How much does a carbon credit cost?

This seems like a pretty straightforward question, but the answer isn’t quite so simple.

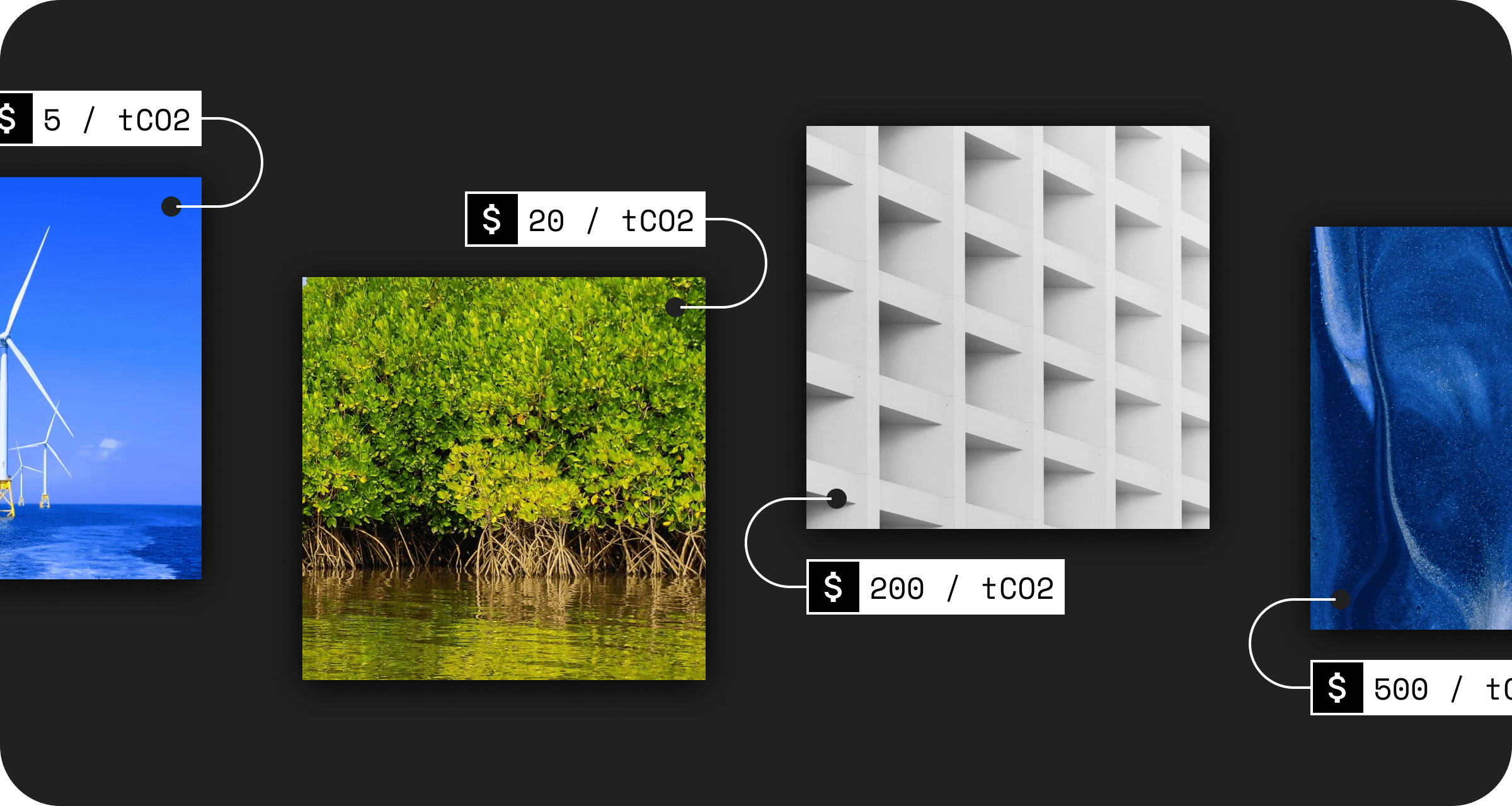

Carbon credit prices can vary significantly, from $5 per carbon credit all the way up to $500. This is for a few reasons:

- Market demand: the market for buying carbon credits (the ‘voluntary carbon market’) is still very new, and so demand across the board has been relatively low – leading to a ‘race to the bottom’ for projects selling carbon credits, offering very low prices in order to make sales. Carbon should be much more expensive than some projects currently sell it for, given the damage it represents.

Subscribe for the latest insights into driving climate positivity

- Market supply & carbon project type: the availability of carbon credits also impacts the price. There are lots of different types of projects that produce carbon benefits and sell carbon credits. Some of these types are well-established, with many projects already in existence (e.g. reforestation, renewable energy) which means the availability of carbon credits in these projects is higher, and costs are therefore lower. Other solutions, especially technology for carbon removal, are still in the early stages of development and implementation, so there is much less availability, and the cost of carbon credits are therefore much higher.

- Project implementation costs: related to the previous point, different projects have different associated costs, which impacts the price that they can sell carbon credits for. For example, well-established projects that have already implemented and scaled their solution have much lower costs to cover than solutions which are still being developed – especially those involving desperately needed new carbon removal technologies and methodologies (e.g Direct Air Capture).

- Project quality and impact: and those project costs also relate to the quality of the carbon project, as high-quality projects which have robust methodologies, rigorous monitoring, ongoing research to improve their impact etc will have higher project costs than low-quality projects who do not do their due diligence. That’s why businesses should never buy cheap offsets – they simply don’t make the positive climate impact you’re paying for.

For a more detailed discussion of all these factors, head to our article: why does cost vary so much in carbon offsetting?

But what does all this mean for businesses looking at buying carbon credits – how do you budget for carbon offsetting when the cost of carbon credits varies so much?

So how should we budget for buying carbon credits, then?

The main thing to remember when considering the cost of carbon credits is that you should never opt for the cheapest offsets.

Cheap carbon credits = low quality = little or no real-world climate impact made.

But, of course, even if you’re choosing only from high-quality carbon projects there’s still variance in the cost of carbon credits – because of the costs of different types of projects we highlighted above.

So, a couple of approaches that may be helpful when factoring carbon credit pricing into budgets:

- Buy from a portfolio of carbon projects. Buying carbon credits from multiple carbon project types helps to balance out the cost whilst still supporting the highest impact projects out there. We always recommend that businesses build a carbon offsetting portfolio aligned with the recommendations of the Oxford Offsetting Principles – which can be done automatically through the Lune dashboard.

- Set a carbon budget and contribute instead of compensating. Typically, businesses buy enough carbon credits to compensate for their own carbon emissions as a company – but often this leads to buying cheap offsets to compensate for emissions at the lowest possible cost to the business, without considering the real impact being made. Instead, decide an internal carbon price or simply an ambitious but manageable budget to spend on contributing to the most impactful solutions out there by buying carbon credits from them.

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.