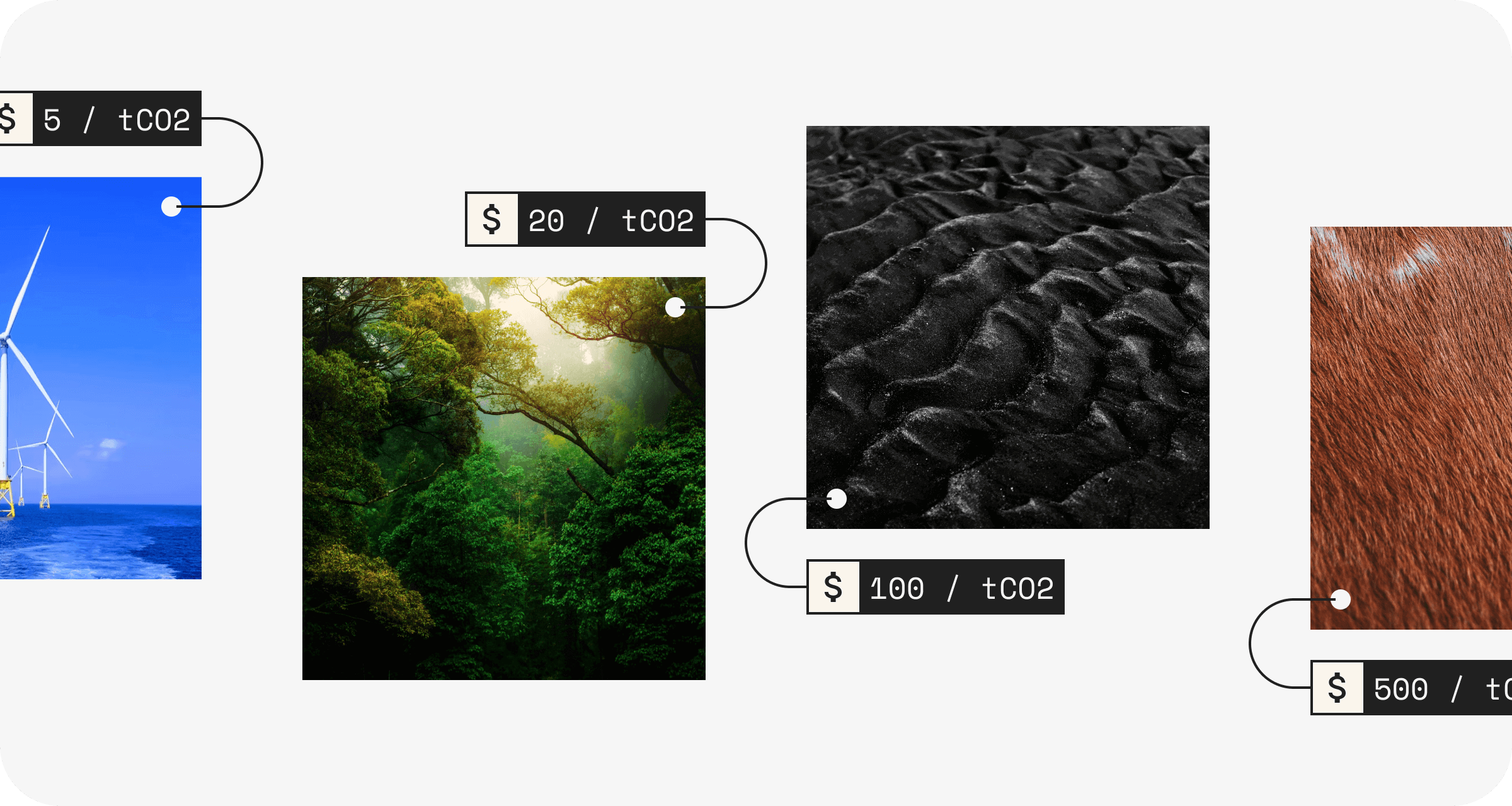

Picture it: you’re choosing which offset projects to purchase carbon credits for to compensate for your company’s annual emissions. You could opt for a project where a credit costs $200. But then you spot another project where each credit is just $5.

Why would you pay $500 per credit when you could pay $5? How much does a carbon credit cost, really?

It’s easy to see why businesses are tempted by cheaper credits.

But although it seems that every carbon credit represents the same climate impact (1 carbon credit = 1 tonne of carbon dioxide removed or avoided) that’s not exactly true – and this variation in carbon credit pricing has huge implications for impact.

So how much does a carbon credit cost, and why does it vary so much?

What influences carbon credit prices?

How much a carbon credit costs typically comes down to varying types of projects.

For instance, you might notice that the project you found selling credits for $5 each is a renewable energy project, whereas the $500 per credit is a direct air capture project.

There are several ways that carbon credits can be priced – take a look at Gold Standard’s explanation for their pricing, for example, which takes into account many factors, particularly project quality and value-added beyond the immediate carbon benefits (i.e. co-benefits).

But, on the most part, carbon credit pricing comes down three key things: quality, running costs, and demand.

1. The quality of the project

We’ve said it before: not all carbon offsets are created equal.

The voluntary carbon market (VCM) is unregulated, with no requirement for projects to be verified.

