Many businesses take the approach of buying carbon credits from a single carbon project to offset their company carbon emissions.

Often it’s to do with cost – why would you opt to include a $250 enhanced rock weathering project when you could go for a $7.50 renewable energy project?

But, buying carbon credits from a single project comes with significant risk.

Building a carbon offsetting portfolio helps to reduce that risk, whilst also maximising the potential impact that your offsetting has.

In this article, we’ll expand on why building a portfolio of carbon credits from multiple different carbon projects is a good idea, as well as different approaches for building that portfolio.

Subscribe for the latest insights into driving climate positivity

Why is a carbon offsetting portfolio a good idea?

Whether you’re buying carbon credits to compensate for your company’s carbon emissions or simply to contribute funding to vital projects, building a carbon credit portfolio instead of buying carbon credits from a single carbon project is a great idea.

Why?

Well, there are two key reasons that it’s better to opt for a carbon offsetting portfolio:

- Reduce risk

- Maximise impact

- Balance out costs.

Let’s take a closer look at these reasons for opting for a portfolio approach to offsetting.

A portfolio reduces the risks of offsetting

Every carbon project comes with risk – there is no perfect carbon project.

Risk that the project will be unsuccessful and the carbon credits either cannot be delivered or are rendered meaningless, risk that the measurements of the project’s impact have been inaccurate, risk that the benefit of the project is reversed earlier than expected (e.g. a wildfire affecting a forestry project), risk that a factor has been missed in due diligence which means the project is actually causing environmental harm elsewhere. And so on.

Of course, these risks are mitigated by ensuring that the carbon projects you support are high-quality, as risk mitigation is an important part of the evaluation of quality projects.

But, some risk will still exist. When you buy carbon credits from a single carbon project, it only takes one of these risk factors to happen for your carbon offsetting to be affected.

And if you’re buying carbon credits to offset your own carbon emissions (especially if you’re using that offsetting to make a green claim e.g. that your company is carbon neutral or net zero) that’s a big problem – which could become costly if you then need to re-purchase further carbon credits to make up for the underperformance.

Buying carbon credits from multiple projects in a portfolio helps to diversify this risk in the same way that investing into a fund instead of an individual company helps to diversify the risk of personal financial investments.

Different projects have different pros and cons – a portfolio approach can maximise the impact

Alongside the varying levels of risk across carbon projects, different types of carbon projects also offer differ in terms of the climate impact they create, in a few important ways:

- Emission avoidance vs carbon removal. Emissions avoidance carbon projects focus on reducing the amount of carbon we emit in the future, such as a forest conservation project to prevent deforestation or a renewable energy project to reduce reliance on fossil fuels for energy. Carbon removal projects remove existing carbon emissions from the atmosphere through nature-based solutions e.g. restoring a mangrove forest to increase carbon sequestration or through technological solutions e.g. Direct Air Capture.

- Short vs long-term storage (permanence). In carbon removal projects there are different levels of permanence i.e. how long-lasting the carbon removal will be. For instance, in a reforestation project the carbon is removed only temporarily until the trees die and (most of) the carbon is re-released. whereas in a direct air capture project it’s possible to inject the captured carbon deep underground where it is mineralised and permanently stored.

- New vs established methodology. Some carbon projects use well-established methodologies and technologies (think forests and wind turbines) whereas others are developing exciting new carbon removal technologies which have the potential to remove vast amounts of carbon, but are in the early stages of development today.

- Immediate vs future impact. Carbon projects issue and sell carbon credits at different points in their development. Some projects sell ex-post carbon credits once the project is already active and carbon benefit has taken place, which means the carbon credits you buy are immediately retired and your emissions instantly compensated for. Other projects (typically early-stage projects or new methodologies which need upfront funding for research and development) sell ex-ante or pre-purchase carbon credits which represent the promise of carbon benefit taking place in the future, meaning your carbon credits will be retired at a later date and your emissions will only be compensated for at that date.

Let’s take a couple of examples to put this in context.

A forest conservation project uses well-established techniques to immediately prevent future carbon emissions through your carbon credit purchase, and is carefully designed to deliver the ultimate programme of co-benefits for environments and local people. But, even with the best methodology and project developers in the world, there will always be a risk of the benefit being reversed earlier than expected due to external risk factors such as wildfire or tree disease.

