit and be unable to fulfil your purchase of carbon credits.

- Price could be inflated: it’s possible that the price of the carbon credits you buy may have decreased by the time your carbon credits are retired, in which case you’ll have paid a higher price than necessary.

- Hard to set up for small purchases (less than $250,000 per year).

For these reasons, multi-year purchases are ideal for businesses who want to make large annual purchases of carbon credits ($1 million+) and want to guarantee cost for future years and budgeting.

What is an investment into a carbon project?

Investing into a carbon project means offering investment to finance a project’s set up phase, often in return for priority access and/or discounted prices for carbon credits from the project in the future.

For example, a company could invest in a reforestation project whilst the project is in the early stages, financing their development and setup. In return, the company gets guaranteed access to 50% of all carbon credits issued over the project’s lifetime, at a 50% discounted price.

The pros of investing into a carbon project are:

- Exclusivity or priority: for companies wanting to buy large amounts of carbon credits, investing into the project can give exclusive access to a guaranteed volume of carbon credits – often at a reduced price.

- Project developer relationship and storytelling: investing into a project means developing a close relationship with a specific project – even more so than a multi-year purchase since you are effectively enabling the project’s existence – which gives a strong story to tell about your climate actions and brings opportunities to collaborate with the project developer on e.g. marketing content or team visits to the project site.

- Business opportunity: accessing carbon credits at a discounted price means you could choose to sell them on for a profit in the future once the project has succeeded and credits are delivered.

And the cons:

- Risk that credits cannot be delivered: because the carbon benefit that the credits represent has not already taken place, there is some risk that the project may fail to produce this carbon benefit and be unable to fulfil your discounted carbon credits.

- Hard to set up for small or medium purchases (less than $500,000 per year).

For these reasons, investing into a carbon project is ideal for businesses who want to make a large purchase of carbon credits ($1 million+) and use their budget to support the development of carbon projects.

In summary

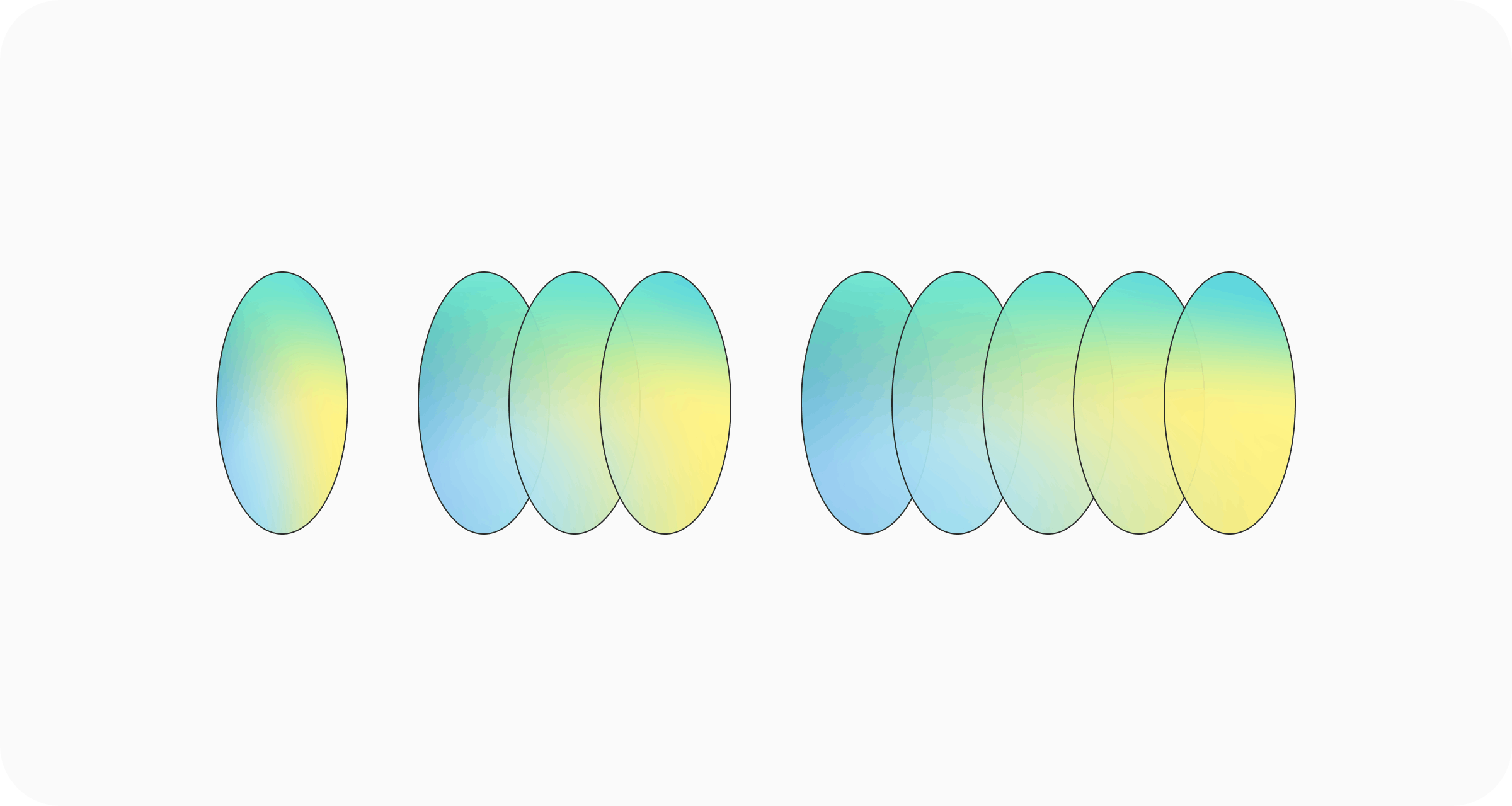

Here’s a summary of the key differences:

Buy carbon credits with Lune

At Lune, we can facilitate all of these approaches to buying carbon credits.

Spot purchasing and forward purchasing can be done through Lune’s dashboard and API, and we can facilitate multi-year purchasing and investing into carbon projects at request.

Not sure which approach best fits your company’s goals? Get in touch to chat more.

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.