Permanence is an important concept in the voluntary carbon market and offsetting.

It’s one of the key markers in what makes a high-quality carbon offset project – alongside additionality, single counting, avoiding overestimation of impact, and co-benefits beyond carbon.

And high-quality carbon projects are a must in offsetting.

Why? Well, the question of ‘does carbon offsetting actually work’ is one that comes up a lot. And the answer is yes, but only if offsetting is done via buying carbon credits from these high-quality projects. It’s the only way you can be confident that real, lasting positive impact is being made.

And permanence is part of that. So, it’s important to understand if you’re buying offsets.

In this article we cover:

- What is permanence in carbon offsetting?

- Why is permanence important?

- How is permanence determined in carbon projects?

- How do high-quality projects approach permanence? Examples across different types of projects – Charm Industrial, Running Tide, Ackron Mixed etc.

- Advice on how to approach permanence in your carbon offsetting approach.

What is permanence in carbon offsetting?

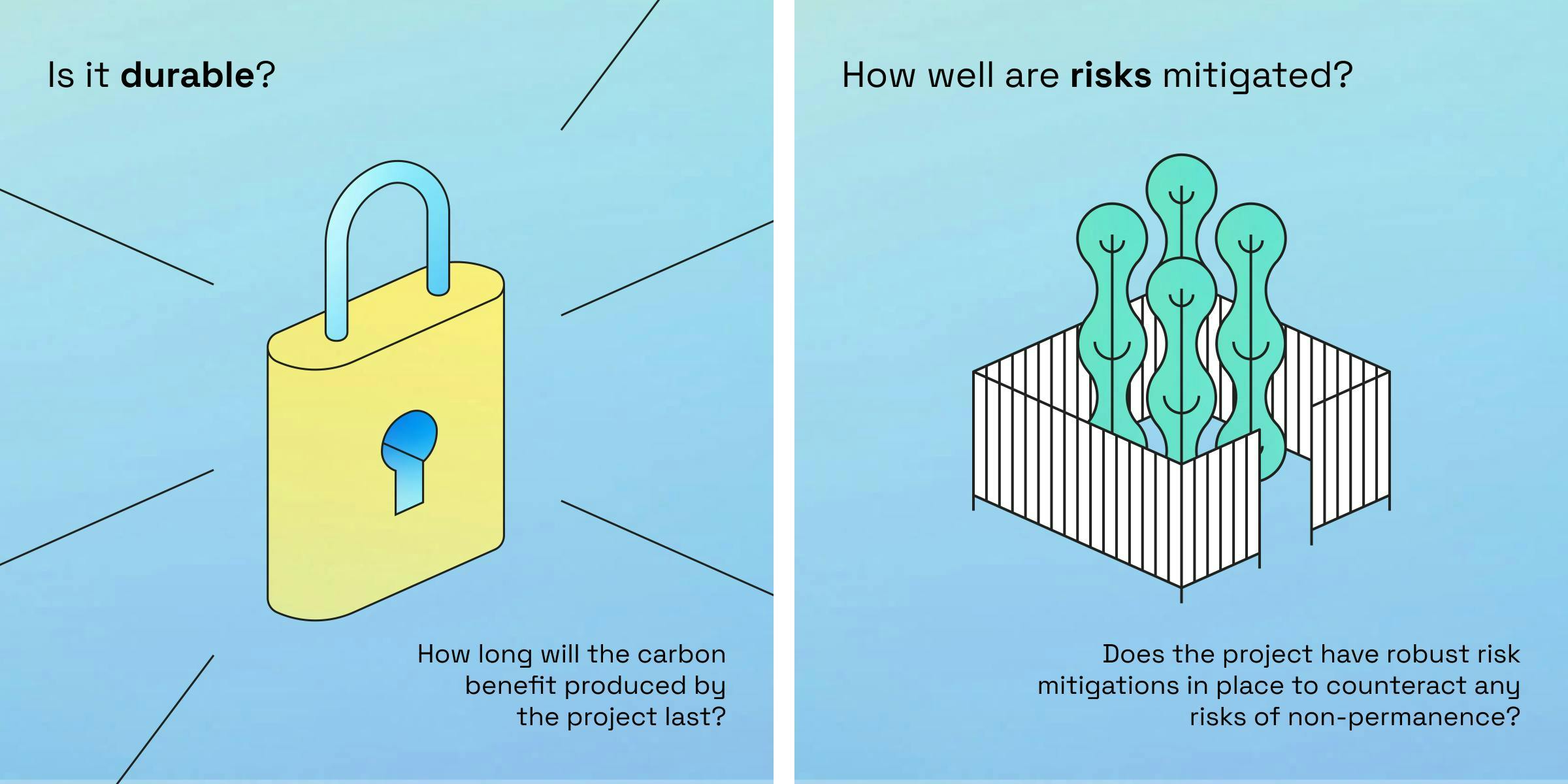

Permanence refers to how durable the carbon benefit – the amount of carbon emissions that are avoided or removed as a result of the project’s work – from an offset project is. It’s a way to measure how long-lasting a project’s impact is, taking into account any risk that the carbon benefit could be reversed in the future.