On the other hand, a Direct Air Capture project uses the funding from your carbon credit purchase to develop and set up their new technology which promises permanent carbon removal with practically no risk of reversal in the future, which is very much needed if we are to become a net zero world. But, the technology is not yet proven to work at scale and will not provide significant co-benefits beyond offering new job opportunities.

Ultimately, there’s huge value in both of these project scenarios.

We need all kinds of climate solutions to minimise the impacts of climate change – we desperately need to protect nature and we also desperately need to scale up carbon removal solutions. And creating an offsetting portfolio helps to spread funding across those solutions and to balance out the pros and cons of different types of projects.

Different projects have different costs – a portfolio approach helps to make offsetting affordable

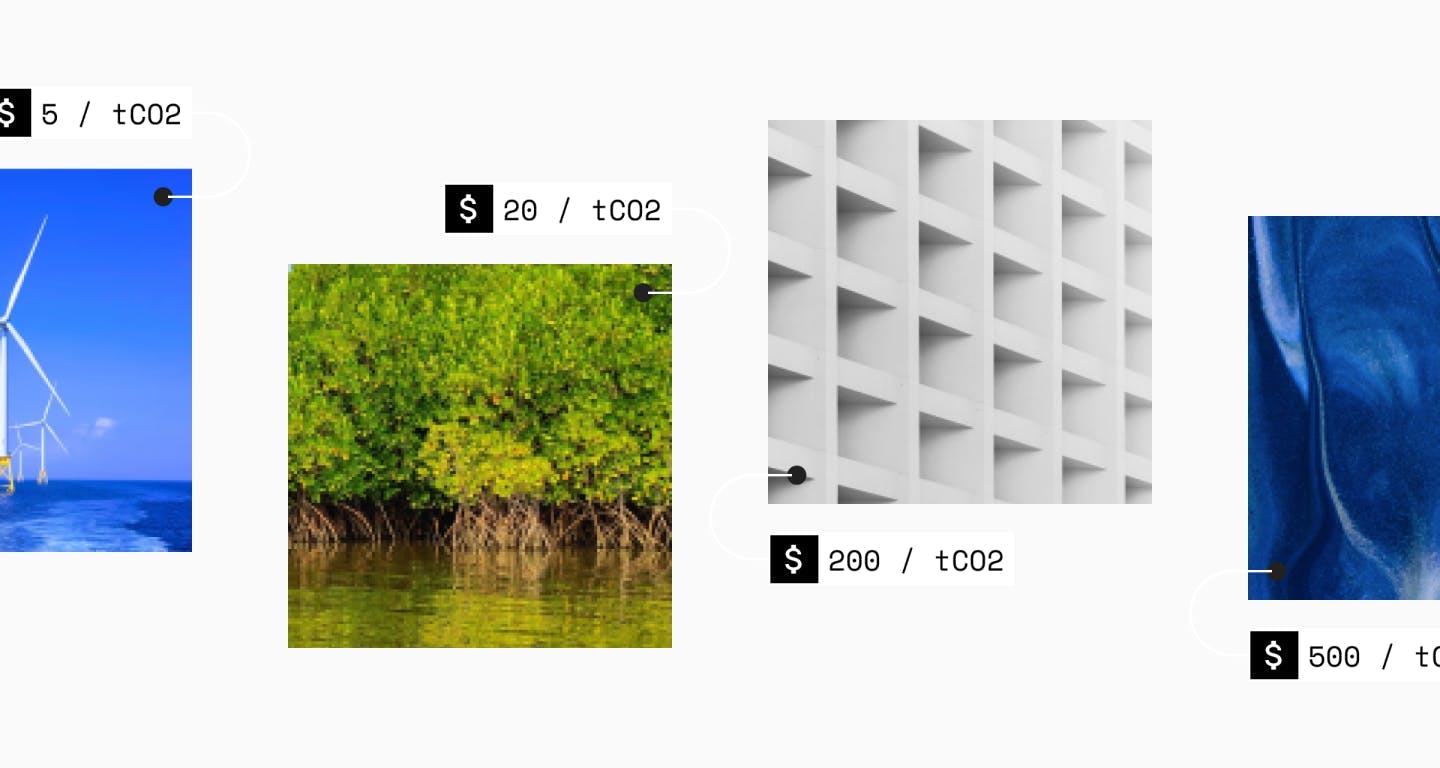

Those differences between the different types of carbon project also mean that the cost of carbon credits does vary significantly today.

