Ever wondered what happens when a carbon credit retires? It's a vital piece in the lifecycle of a carbon offset.

But what does it actually mean to ‘retire’ a carbon credit? When does retirement take place? And how quickly is the credit retired?

Let’s answer those questions by taking a look at the lifecycle of a carbon credit – including where carbon credit retirement fits in.

What is the lifecycle of a carbon offset?

In the lifecycle of a carbon credit, there are three key stages. They are issued, sold, and then retired.

1. Carbon credits are issued

Carbon credits are issued for a project based on the amount of carbon emissions they will prevent from happening (emissions avoidance) or remove from the atmosphere (carbon removal). Each carbon credit is the equivalent of 1 tonne of CO₂ avoided or removed.

These credits can be issued either once the carbon benefit has occurred e.g. in reforestation the forest has successfully grown and has removed the planned amount of carbon (known as ex-post carbon credits) or can be issued before the carbon benefit takes place, based on the expected benefit that will take place in the future (ex-ante or pre-purchase carbon credits).

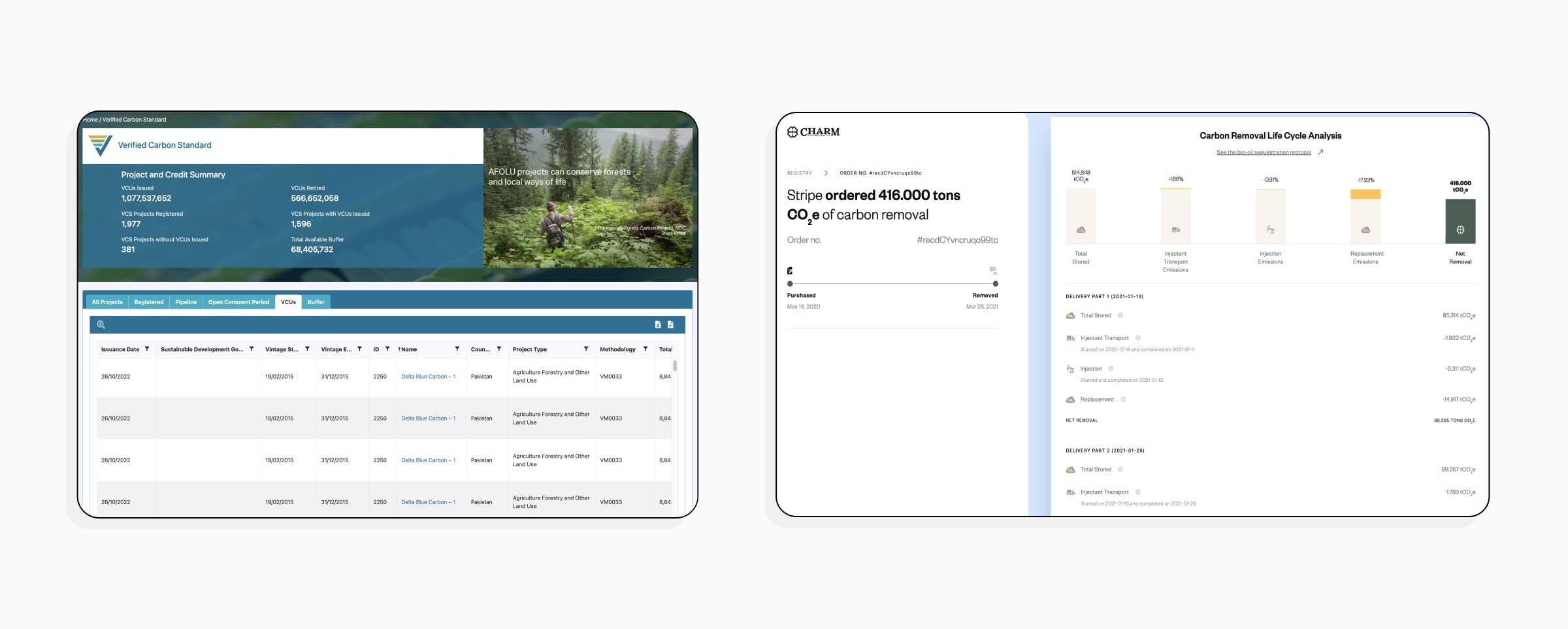

Carbon credits should always be issued in a publicly available registry, to ensure transparency and traceability – crucial in ensuring that double counting never occurs. For projects certified via a carbon standard like Verra or Gold Standard, the carbon credits will be issued in the registry of that carbon standard. Projects that are not yet certified typically manage their own registry.

2. Carbon credits are sold

The project developer then sells the issued carbon credits to entities who want to buy carbon to compensate for their own emissions (or simply to contribute to climate solutions) – typically businesses. The income from the sale is used to finance the project’s work.

Some project developers sell credits directly to individuals or businesses themselves; others sell credits to middlemen like consultancies or carbon marketplaces who then sell them on to the individuals or businesses.

3. Carbon credits are retired

The retirement of a carbon credit is a crucial step in its lifecycle. Retirement occurs once the carbon benefit which the credit represents has taken place.

It is retired in its registry to indicate that it has been used. It is taken off the carbon market, and cannot be sold or traded again.

Note that this only happens once the impact has actually occurred i.e. the emissions have been avoided or removed from the atmosphere.