Permanence is an important marker of quality in carbon projects which include storage of carbon, because the length of time that the carbon is stored for can vary widely.

That’s both nature-based projects where carbon is stored in nature’s carbon sinks (e.g. trees, oceans, soil) and engineered carbon removal projects (e.g. direct air capture), where the removed carbon is either used or stored to prevent it returning to the atmosphere.

Carbon projects are defined as ‘permanent’ if carbon is stored for 1,000 years or more, because this is the length of time that carbon emissions remain in the atmosphere for once emitted – so it means the project can be said to be having a truly equivalent impact.

With that in mind, let’s take a closer look at why permanence is so important in carbon projects

Why is permanence important in carbon projects?

Two big reasons.

- The impact of our offsetting should be equivalent to the impact of our emissions

- We need permanent carbon removal to prevent the worst impacts of climate change

Subscribe for the latest insights into driving climate positivity

1. The impact of our offsetting should be equivalent to the impact of our emissions

First, remember that in carbon offsetting, we buy carbon credits that represent 1tCO2 that has been avoided or reduced through the actions of a carbon project, to compensate for our own carbon emissions as a company or individual.

And as we mentioned earlier, those carbon emissions that we’re responsible for will remain in the atmosphere for up to 1,000 years once emitted – meaning that our emissions today could still be wreaking havoc in the year 3023. The impact is very long-lasting.

The 1tCO2 that our carbon credit represents could have been prevented from entering the atmosphere for 1,000 years, in which case it’s equivalent to the impact our emissions have had. But, it could have been prevented from entering the atmosphere for a much shorter period of time, in which case we’re compensating for our emissions with something that’s actually much less impactful.

So temporary offsets can only be said to delay the inevitable planetary harm of the carbon emissions, for a short period of time – as Robert Hoglund has articulated well – which causes problems when we’re using that offsetting to say that we’ve dealt with our environmental impact as an individual or business.

That’s why permanence is so important in carbon offsetting.

The ideal scenario would be to offset using carbon credits from permanent projects, so that we know the positive impact made is equivalent to the negative impact from our own emissions.

2. We need permanent carbon removal to prevent the worst impacts of climate change

Secondly, aside from the offsetting context, if we’re going to beat climate change then we need carbon to be stored for good.

Almost every modelled scenario that scientists have created for us to meet the Paris Agreement climate targets requires a large amount of carbon removal (and those that don’t require extremely deep emissions reductions, which we’re way off track for).

And that carbon removal must be permanent – taking carbon emissions out of the atmosphere and storing them permanently so that they can never be released again.

Otherwise, we’re just pushing the problem a little further into the future.