Projects using well-established methods and technologies have significantly lower research, set up, and operating costs than projects working to develop and scale up brand new methods and technologies.

Plus, supply and demand plays a role in cost too.

There’s simply more carbon projects in existence for well-established methods like forestry or renewable energy – because they’re easier to set up and run – meaning there’s a higher supply of carbon credits and so they tend to be cheaper.

In contrast, for new and developing methodologies like Direct Air Capture or enhanced rock weathering there are only a handful of projects in existence today, so there’s much lower supply of carbon credits in these project types which drives costs up. But, as we’ve seen, it’s super important to buy carbon credits in these early-stage projects to help them develop and scale to their full potential – and many businesses avoid this due to the higher costs.

So, alongside balancing out the pros and cons of different carbon project types, building a portfolio also helps to balance out the costs of varying carbon project types – helping companies to avoid simply opting for the cheapest offsets and sacrificing on impact.

What does a best practice carbon offsetting portfolio look like

We’ve covered why it’s a good idea to buy carbon credits from a portfolio of different projects. But which projects? What mix of project types should be included for a best practice carbon offsetting portfolio?

There are several different approaches you could take – let’s look at a few.

An Oxford Offsetting Principles aligned portfolio

The Oxford Offsetting Principles were developed as a framework for businesses to use to ensure their offsetting is actually aligned with the science on how the voluntary carbon market can accelerate progress towards global net zero targets.

