In 2022, the Securities and Exchange Commission (SEC) proposed a rule change which would make it mandatory for companies to disclose climate-related information.

Although it’s currently in the proposal stage, it’s a strong signal that there will be greater enforcement coming for businesses in terms of their environmental impact and their plans to transition to a lower carbon business model.

This article will cover everything you need to know about the proposed SEC climate disclosure rule in the US:

- What is the proposed SEC climate disclosure rule ?

- Who would the proposed SEC climate disclosure rule apply to?

- When would the proposed SEC climate disclosure rule come into effect?

- What would reporting include?

- How can companies prepare?

We’ll keep the article updated as new developments arise, so make sure you bookmark it safely – and you can sign up to our monthly newsletter to be notified too.

Plus, for an overview of current and upcoming corporate climate disclosure regulations across the world, head to our legislation overview blog – we keep it up to date with all the latest on sustainability-related legislation for businesses.

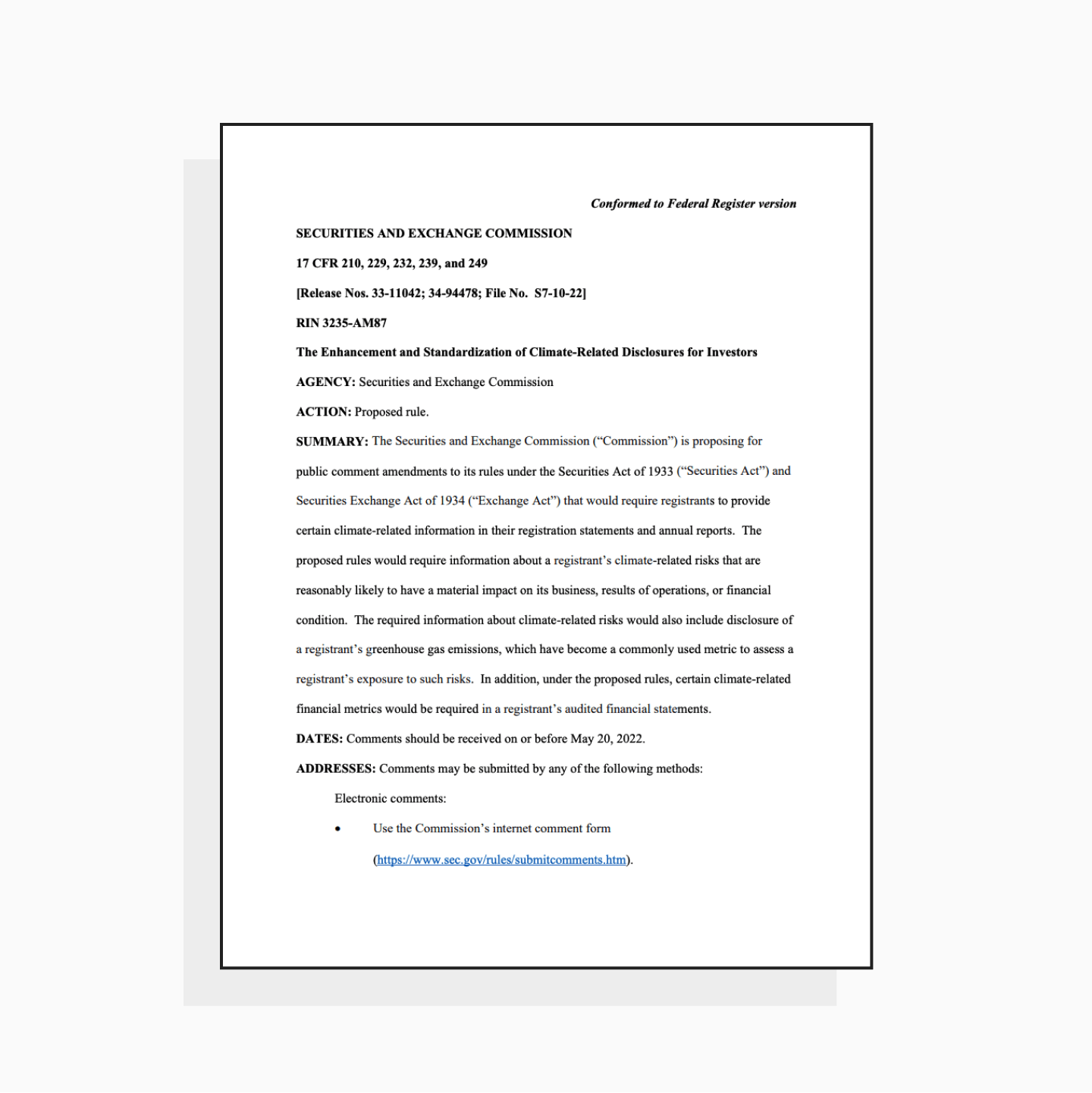

What is the proposed SEC climate disclosure rule?

In March 2022, the US Securities and Exchange Commission (SEC) made a proposal for rules making it mandatory for companies to disclose climate-related information.

The proposed rule came about largely due to increased pressure from investors, who want to be able to assess climate risk in their portfolios and new investments.

Importantly, the proposal letter highlights that many companies have already made green transition plans and targets, and that this reporting is necessary to ensure that these targets are being worked towards.

Before this proposal, the last guidance from the SEC was in 2010, in an ‘‘interpretive release to provide guidance to public companies regarding the Commission’s existing disclosure requirements as they apply to climate change matters’. This guidance gave companies a large amount of discretion about what climate-related disclosures they needed to include in their reporting, and it was mostly through voluntary frameworks such as publishing an annual impact report.

So, if this rule is adopted, it represents a huge change in how companies in the US report on their environmental impact.