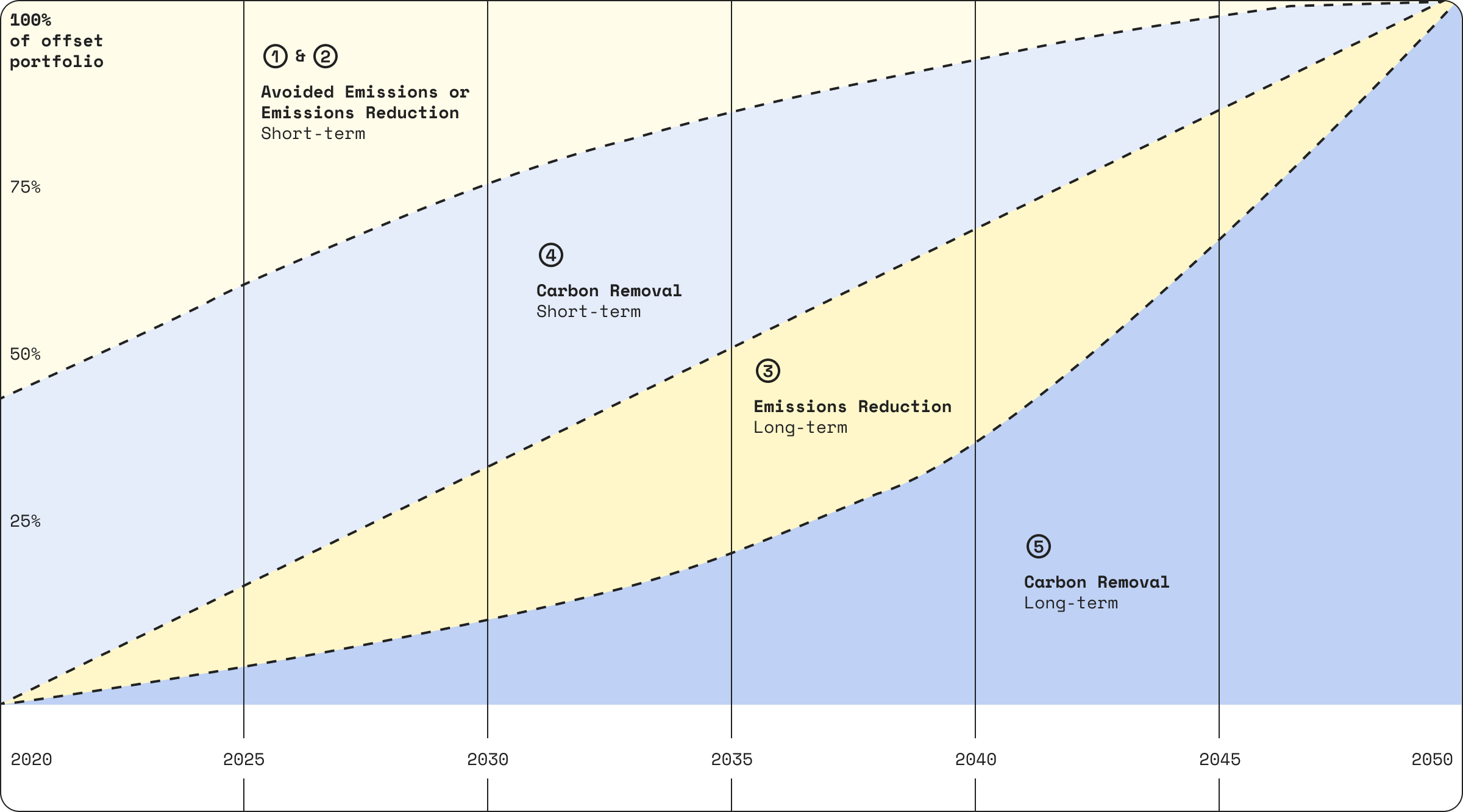

This is why the Oxford Offsetting Principles highlight the need for carbon buyers to shift to buying 100% permanent (long-lived) carbon removal by 2050.

Here’s what the Oxford Offsetting Principles’ suggested timeline looks like:

Graph from Oxford Offsetting Principles, p. 9

Graph from Oxford Offsetting Principles, p. 9How is permanence determined in carbon projects?

There are 4 key questions in determining permanence in carbon projects:

