There’s currently change underway in how UK companies disclose their environmental impact – with the Sustainability Disclosure Requirements (SDRs) becoming the new standard.

This article will cover everything you need to know if your business operates in the UK:

- What are the Sustainability Disclosure Requirements?

- Which companies do the SDRs apply to?

- When do the SDRs come into effect?

- What does reporting need to include?

- How can companies prepare?

We’ll keep the article updated as new developments arise, so make sure you bookmark it safely – and you can sign up to our monthly newsletter to be notified too.

Plus, for an overview of current and upcoming corporate climate disclosure regulations across the world, head to our legislation overview blog – we keep it up to date with all the latest on sustainability-related legislation for businesses.

What are the Sustainability Disclosure Requirements?

In October 2021 the UK Government announced its green finance strategy as part of the plan to transition to a net zero economy –Greening Finance: A Roadmap to Sustainable Finance report.

The first phase of the roadmap includes the introduction of Sustainability Disclosure Requirements (SDR).

As it stands, there are various different sustainability reporting regulations in the UK:

- FCA mandated TCFD-aligned disclosures: introduced in 2022 for UK listed commercial companies with a premium or standard listing, UK asset managers, life insurers and FCA-regulated pension providers. This represents around 1,300 companies.

- Streamlined Energy and Carbon Reporting (SECR) - introduced in 2019, the SECR requires large UK companies to disclose their energy use, greenhouse gas (GHG) emissions, and progress on energy efficiency improvements in their annual financial reporting

- BEIS Climate-Related Financial Disclosure: introduced from April 2022, the UK Department for Business, Energy, and Industrial Strategy (BEIS) requires UK-registered companies with over 500+ employees or £500M+ in annual revenue to complete annual sustainability and climate-related disclosure reporting, using TCFD guidelines.

It’s a complex landscape for companies and investors alike to wrap their heads around.

So, the SDRs aim to unify corporate sustainability reporting into one set of comprehensive rules on climate disclosure – which companies need to report, what should be included, when it should be reported, in what format, by who, and so on.

This will give businesses a clear framework on how to report on climate risks and opportunities, increase the number of businesses reporting on their environmental impact, and ensure investors and stakeholders have access to the information they need to make informed decisions.

The development of the Sustainability Disclosure Requirements is now with the Financial Conduct Authority (FCA) who will develop the legislation itself.

The details are TBC (and we’ll keep this article updated as developments arise) – most recently, the FCA published a discussion paper for public consultation, exploring consumer-facing climate disclosure and sustainability labelling (which is also part of the greening finance roadmap).

When do the SDRs come into effect?

The Sustainability Reporting Directive is expected to be finalised and implemented in 2023.

After implementation, there would then be a rollout period for companies to start their annual reporting – with all companies fully on board by 2025.

What will reporting need to include?

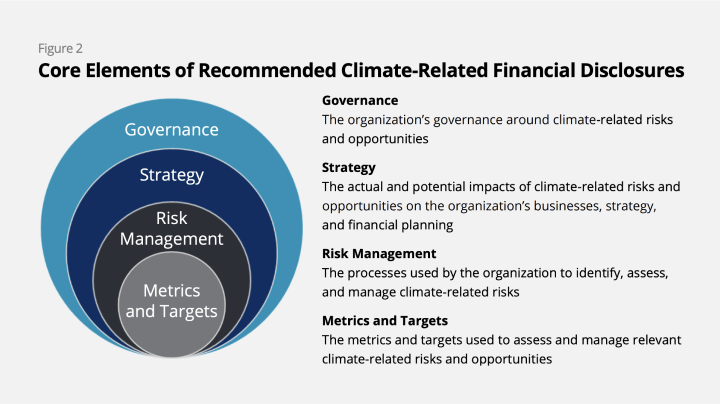

The Sustainability Reporting Directives will be based on the recommendations of the Taskforce for Climate-related Financial Disclosures (TCFD) and, once finalised, the global standard being developed by the International Sustainability Standards Board (ISSB).

So, although we don’t know the full details of what companies will be required to include in their reports, we can expect that it will require at least what is suggested within the TCFD recommendations – giving us a good idea of what reporting will need to include.

In very brief, the TCFD rules require 11 disclosures across 4 key areas:

- Governance

- Strategy

- Risk management:

- Metrics and targets

Read more in our article: What should you include in corporate sustainability reporting? An overview of global standards for climate disclosure

How can companies prepare for Sustainability Disclosure Requirements?

If your company operates in the UK, we’d recommend starting to get everything in order sooner rather than later – it’s highly likely you’ll soon be legally required to report on your environmental impact and plans to reduce it, and there’s a lot to do to get prepared for that.

Plus, beyond the legislation, there’s a very strong business case for working on sustainability anyway – from risk management to customer loyalty to employee satisfaction and more.

Luckily, there are plenty of actions to get started with to put you in good stead for upcoming changes:

- Take a look at the Task Force on Climate-Related Disclosures (TCFD) recommendations on corporate climate reporting – they’re currently the most accepted and adopted standard for how companies should disclose on climate, and the UK SDRs will be based on them, so they’ll give a good idea of what you’ll need to report and how.

- Calculate your existing carbon emissions to understand your starting point and identify areas for improvement.

- Set rigorous targets and KPIs to reduce emissions as much as possible, always using a respected framework such as Science Based Targets.

- Buy high-quality offsets to compensate for emissions you’re unable to reduce (or that will need long-term work to reduce).

- Identify climate risks to your business, and put mitigation measures in place – climate should definitely be part of your risk management process.

- Explore climate opportunities in your industry – how could your business respond to climate change beyond your own carbon footprint? For instance, in the payments industry that may be exploring how to offer consumers and/or businesses a ‘green’ payments alternative.

- Starting with developing an impactful sustainability strategy which lays out how you will approach sustainability at your company and how it aligns with your overall goals and vision is the way to go – including all of the above actions.

Want support? We can help with calculating your emissions, high-quality offsetting, and exploring opportunities for embedding climate impact within your product – get in touch.

Subscribe for the latest insights into driving climate positivity

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.