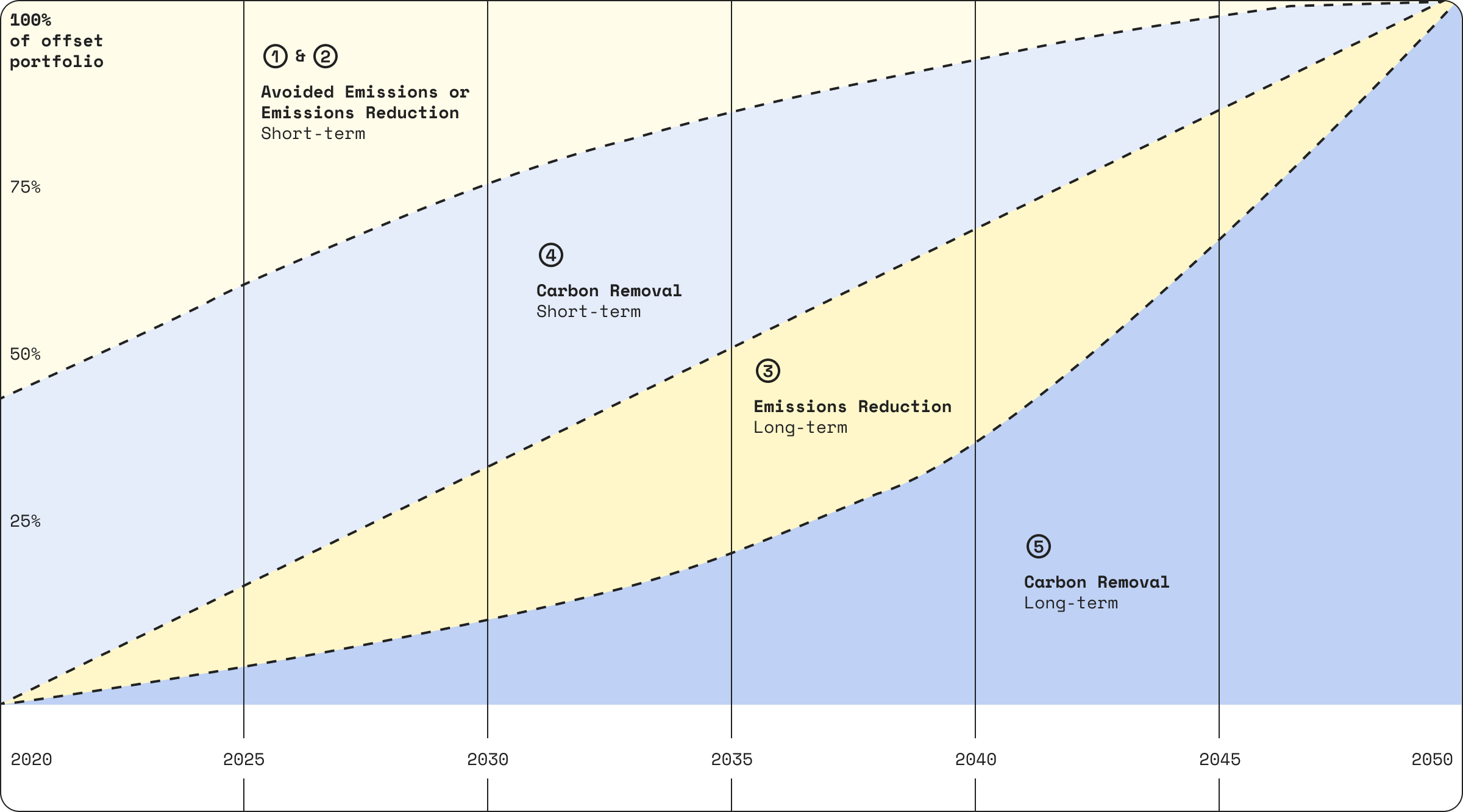

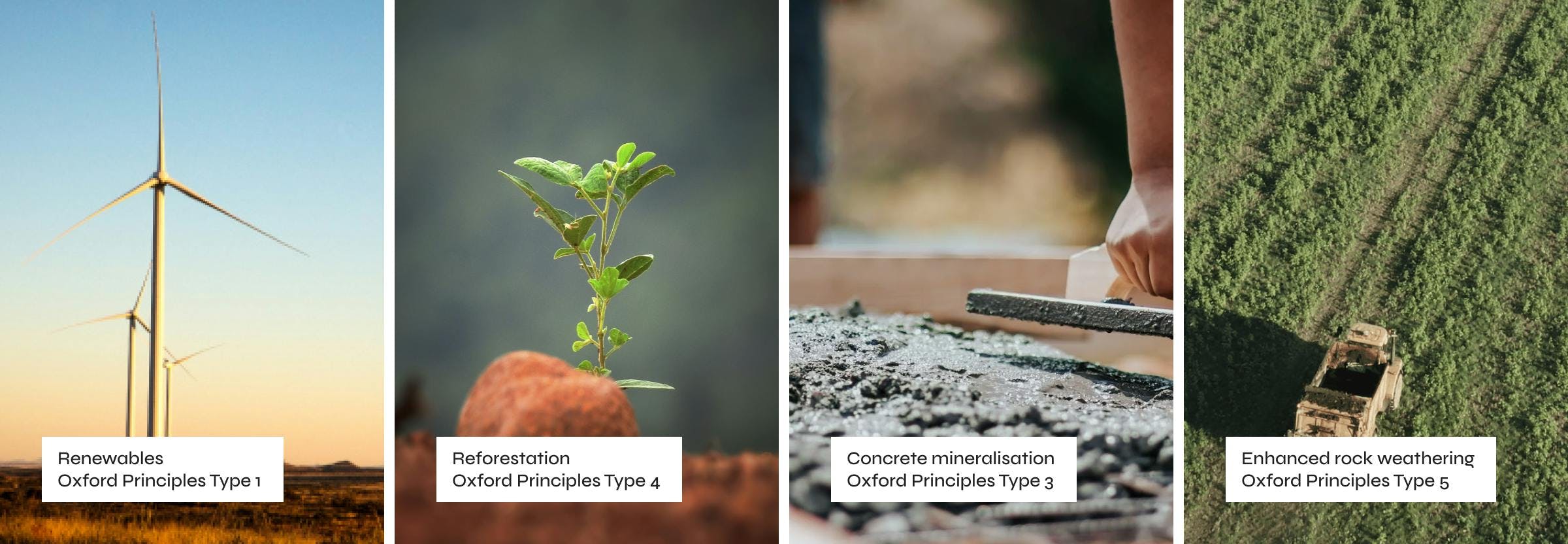

It focuses on that balance between impact and cost that we’ve already looked at, advocating the creation of an offsetting portfolio which changes over time:

- In the short term the portfolio should contain a mix of emissions avoidance and carbon removal projects as well as a mix of short-term and long-term carbon storage projects – to make offsetting affordable for businesses whilst balancing immediate impact with supporting the development of future carbon removal solutions.

- In the long term the portfolio should gradually shift more and more spend into carbon removal projects with long-term storage to continue to maximise impact as these projects scale up and the cost of their carbon credits reduces – with the ultimate aim of the portfolio being 100% permanent carbon removal by 2050.