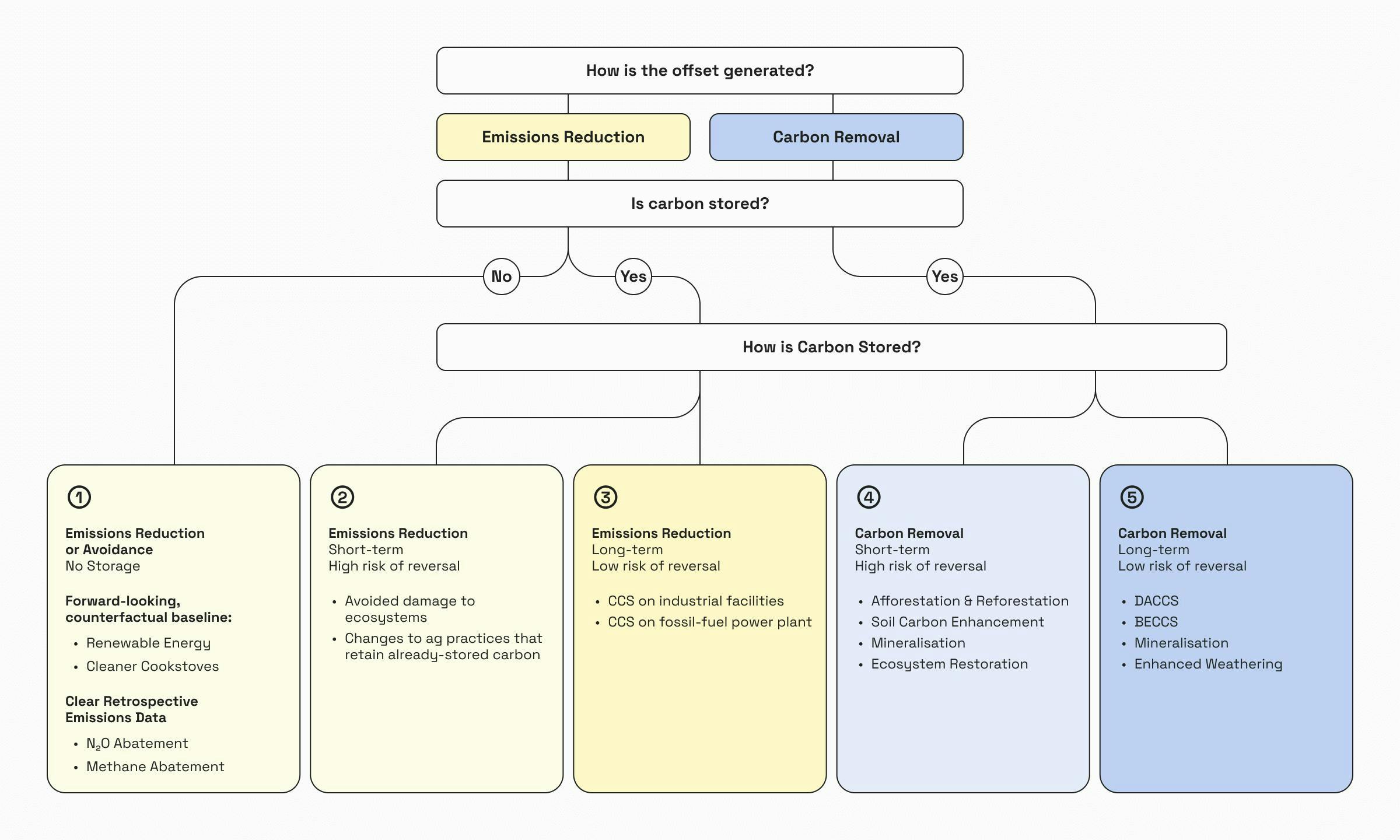

- Is carbon stored by the project? As we’ve mentioned, some emissions reduction projects do not include carbon storage e.g. renewable energy or methane reductions in dairy farming.

- If carbon is stored, how long for? For carbon projects that do include storage, the length of time varies widely. Storage can be for the short-term (decades) as in afforestation projects where carbon will be released when trees eventually die. Or storage can be for the long-term (centuries) as in enhanced weathering projects where carbon is mineralised in rock and enters the slow carbon cycle.

- What is the risk of reversal? Related to the previous question, some forms of storage have a higher risk of being reversed than others. To use the same example, in an afforestation project we know it’s highly likely that the carbon benefit will be reversed i.e. carbon stored in trees will eventually be released when a tree dies. There’s also a high risk that this could happen earlier than intended by the project, with factors like wildfires, disease, neglect etc which could cause a tree to die earlier than expected. In contrast, in the enhanced weathering project once the carbon has turned to solid rock through mineralisation, this cannot be undone and we know that the slow carbon cycle takes thousands or millions of years to re-release carbon, and so there is a low risk of reversal.

- What’s the lifetime of the project? It’s important to acknowledge the role of the project developer too. In creating a carbon project and storing carbon, the project developer makes a commitment for a length of time. The longer that length of time, the more confidence we can have that the carbon will stay stored. This is particularly important in carbon projects with short-term storage. For instance, in the afforestation example, a project with a 5 year lifetime could lead to a forest being abandoned at the end of 5 years, and we have no idea what will happen to the trees and the carbon they store after that point – which lowers our confidence in the project and increases the risk of reversal.