This has led to some taking advantage of the opportunity to use selling carbon credits as a source of income, and illegitimately selling credits in low-quality projects that lack permanence, additionality, baselines, monitoring and reporting etc – in a nutshell, that don’t have the climate impact they’re claiming to.

These projects typically aim to sell as many credits as possible, which means the carbon credit price is much lower to appeal to buyers. To add to this, because they’re low-quality projects without all the rigorous checks and precise development to ensure real-world climate impact, they have much lower running costs and so are able to afford to sell credits cheaply.

Which leads us nicely to the second key factor in understanding how much a carbon credit costs – running costs.

Subscribe for the latest insights into driving climate positivity

2. The project’s running costs

For high-quality carbon offset projects, the ability to sell carbon credits is what makes the project financially viable – funding the research, development, implementation and ongoing operation of the project.

Some project types have higher setting up and/or running costs than others, for instance if they require a substantial amount of research and development before getting started, or if they’re a technology based project with high operating costs. These types of projects will need to sell their credits at a higher price to fund the project’s success.

You may have noticed that some of the most expensive carbon credits at the moment are for new, innovative, permanent carbon removal projects – such as Direct Air Capture (DAC), biochar, and seaweed farming – and this explains why that’s the case. They’re early-stage projects developing new methods, often using new technologies. They’re expensive to run, and that leads to more expensive carbon credits.

But, these early-stage carbon removal projects are critical for the future of our planet.

We need them to scale up successfully, and so there’s an opportunity for businesses to make a huge impact by contributing to these types of projects – even if it means buying less carbon credits because of the higher cost.

On the other hand, emissions reduction/avoidance projects are generally well-established, receive funding already, and have lower running costs.

That’s why you’ll sometimes see renewable energy offsets at costs as low as $5 per tonne of CO2 – it’s a well-known and accepted type of project with lots of existing buyers, and the cost of the materials needed has come down massively in recent years.

3. Supply and demand

Like any other market, carbon credit prices are impacted by supply and demand.

As we’ve seen, many of the more innovative, permanent carbon removal projects are newly formed and in the early stages of development. This means the supply of carbon credits for these project types is low, because there simply aren’t that many credits out there to be sold yet, and therefore those that do exist are more expensive. As existing projects scale up, and new projects arise, supply will increase and costs should come down.

On the other hand, projects like renewable energy and forestry are already well-established and there are lots of them out there, so supply of credits isn’t an issue and costs are lower.

It’s also worth noting that demand for carbon credits so far has been relatively low on the whole – it’s a ‘voluntary’ market, after all. This has led to a ‘race to the bottom’ for sellers to be able to sell their carbon credits, leaving the average cost of carbon low overall.

This pricing is unsustainable if we want to achieve climate targets. The World Bank calculated that we need carbon credits to cost $40-80 each if we are to meet Paris Agreement targets of keeping warming to a maximum of 2 degrees.

In 2022 we’re seeing demand grow as more and more individuals and businesses start to address their carbon footprint. And that demand is going to continue increasing rapidly. McKinsey, for instance, estimates a 15x growth in demand by 2030 – at Lune, based on what we’re seeing, we’re actually expecting it to be a lot higher than that. This includes demand for carbon removal credits – there have been a few large carbon removal commitments and purchases by high-profile businesses this year, which is likely to spark others following suit.

That means that the average cost of carbon is also going to increase.

Which is a good thing, because it will better reflect the true climate cost of emissions, and encourage change. It will also reduce the variance of cost across types of carbon offset projects, creating more equal pricing and reducing the temptation to simply opt for the cheapest offset.

Businesses should never default to the cheapest option if they want to make a real difference

As you’ve seen, when it comes to offsets the cheapest is typically the lowest-quality.

That’s why we’d never advise businesses to simply opt for the cheapest option out there. It won’t make a difference for the planet, and you’re putting yourself at risk of greenwashing allegations that could cost you customers, investors, and employees.

Always ensure you’re opting for quality first when offsetting – that's why we've curated a library of vetted, high-impact offset projects.

But, even within high-quality projects there’s variance in pricing – as we’ve seen.

Generally, the most expensive carbon credits are where real impact is going to be made – contributing to the development and scaling of the technologies and solutions that have real potential to make lasting change.

Of course, we fully appreciate that not every business is going to be able to pay $100+ to offset every ton of carbon emissions. We’re also well aware that the person leading the charge on climate initiatives at a company isn’t always the one with the power to sign off budgets, and getting buy-in from senior leaders can be a huge barrier when choosing which offset projects to support.

So, we have two suggestions to maximise impact whilst keeping costs manageable:

- Firstly, as we mentioned earlier, you could take the approach of contribution rather than compensation. Instead of focusing on compensating in full for your own emissions as a business, you instead focus on contributing financially to the most impactful projects out there – so instead of ‘we’ve offset x emissions’ it becomes ‘we’ve contributed $x to the highest-impact solutions’.

- Alternatively, we often recommend that businesses build a high impact portfolio of offsetting projects by aligning with the Oxford Principles for Offsetting – which can be done easily through our software. This enables you to balance out cost by supporting both established emissions reductions and early-stage carbon removal projects, and this portfolio would change over time, shifting more spend into those permanent carbon removal projects as costs come down.

As a starting point, take a look at how we evaluate carbon projects for quality and real-world impact at Lune.

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.