A true climate leader looks beyond its value chain. This broader approach, known as Beyond Value Chain Mitigation (BVCM), is deemed by the Science-Based Targets Initiative (SBTi) as a crucial step alongside decarbonisation.

The SBTi is the gold standard for net zero strategies, it works with over 5000 companies that make up 34% of the global economy. When it comes to climate leadership, SBTi is at the forefront. So when the SBTi strongly recommends companies deliver BVCM on an annual basis, we listen.

But what is beyond value chain mitigation — and how do companies get it right?

What is beyond value chain mitigation (BVCM)?

Beyond value chain mitigation is climate action or investments outside a product or process’s lifecycle. So beyond sourcing, production, consumption, and disposal. Carbon credits are the most established example of BVCM.

BVCM does not replace decarbonisation. When done correctly, it increases a company’s climate impact magnitude. Think of decarbonisation as reducing your home's energy use, while BVCM is like investing in a community solar project. Both are essential for a climate positive future.

What should BVCM do?

BVCM has two overarching goals: fund projects that mitigate short-term negative climate impact, and scale projects needed to reach net zero in the long-term. What does this look like?

Effectively, we must prevent activities that worsen climate change while scaling long-term solutions.

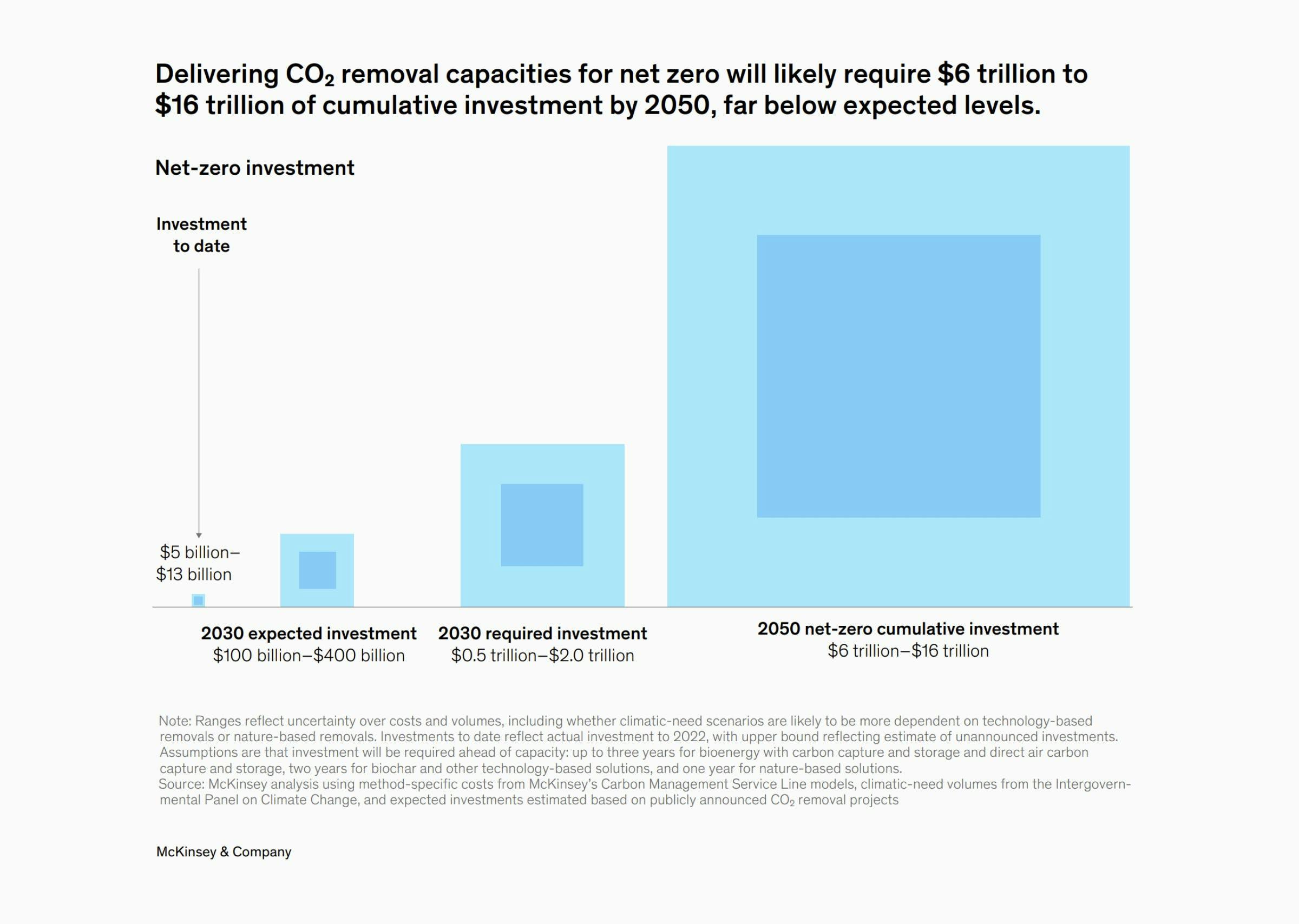

For example, deforestation accounts for 11% of GHG emissions — forest conservation and protection projects stop this. On the flip side, we need to scale the permanent carbon removal market by 100–1,000 times. If we don’t start today, there will simply not be enough carbon removal available for any company to achieve their net zero targets in 2050.

To meet the demand for net zero, we need to scale the carbon removal market 100x within the next decade.