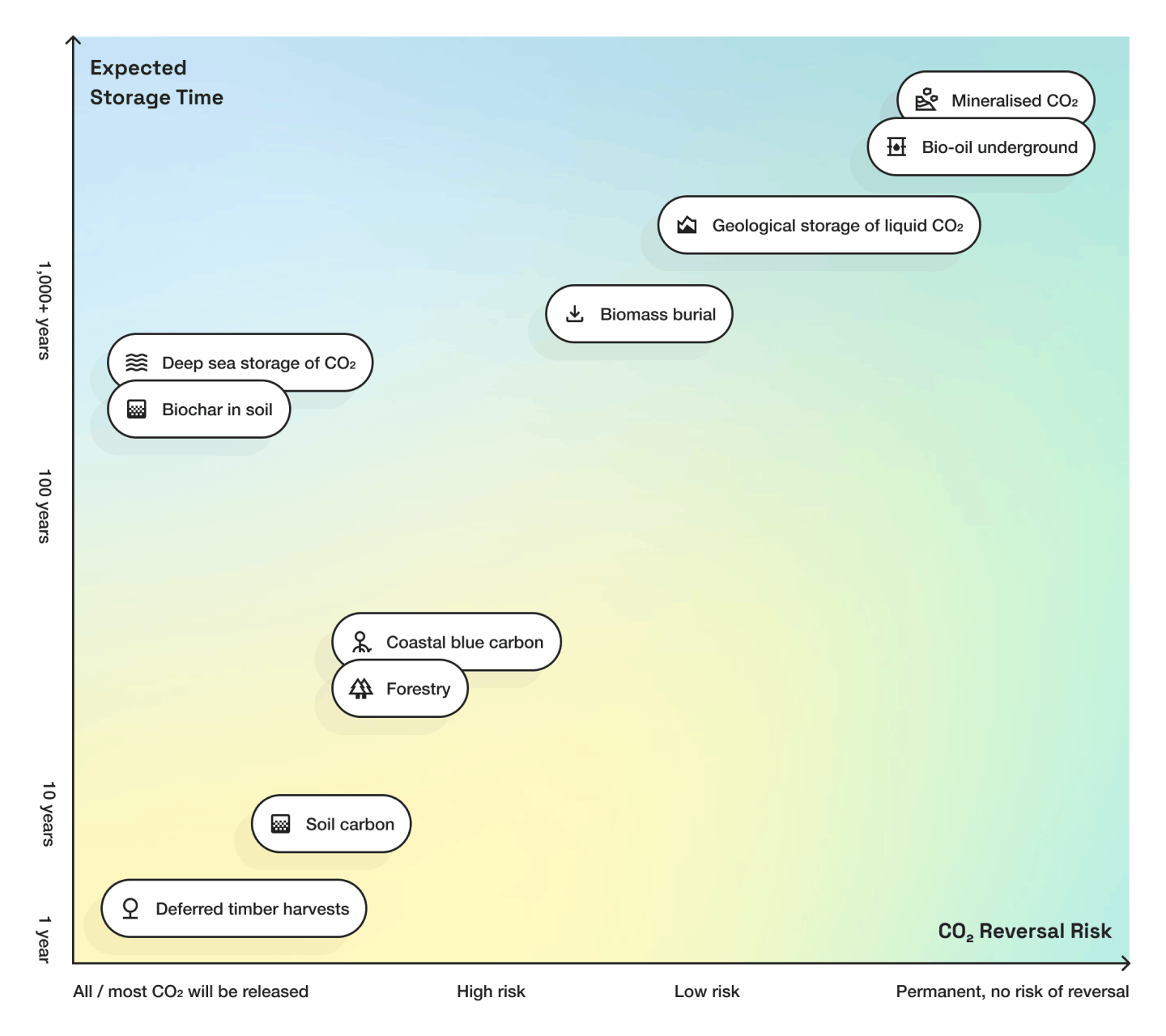

This is why the authors of the Oxford Offsetting Principles separate carbon project types depending on the length of time carbon is stored for, and the risk of reversal:

Diagram from the Oxford Offsetting Principles, p.7

Diagram from the Oxford Offsetting Principles, p.7How do high-quality projects approach permanence?

In carbon offsetting, as we know, quality is everything. So what should carbon buyers be on the lookout for from carbon projects in terms of permanence, to know that they’re a high-quality project?

Well, there are two sides to this question:

- Prioritising permanent carbon removal projects

- What to look for in non-permanent carbon projects

Prioritising permanent carbon removal projects – they’re to be provide long-term carbon storage

Firstly, as the Oxford Offsetting Principles highlight, carbon buyers should ideally purchase carbon credits from carbon removal projects with long-term (permanent) storage, to ensure real and lasting impact from offsetting.