So, in practice, in the short-term you might create an offsetting portfolio which looks like:

- 50% renewables – emissions avoidance with no storage

- 40% reforestation – carbon removal with short-term storage

- 5% concrete mineralisation – emissions avoidance with long-term storage

- 5% enhanced weathering – carbon removal with long-term storage

And then over time you would then shift more spend into concrete mineralisation and enhanced weathering – and potentially add other long-term carbon removal projects too – to maximise impact.

Funding innovative carbon removal technologies

The Oxford Offsetting Principles suggest that all companies should be buying 100% permanent carbon removal for their offsetting by 2050 to be in line with science-backed pathways towards global net zero.

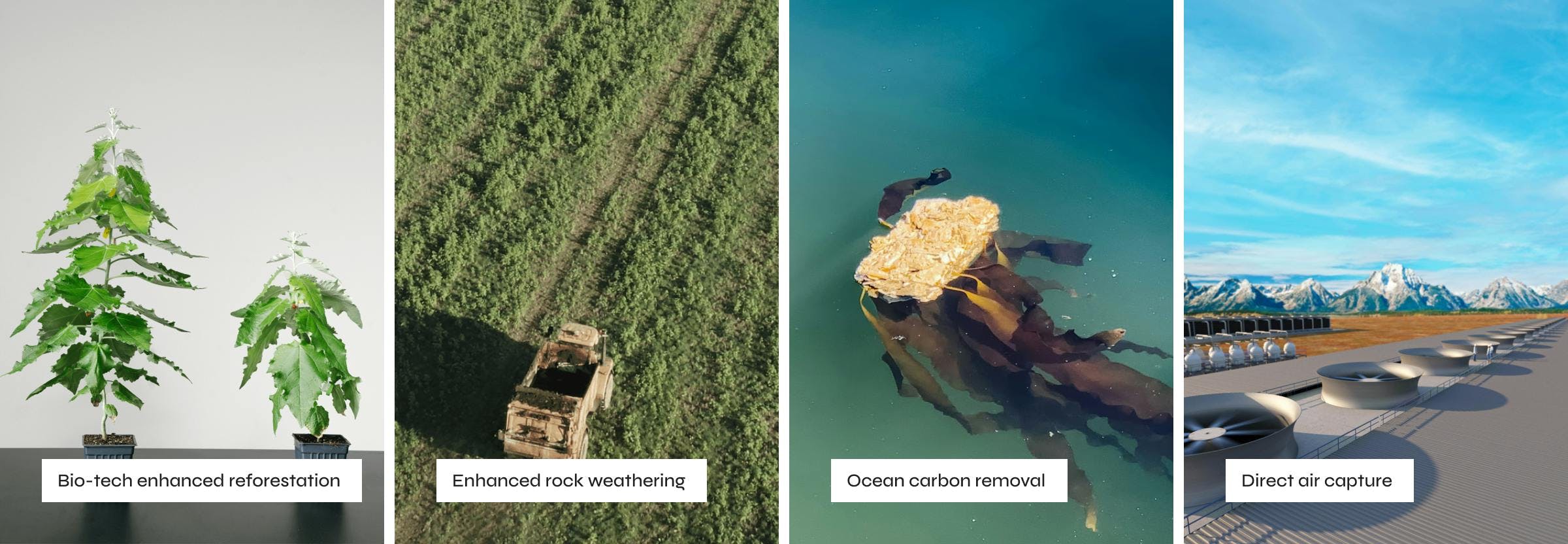

Some forward-thinking companies are committing to buying 100% permanent carbon removal right now.

It might be to fulfil a net zero commitment – like Vestre, for example. Or it might simply be to do their part and demonstrate true climate leadership in funding vital carbon removal technologies – like the growing number of companies investing in the Frontier advance market commitment.

Either way, building a portfolio of different innovative carbon removal projects is an incredible way to use your climate budget to make a real difference.

It might look like this:

- 50% bio-tech enhanced reforestation

- 20% enhanced rock weathering

- 20% ocean carbon removal

- 10% direct air capture

A nature-based portfolio

On the other hand, your company might decide that it wants to prioritise carbon projects in nature-based solutions, helping to fund the protection of nature, wildlife, and biodiversity.