To meet the demand for net zero, we need to scale the carbon removal market 100x within the next decade.To achieve these goals, a BVCM portfolio should address four principles: scale, financing need, co-benefits, and climate justice. Punchy. But what do these principles really mean?

- Make net zero easier to reach: for example, preventing natural carbon sinks – like forests – from being depleted in the first place.

- Plug investment gaps: for example, nascent carbon removal technologies, are generally underfunded due to low return on investment, high risk, or lack of aid from governments but critical to reaching net zero.

- Have benefits beyond carbon: that accelerate other UN Sustainable Development goals. For example, restoring mangroves not only captures carbon but acts as a flood defense for local communities and ecosystems.

- Address inequality: the impacts of climate change are not fair. Low income countries, indigenous populations, and minority groups will feel the greatest impact of climate change and so need the greatest support.

The SBTi’s four principles for making high-impact and -integrity BVCM investments

The SBTi’s four principles for making high-impact and -integrity BVCM investmentsWill the SBTi validate BVCM claims?

While the SBTi will continue to validate company science-based decarbonisation targets, they have no intention of validating BVCM claims. However, they have pledged their support to the Voluntary Carbon Markets Initiative (VCMi), which has begun certifying carbon integrity claims.

Why do companies need to deliver BVCM?

Government funding is slow. The climate crisis demands urgency. To meet net zero, we need to scale the carbon markets a hundred times by 2030. If we want the best shot of meeting this, we need the unlock financial flows from the private sector.

And these flows are powerful. If all the companies with SBTi-approved targets had offset 100% of their unabated scope 1 and 2 emissions in 2022, the result would be 422 million tons of CO2e of BVCM. That’s enough to cover more than the UK’s total emissions in 2022.

