How could sustainability in the payments industry contribute to a net zero future?

Well, the payments landscape is vast – from in-store purchases to ecommerce to credit cards and beyond. It’s also an industry where innovation is the norm.

For instance, over the last 20 years we’ve seen a mass shift to digital payments, with over 700 billion non-cash transactions made per year. That market alone is now valued at $7.36 trillion and is expected to be worth $15.27 trillion by 2027. On top of that we have contactless payments, open banking, mobile payments and more.

And now, it’s climate change that’s on the agenda for payments innovation.

Climate impacts are a risk for the industry. A 2020 EY report found that 52% of banks see climate change as a risk for the next 5 years, up from 37% in 2019.

But at the same time, there’s a massive opportunity – we need drastic transformation across all industries to keep to climate targets.

Because of their influence on everyone’s purchasing habits, payments companies are uniquely positioned to accelerate change. That’s why ‘mobilising finance’ was a key topic for COP26 in securing the goal of global net zero emissions by 2050:

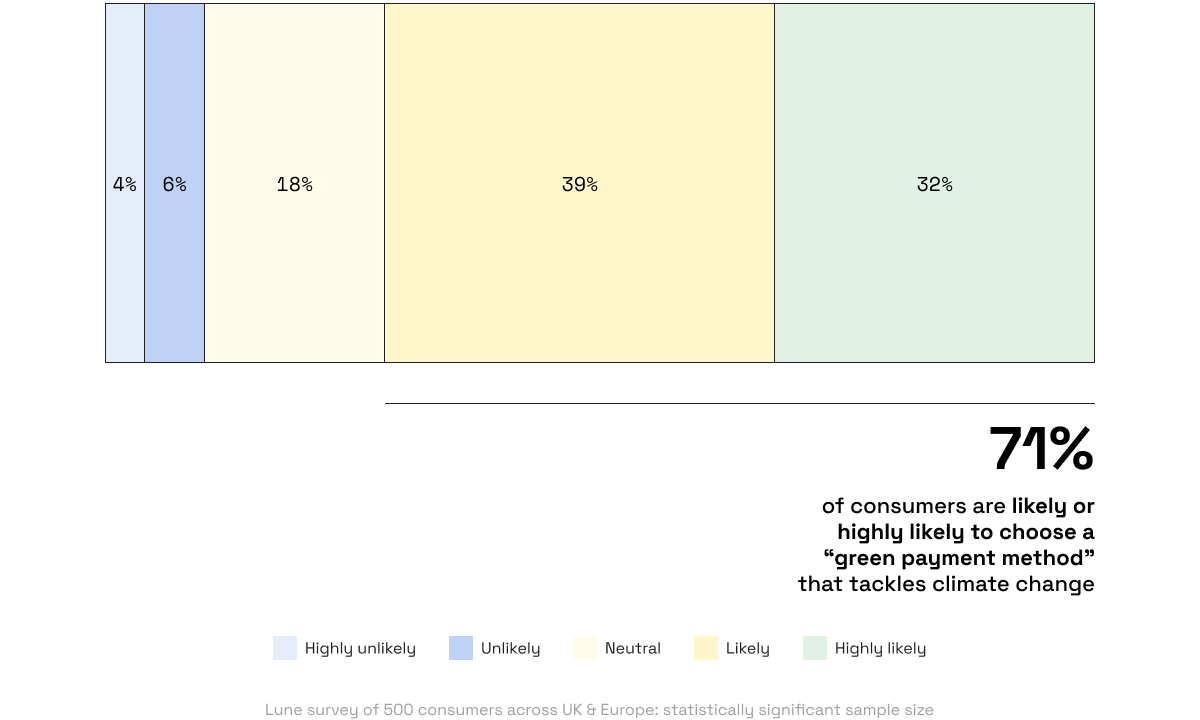

And with 3 out of 4 consumers looking for a green payments option (that doesn't yet exist at scale), it’s a business opportunity too. Especially when you consider that payments is a sector that has historically been seen as high-emitting, spurring consumerism and relying on fossil fuel investments – there's huge customer loyalty and brand reputation benefit to be gained from driving sustainability in the payments industry.

So, change is needed. But what could that change look like?

So far we’ve seen banks start to bring in sustainable services, such as Mastercard’s Carbon Calculator. We’ve seen payments tech companies begin to integrate green options, like Stripe Climate.

But there’s plenty of room for more.

An area of real opportunity – both from the perspective of business growth and of climate impact – lies in enabling businesses to bring climate into payments transactions, including through green debit cards.

Green payments: turning every transaction climate positive 🌍

Payments transactions are made all the time. More often than not these transactions are made mindlessly – without any thought of the environmental impact of a purchase.

Subscribe for the latest insights into driving climate positivity

So, what if sustainability in the payments industry means that every business brought positive climate impact into the checkout flow for their customers – if every single purchase made contributed to permanent carbon removal?

And taking it one step further, imagine if this kind of climate positive payment became the default setting for all payments?

It would be game-changing.

Millions of companies would be working together to remove huge amounts of CO2 from the atmosphere, through their green payments flow.