In this case, you might build a portfolio across different types of nature-based projects, which could look like this:

- 25% forest conservation

- 25% restoring mangroves in coastal wetlands

- 25% soil carbon sequestration

- 25% reforestation

Build a carbon offsetting portfolio in the Lune dashboard

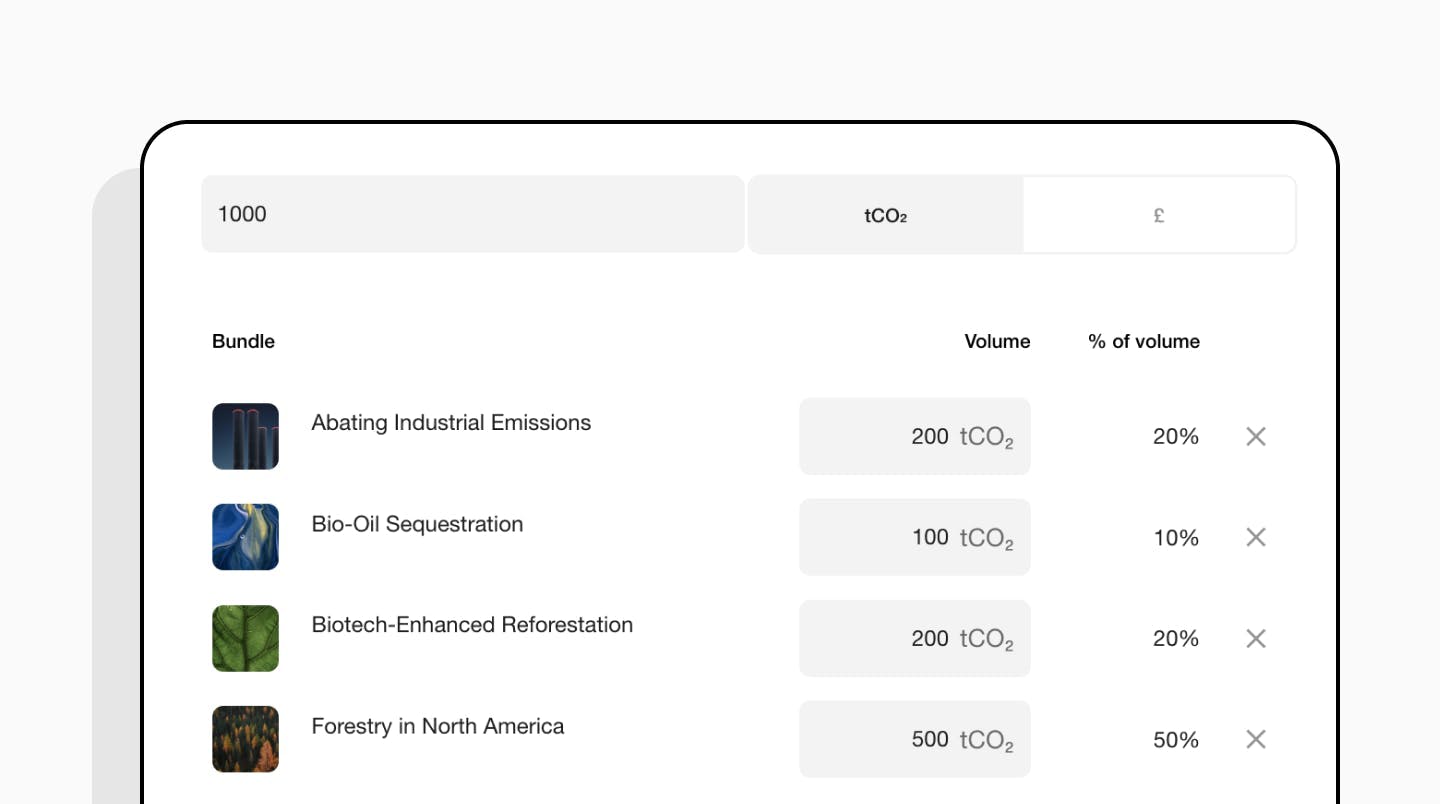

Once you’ve decided on the type of carbon offsetting portfolio you want, you need to actually build it.

This can be done manually by engaging with individual projects and keeping track of your portfolio in e.g. a spreadsheet.

But, it’s much more efficient to work with a partner like Lune to build a portfolio – we’ve already curated a library of vetted, high-quality carbon projects, and it’s easy to build a portfolio in our dashboard.