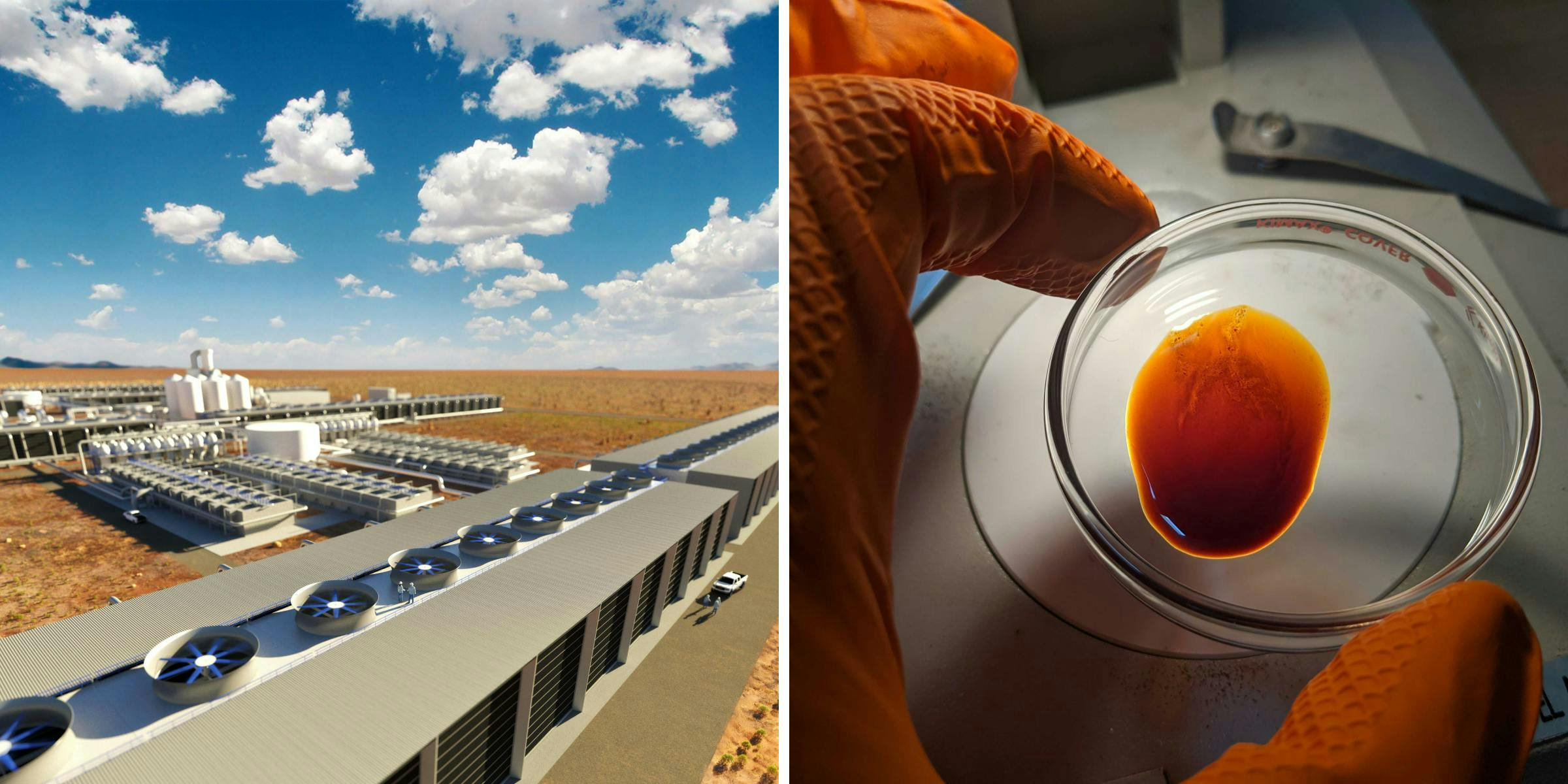

Permanent carbon storage methods are pretty new, so we’re likely to continue to see developments in this area. But a few examples of projects with permanent carbon storage from the Lune library are:

- 1PointFive (Direct Air Capture and geological storage): extracting carbon from the atmosphere and turning it into a liquid form which is then injected deep underground via wells, where it solidifies.

- Charm Industrial (bio-oil sequestration): waste biomass is converted into liquid form (bio-oil) which is injected deep underground via wells, where it solidifies.

- UNDO (enhanced weathering): waste basalt rock is crushed and spread on agricultural land, increasing the carbon removed in the natural process of rock weathering – wherein carbon is turned into solid carbonate in the natural carbon cycle. Read more in our deep dive on enhanced weathering.

- Running Tide (ocean carbon removal): buoys seeded with fast-growing kelp are deployed into the open ocean, removing carbon as they grow. The buoys sink to the depths of the ocean once they reach a critical mass, where they enter the slow carbon cycle and remain stored for hundreds of years. Read more in our deep dive on ocean carbon removal.

High-quality projects are always open and transparent about their methods, so you’d expect to be able to easily find information on how they are storing the carbon they remove and why they’re taking this approach – as well as scientific backing for this approach. As an example, take a look at 1PointFive’s explanation of their geological storage method.

Finding the best non-permanent carbon projects

Of course, not all carbon offsetting projects are permanent carbon removal projects.

And there’s still value to be had in non-permanent carbon projects.

Permanent carbon removal is still in the very early stages. All of the projects we outlined previously are using new, innovative methods for removing and storing carbon. They’re all still undergoing significant research and development, and it will be years before they’re able to fully scale up their approaches to the level of permanent carbon removal we need. Because of this, they’re also currently very expensive to buy carbon credits from.

This means that many individuals or businesses who are buying carbon credits for offsetting purposes simply cannot afford to offset their emissions fully using permanent carbon removal – and even if everyone could afford it, there wouldn’t be enough carbon credits available.

So, buying (much more affordable) carbon credits now from carbon projects with temporary carbon storage means that in the short-term this carbon does not enter the atmosphere – buying us time for permanent carbon removal to reach scale.

Here’s a summary of the different types of carbon projects, and their level of permanence:

If you’re buying carbon credits from projects with temporary carbon storage, you still need to make sure they’re doing everything they can to maximise permanence and mitigate the risk of reversal within their project and storage type.

This means checking their methodology and project documentation to understand their approach, and reaching out to ask them any unanswered questions.

It also means checking whether they are certified by a carbon standard such as Verra or Gold Standard.

Any project using an established methodology should be certified (it’s only those trialling new methodologies that cannot be certified, which is those early-stage permanence carbon removal projects). Being certified means that the project is following the methodology verified by that carbon standard, which will always include permanence checks. Importantly, carbon standards often also dictate that projects must build a buffer into their calculations, to account for any unexpected issues such as a wildfire in a forestry project – such as the Gold Standard’s compliance buffer.

Beyond this, carbon projects should also build a buffer into their measurements. This exists to mitigate any underperformance by a project, which means they create less carbon benefit than expected. Underperformance can be related to permanence, for instance if carbon storage is lost by a wildfire in a forestry project – so it’s an important marker of quality in terms of the risk of reversal.

So, common red flags in terms of permanence to look out for which indicate that projects may be low-quality are:

- A short project lifetime, indicating low commitment from the project developer and a high risk of reversal

- Limited proof of the reversal risk being mitigated e.g. in a forestry project you’d expect to see evidence of how they will reduce the risk of wildfires in the project area

- Unwillingness to engage in conversation or answer questions regarding permanent and reversal risk.

- No certification from a carbon standard which has a built-in buffer, and/or no evidence of building in a buffer into their own measurements of their carbon benefit.

