It’s no secret. Carbon credits had their peaks and troughs in 2023. Yet, through economic strain and intense scrutiny, the science remains clear; all paths to net zero demand a dual strategy of both decarbonization and carbon removal. Climate leaders – who are decarbonising twice as fast as their peers — are already awake to this. But as more begin to catch up, paradigm shifts are inevitable for the voluntary carbon market in 2024.

Here are my predictions for carbon credits in 2024, and how sustainability leaders can navigate these changes.

1. The year of recovery: a tipping point for carbon credits in 2024

After 1.5 years of turmoil, there will be a significant rebound for the voluntary carbon market in 2024. This resurgence will likely be fueled by enhanced trust in market mechanisms, improved regulatory frameworks, and a growing acknowledgement of the critical role of carbon credits in accelerating net zero goals.

2. Flight to quality for climate projects

‘Flight to quality’ is where investors shift their asset allocation away from riskier investments and into safer ones. This year, we will witness a 'flight to quality' in carbon credits, driven by a desire to maximise climate impact, avoid greenwashing allegations, and adhere to new quality standards like ICVCM.

The result? The price between low and high quality climate projects will grow. This shift emphasises the need for greater expertise in project selection and underscores the importance of quality over quantity. At Lune, only the top 10-20% of climate projects we vet make the cut. This is how we deliver measurable impact and peace of mind to our customers.

Learn more about our rigorous evaluation process by downloading our quality assessment guide.

Subscribe for the latest insights into driving climate positivity

3. Permanent carbon removal goes mainstream

Permanent carbon removal will go mainstream in 2024, driven by both industry understanding and project certification. Currently, only the methodology behind biochar has a certification standard, but in 2024 many more will follow.

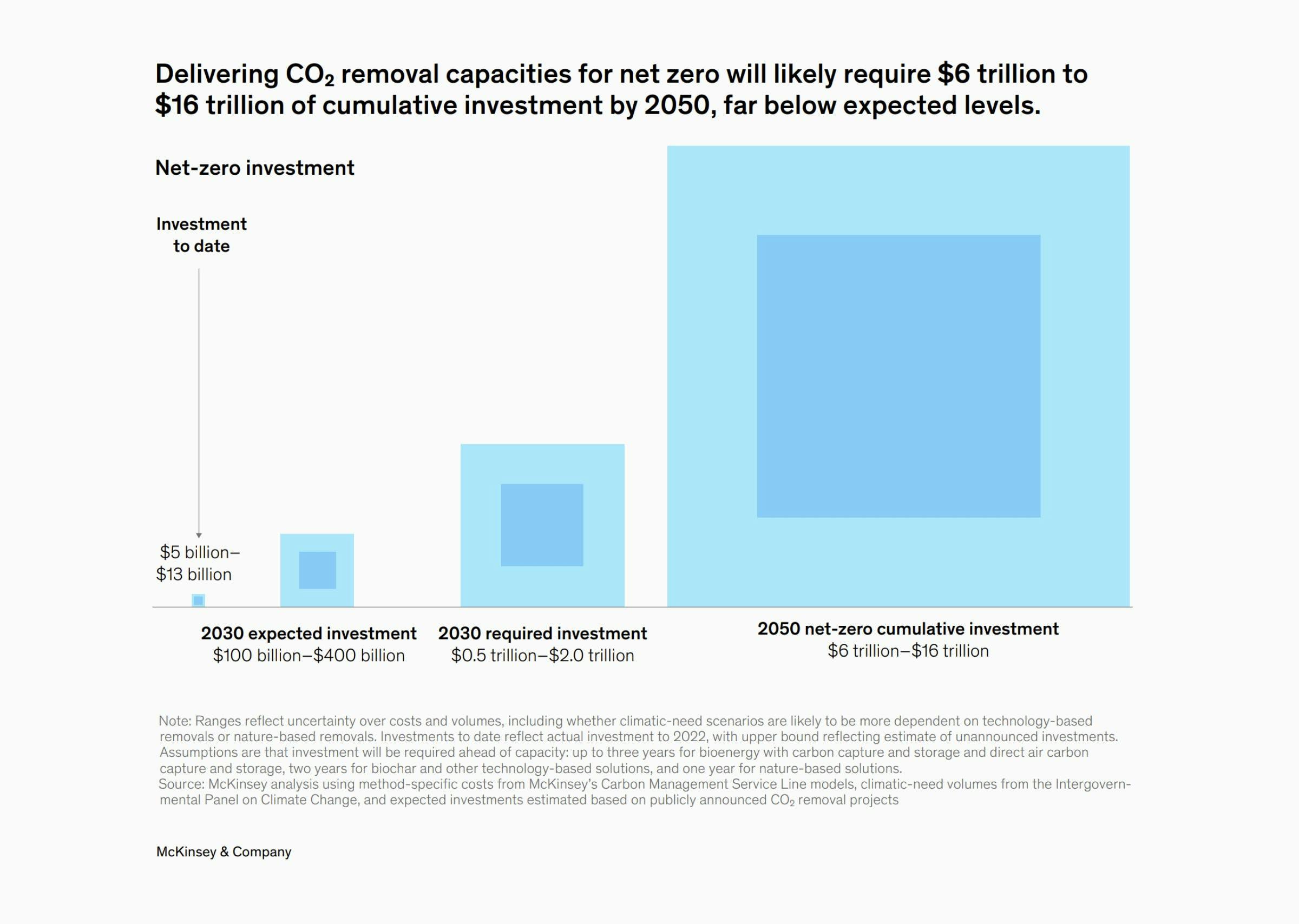

The certification of other methodologies, like Direct Air Capture and Enhanced Rock Weathering, is essential for scaling carbon removal. This development signifies a maturing market ready to embrace diverse and innovative solutions to meet the forecast at least $6 trillion investment needed to meet net zero.

4. De-coupling decarbonisation and CDR budgets

A trend that surfaced in 2023 was the separation of budgets for decarbonisation and Carbon Dioxide Removal (CDR). Growing in popularity this strategy empowers businesses to fund more impactful, and typically more expensive climate projects, rather than offset emissions.

Businesses will become more literate in the co-benefits climate projects provide. When done properly, climate projects are the single best mechanism to address climate change, biodiversity loss, and humanitarian crises. With some companies even beginning to adopt biodiversity targets, carbon credits have the potential to accelerate wider ESG goals.

5. Confident claims: Overcoming greenwashing fears

The fear of triggering the greenwashing brigade will diminish significantly in 2024. Standards, like VCMI, and others focused on claims will empower companies to follow a clear path towards making the right claims. Confidently.

Customers are demanding businesses take climate action, and greater clarity on how to do this properly will accelerate sustainability goals. This development will bring much-needed clarity and credibility to climate communications, enabling businesses to share their climate narrative and impact transparently and effectively.

Partnering for a climate positive future

As we accelerate into 2024, the voluntary carbon market is poised for transformative changes. The world is finally recognising that to reach net zero by 2050, we need to scale carbon removal. Fast.

For businesses wanting to lead the charge, partnering with Lune empowers you to navigate carbon credits with ease and expertise. Our experts leverage a rigorous vetting process and comprehensive six-point evaluation criteria to connect you with climate projects that deliver measurable impact and peace of mind.

To learn more about how Lune can bolster your 2024 net zero strategy, download our guide.

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.