Who would the proposed SEC climate disclosure rule apply to?

The proposed rule would apply to US 10-K filers as well as foreign private issuers who file 20-F forms with the SEC – i.e. all companies registered with the SEC.

When would the proposed SEC climate disclosure rule come into effect?

The proposed rule would come into effect for the financial year 2023 – with first reports due in 2024. But, there would be a phased introduction:

- Large companies would need to disclose from this first year – so filing a report in 2024 for the financial year 2023

- Smaller companies would have a yearlong grace period, and would be required to file their first report in 2025 for the financial year 2024

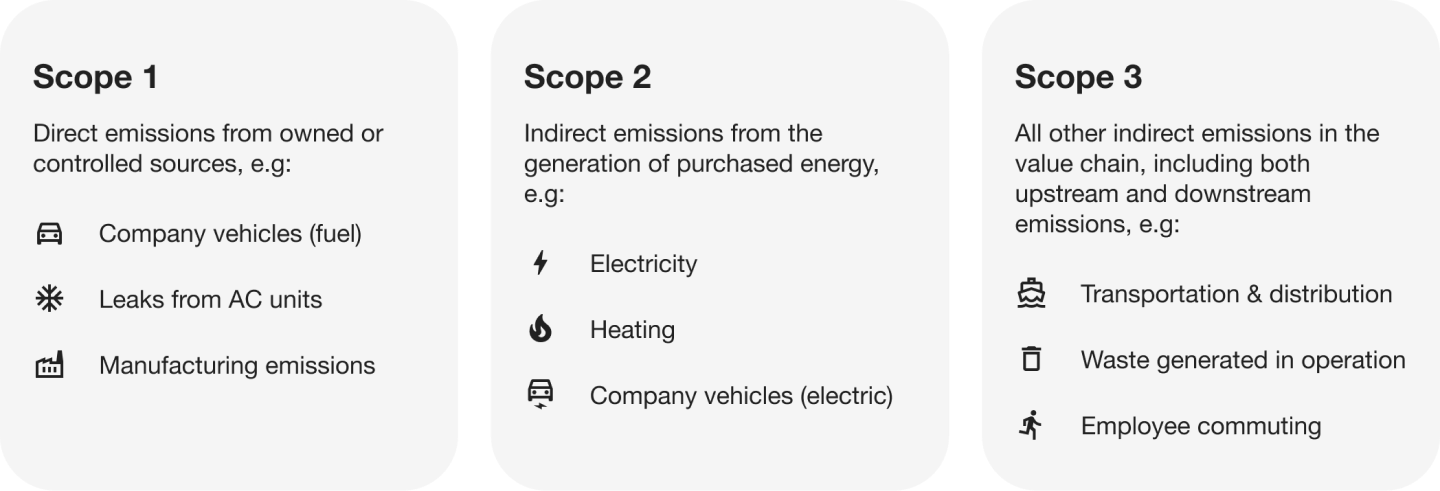

- There would also be an additional yearlong grace period for including Scope 3 emissions in the reporting, expected to be in reports from 2025 for the financial year 2025 – in recognition of the challenges related to this aspect in understanding and gathering the data of emissions across the entire supply chain.

What would reporting include?

If adopted, the SEC rule would require companies to disclose detailed reporting of their climate-related risks, emissions, and net-zero transition plans.

The SEC highlights that reporting would be across 4 areas:

- Governance: The governance of climate-related risks and relevant risk management processes

- Financial impact (materiality): How any climate-related risks identified by the registrant have had or are likely to have a material impact on its business and consolidated financial statements, which may manifest over the short-, medium-, or long-term

- Strategy: How any identified climate-related risks have affected or are likely to affect the registrant’s strategy, business model, and outlook;

- Risk: The impact of climate-related events (severe weather events and other natural conditions) and transition activities on the line items of a registrant’s consolidated financial statements, as well as on the financial estimates and assumptions used in the financial statements.

And the rule as a whole is building on the recommendations from the Taskforce for Climate-related Financial Disclosures (TCFD) – but aims to go above and beyond the TCFD recommendations in scope.

As it’s currently only a proposed rule, there are likely to be changes in the details – but based on this information so far, we can expect it to be a rigorous, robust piece of legislation.

For the full details, go to page 40-46 of the proposed rule PDF.

How can companies prepare for the SEC climate disclosure rule?

If your company is included in those that will need to comply with the SEC climate disclosure rule, we’d recommend starting to get everything in order sooner rather than later – there’s a lot to do. Plus, beyond the legislation, there’s a very strong business case for working on sustainability anyway – from risk management to customer loyalty to employee satisfaction and more.

Luckily, there are plenty of actions to get started with to put you in good stead for upcoming changes:

- Get familiar with the Task Force on Climate-Related Disclosures (TCFD) recommendations on corporate climate reporting – they’re currently the most accepted and adopted standard for how companies should disclose on climate, with a detailed framework of how companies should report on climate.

- Calculate your existing carbon emissions to understand your starting point and identify areas for improvement.

- Set rigorous targets and KPIs to reduce emissions as much as possible, always using a respected framework such as Science Based Targets.

- Buy high-quality offsets to compensate for emissions you’re unable to reduce (or that will need long-term work to reduce).

- Identify climate risks to your business, and put mitigation measures in place – climate should definitely be part of your risk management process.

- Explore climate opportunities in your industry – how could your business respond to climate change beyond your own carbon footprint? For instance, in the payments industry that may be exploring how to offer consumers and/or businesses a ‘green’ payments alternative.

- Starting with developing an impactful sustainability strategy which lays out how you will approach sustainability at your company and how it aligns with your overall goals and vision is the way to go – including all of the above actions.

Subscribe for the latest insights into driving climate positivity

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.