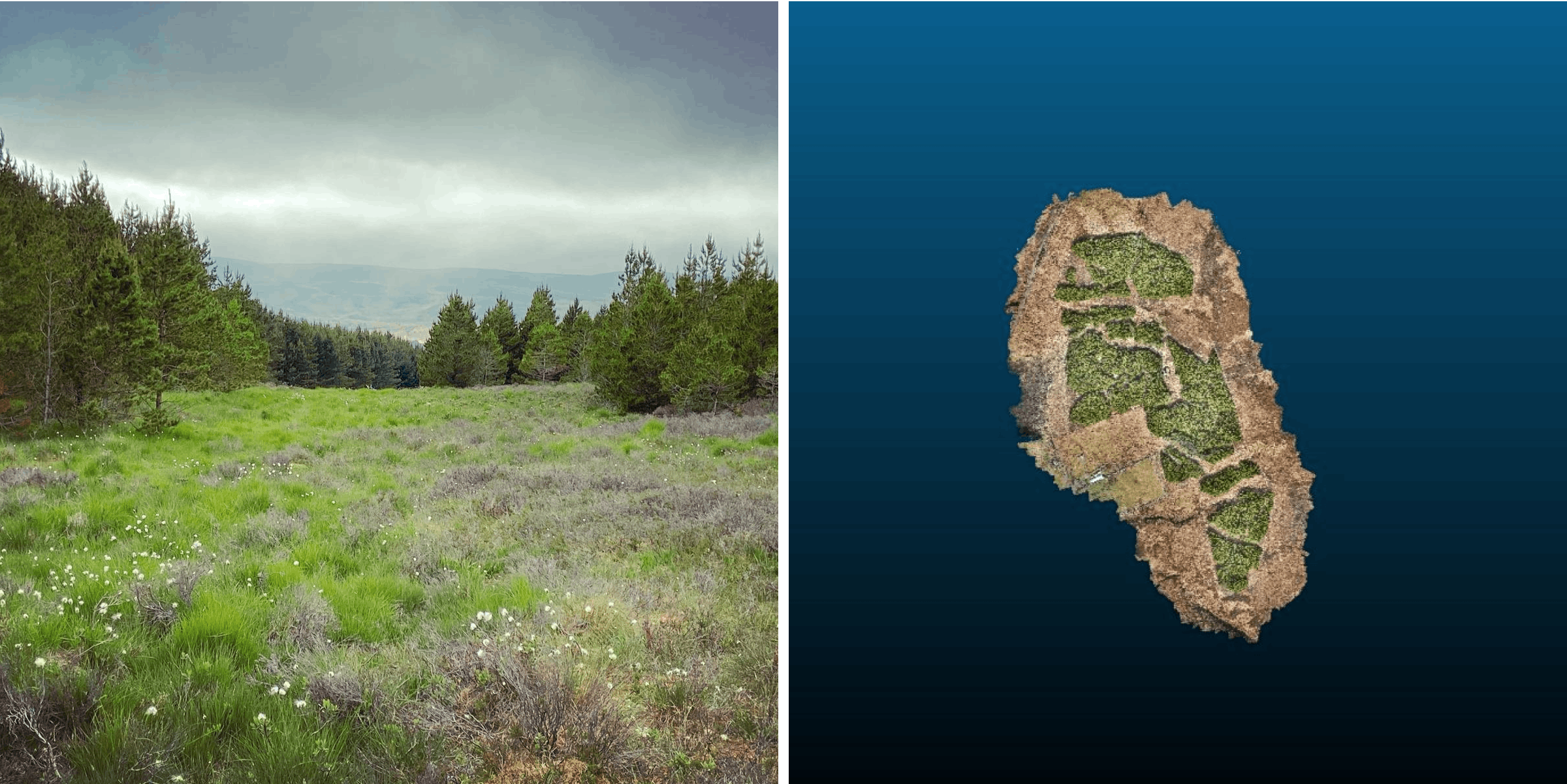

An example of a high-quality but non-permanent carbon project from the Lune library is the Ackron Mixed afforestation project, managed by Treeconomy.

As we’ve seen, afforestation projects provide only short-term storage, because the tree will eventually die and re-release carbon. And there’s a high risk of reversal due to factors such as disease, wildfires, changing land ownership and use etc.

High-quality afforestation projects will always take these permanence factors into account in their methodology and in their ongoing monitoring of the project – which is exactly what Treeconomy do at Ackron Mixed, including:

- A 75 year project lifetime to ensure the land use remains the same for the long-term, documented via their certification with the Woodland Carbon Code

- Planting a mixture of tree varieties to create a mixed native woodland, which reduces the risk of disease or insect infestation which impacts the entire forest (as well as promoting biodiversity too!)

- Remote sensing and satellite technology to carefully monitor the trees to protect them from disease, animal damage, wildfires etc and to ensure they can access the water, nutrients, sunlight etc needed to thrive.

In summary: our advice on how to approach permanence in your carbon offsetting

To summarise, we have two key pieces of advice for carbon buyers in terms of the permanence of the carbon projects they offset with.