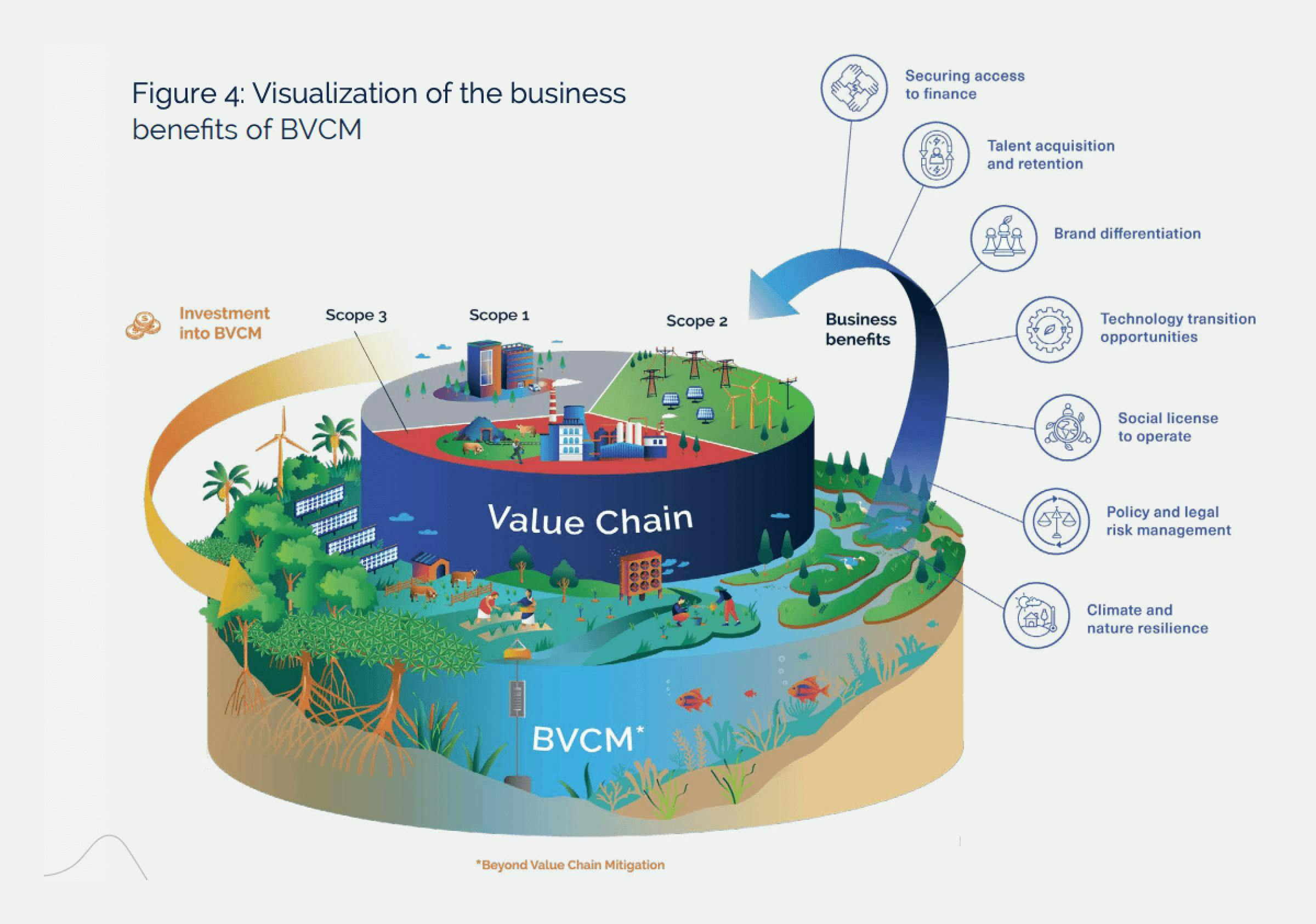

However, if you’ve ever had the opportunity to build a business case, you’ll know there has to be a benefit to the business. Fortunately, BVCM is blooming with business benefits.

What are the benefits of BVCM to businesses?

Done correctly, funding BVCM can futureproof business and enhance long-term value. The benefits vary from business to business as they depend on its region, market, and industry, but range from securing finance to technology transition opportunities. For example, the Polluter Pays Principle means that companies in the EU are liable to bear the cost of pollution — BVCM could reduce their litigation risk.

To understand the true benefits of BVCM, you need to assess your company and it’s network on an individual basis.

Subscribe for the latest insights into driving climate positivity

Visualisation of business benefits from BVCM

Visualisation of business benefits from BVCM How should businesses implement BVCM according to SBTi recommendations?

The voluntary carbon markets are like the wild west — too often, good intentions can fall short. By following the best BVCM practices outlined by the SBTi, companies can avoid the dreaded pitfalls of accidental greenwashing.

Step 1: Commit to net zero

- Create a detailed record of all greenhouse gas emissions your company produces.

- Set, submit, validate, and disclose a science-based net zero target

- Develop and publish a plan for how your company will transition toward net zero

Step 2: Make a BVCM pledge

- Build a business case about how BVCM can benefit the business and the planet

- Decide how much your company will commit to a given amount of BVCM each year for at least five years

- Define the scale of BVCM, this could be linked to unabated emissions, or a carbon removal target needed to make a claim in line with the VCMI Claims Code

Step 3: Act on your BVCM pledge

- Outline strict quality standards and guardrails for any climate action projects you support, ensuring they truly benefit the environment and communities — or work with a trusted provider like Lune to deliver measurable impact and peace of mind

- Design a portfolio of BVCM activities to scale multiple climate solutions

Step 4: Disclose your progress

- Develop a system to measure, report, and verify your BVCM investments

- Report annually on your BVCM activities, investment, and outcomes

- Make transparent and accurate claims

Curate high quality BVCM portfolios with Lune

Only high quality beyond value chain mitigation activities can accelerate net zero. The SBTi has given clear guidance what high integrity BVCM portfolios look like. With Lune, you can curate high quality portfolios needed to underscore a robust net zero strategy.

To learn how you can build high quality carbon credit portfolios with Lune, download our quality assessment guide.

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.