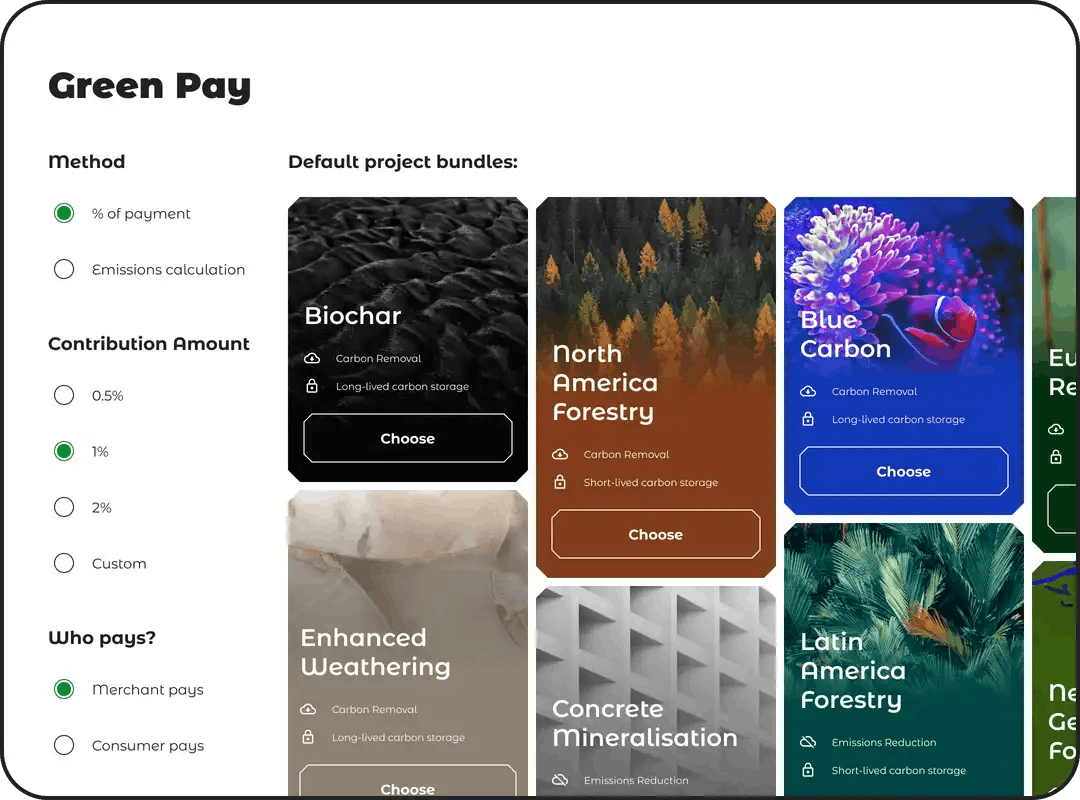

And with payments companies sitting at the very heart of transactions, they have a unique position to drive this kind of positive impact on a vast scale – offering a customisable green payments option to the hundreds or thousands of merchants they work with would turn every checkout flow (when switched on) climate positive.

It’s great for brand differentiation as well – a constant struggle for payments companies. How? Because we already know for a fact that consumers are actively asking for greener payments solutions and so offering this as an option delights customers, leading to increased conversion and customer loyalty.

That's why we're already seeing this kind of payment option from large payments companies like Stripe, Mastercard, and Klarna. And given the number of payments companies out there, there's room for much more.

But what about where consumers manage those payments transactions themselves?

Enter: the green debit card.

Making climate positive payments personal with green debit cards 💳

Whereas a single consumer may make purchases from a myriad of different retailers using a myriad of different payment solutions, they’re likely to only use 1 or 2 debit cards to make those purchases.

A debit card account, therefore, gives a much more full picture of the environmental impact of an individual consumer’s spending – so they also hold importance when considering sustainability in the payments industry.

We also have much more developed relationships with our own debit card accounts (compared with a payments company for a single transaction) – they’re where we are paid our salaries, make monthly budgets, pay bills, transfer money to pay back friends etc – meaning there’s an opportunity to engage consumers with climate impact on a more personalised level, through their debit card account.

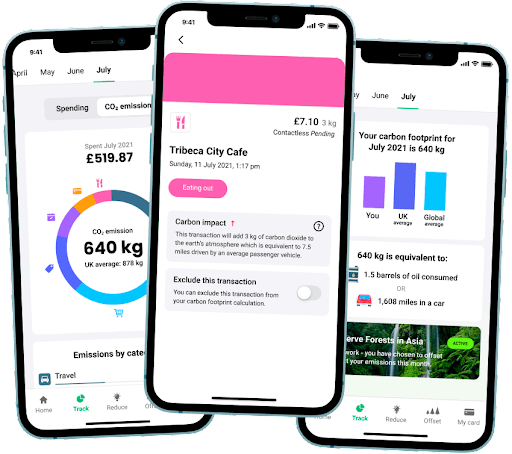

A green debit card, for instance, includes the carbon footprint of each individual purchase to keep climate impact top of mind.

It could also gather data over time, for instance generating a report of the carbon emissions from a month’s spending.

These features would, in turn, nudge a consumer into making more considered, conscious purchases in future.

Plus, a green debit card could also go beyond just bringing visibility and education to the impact of our purchases. It could also neutralise the impact of those purchases by including high-quality carbon offsetting. And it could include customers in that by allowing them to choose which project(s) to support on a regular basis.

That’s exactly what green debit card company Tred have launched.

They integrated with the Lune API for carbon offsetting – showing consumers the carbon footprint of their purchases and helping them to offset that footprint on a monthly basis, choosing which of our high-quality projects to support.

We're expecting to see more and more green debit card options enter the market. At the same time, others in the payments industry are also looking beyond physical cards at other sustainable solutions within open banking.

There really is a huge opportunity for both growth and impact via sustainability in the payments industry, that's ripe for the taking.

Popular insights

Popular insights