Firstly, ensure you buy only from high-quality projects that are taking permanence into account. That means when you’re evaluating carbon offset projects based on permanence, you should be looking for:

- Evidence of long-term (permanent) carbon storage, or…

- Evidence that the project has taken their impermanence into account and mitigated it as much as possible – they’re certified by a carbon standard, they’re open and transparent about their methodology, they have a long project lifetime.

Secondly, in terms of your actual approach to offsetting, we’d recommend prioritising those permanent carbon removal projects, for the reasons we outlined in this article.

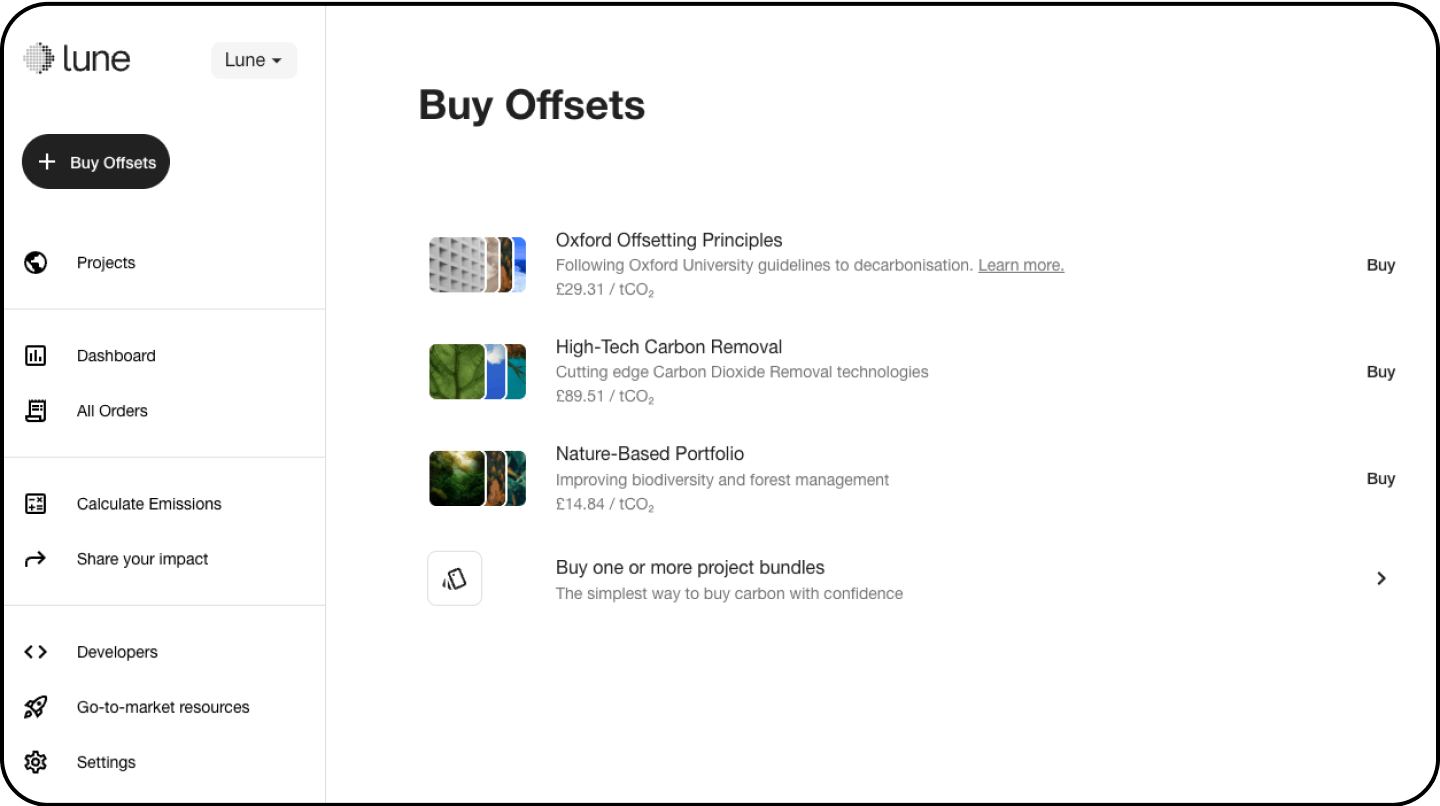

But, given these projects are currently the most expensive out there, if you can’t afford to offset with 100% permanent carbon removal, then we’d recommend following the advice of the Oxford Offsetting Principles. This means building a portfolio of different carbon project types across emissions reduction and carbon removal, short and long-term storage, and increasing spend in the carbon removal and long-term storage as time goes on.

That’s why at Lune we enable businesses to easily create a portfolio of high-quality carbon projects based on the Oxford Offsetting Principles through our dashboard, so purchases are aligned with expert research.

Get started by accessing our full evaluation process for finding the highest quality carbon projects with maximum real-world impact – including permanence and 5 other vital criteria. Or, if you’re ready to explore, head to the Lune dashboard to take a look at our carbon projects and start purchasing carbon credits.

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.