This means that there are two different timelines for carbon credit retirement, depending on the type of carbon credit you buy (ex-post vs ex-ante vs pre-purchase):

- For ex-post carbon credits, retirement takes place immediately after your purchase, and you should receive proof of the carbon credit retirement immediately – though this can take days or weeks currently due to legacy processes in the voluntary carbon market – but our instant retirements are changing that.

- But, for ex-ante and pre-purchase carbon credits retirement will not take place immediately after your purchase, because the impact has not yet taken place. You should still receive a carbon certificate as proof of your purchase, but you won’t receive confirmation of carbon credit retirement until the point in the future when the carbon benefit has actually taken place – and the project you buy from should inform you of the timeline for this.

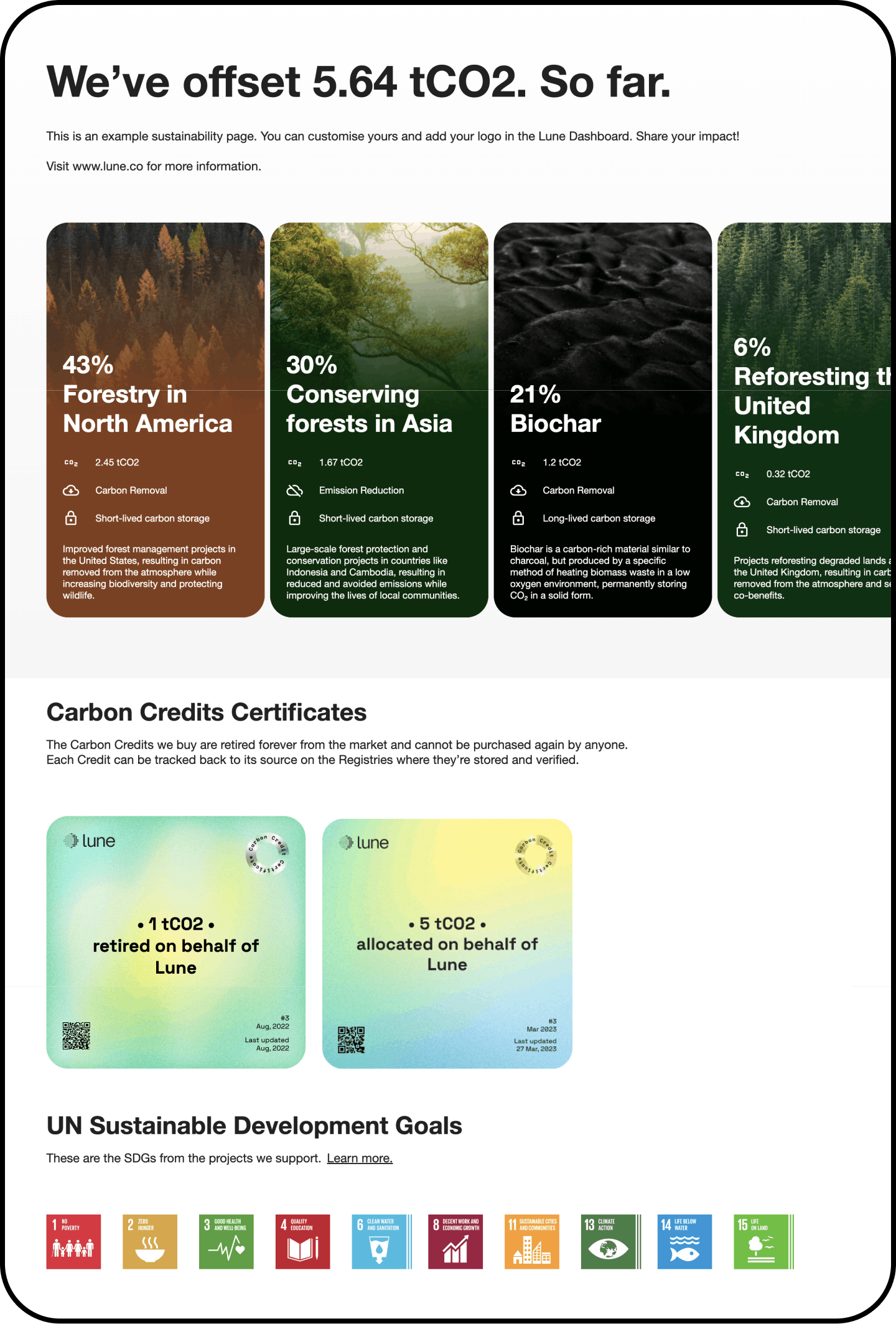

At Lune we distinguish between these two timelines on our carbon offset certificates.

For carbon credits that have been retired, the carbon certificate indicates ‘retired’ in the name of the buyer.

And for those which have been purchased but not yet retired, the carbon certificate indicates ‘allocated’ in the name of the buyer – and this is updated in the future at the point when retirement occurs.

Here’s what that looks like on our example Sustainability Page (automatically generated for all Lune customers to share their impact):

Why carbon credit retirement matters

Retiring carbon credits is vital as it ensures the purchase and impact are traceable, and avoids any double counting.

Double counting is when more than one entity claims the impact of a single carbon credit. This is greenwashing. Only by preventing double counting can we accelerate net zero.

Transparent and traceable carbon offsets

Understanding the full lifecycle of a carbon offset —from its creation to its retirement — helps sustainability leads accurately build effective carbon credit portfolios that fulfil sustainability goals.

If you’re looking for more information on carbon offsetting and how the voluntary carbon market works, we’d recommend downloading our Complete Guide to Carbon Offsetting.

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.