If you want to buy from a bespoke portfolio you can also easily build your own portfolio – for instance if you wanted to choose projects across a specific geographic spread e.g. North America and Canada:

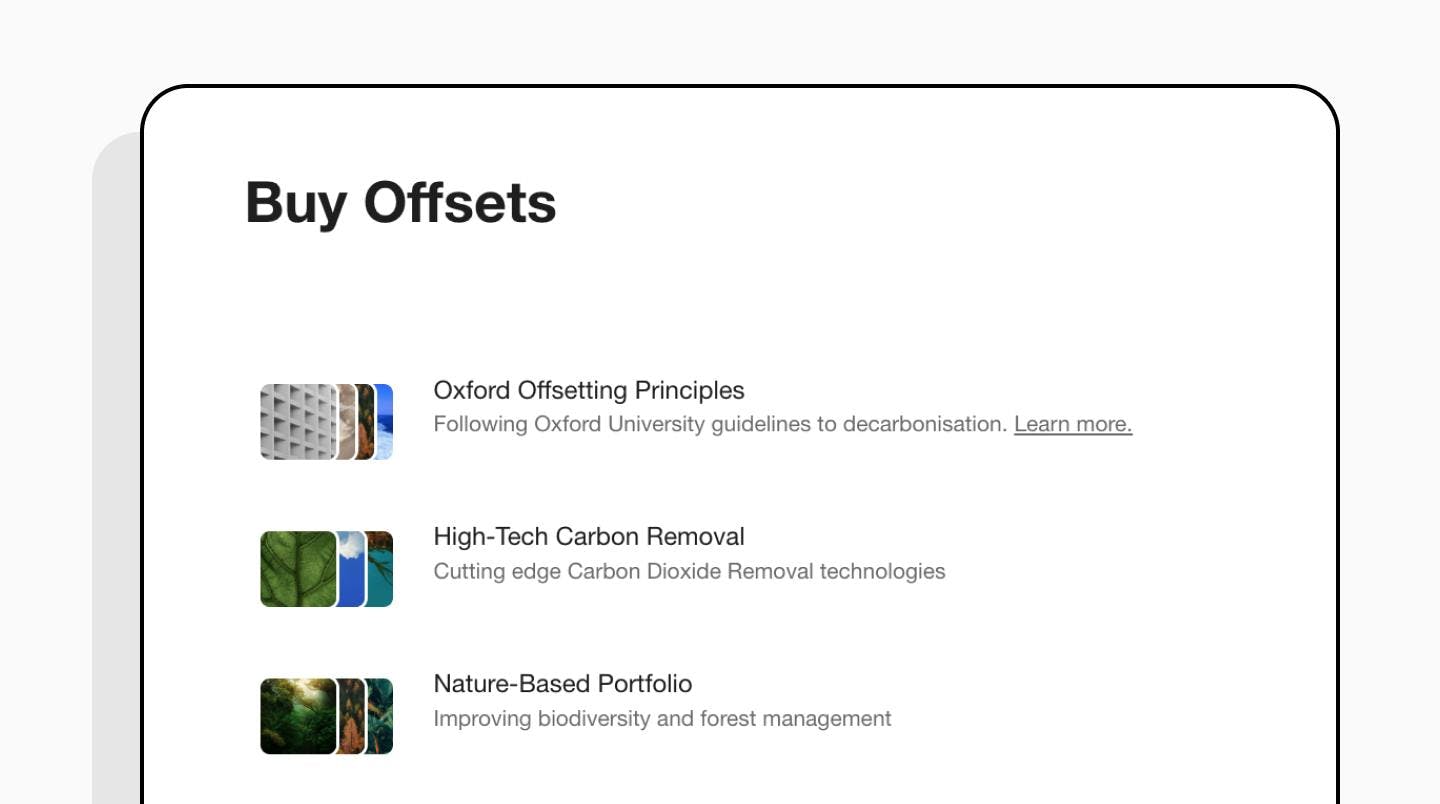

Or, we also have ready-made carbon offsetting portfolios across the three examples we’ve just walked through – Oxford Offsetting Principles, innovative carbon removal technologies, and nature-based solutions:

Plus, we have existing relationships with all of the project developers in our library, meaning that if you’re keen to build a longer term portfolio and buy carbon credits on an ongoing, multi-year basis (e.g. to keep your purchases aligned with the Oxford Offsetting Principles over time) then we’re able to facilitate that for you – just get in touch and the team will be in touch to set up an initial chat about your hopes and requirements.

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.