As company stakeholders go, investors are pretty vital.

Whether you’re an early-stage company raising venture capital to get the business off the ground, or an established brand working to increase the value of the company, the financial backing and guidance of investors and shareholders is of great importance.

And investors are increasingly making climate disclosure a key factor in evaluating companies to add to their investment portfolios. According to Morgan Stanley, 88% of global investors express interest in sustainable investing, with nearly all Gen Z (99%) and Millennial (97%) investors leading the charge.

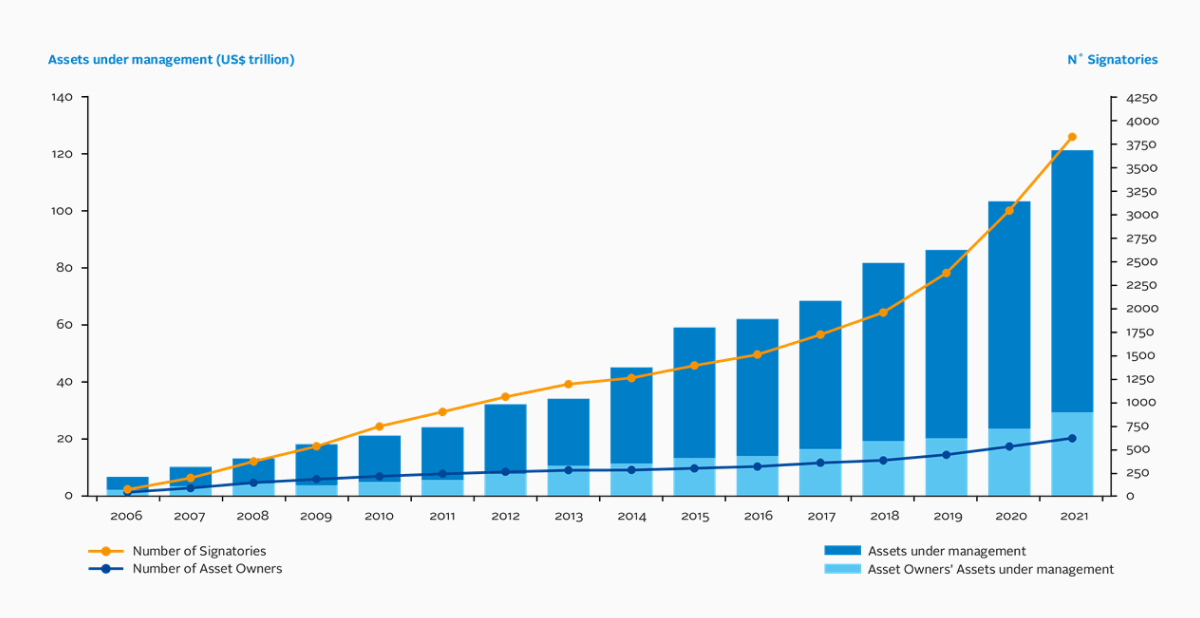

The Principles for Responsive Investment (PRI) collective now has over 5000 signatories who have committed to 6 core principles to bring environmental and social impact into their investment decisions.

The PRI's growth has accelerated significantly over the past few years as more and more entities focus on responsible investment, as you can see in this graph showing their growth from 2006-2021:

Principles for Responsible Investment, 2021

Principles for Responsible Investment, 2021So, being able to demonstrate that as a business you’re prioritising sustainability is crucial for relationship management with existing shareholders, as well as for attracting new investment into the company. Alongside several other arguments (risk management, customer acquisition and loyalty, employee retention), this is a major reason that businesses are making sustainability a top business priority – the business case for sustainability is incredibly compelling.

Two questions arise:

- What’s in it for investors – why are they prioritising sustainability?

- How can businesses prepare – what do investors want to see about?

Subscribe for the latest insights into driving climate positivity

Risk and reward: why investors are prioritising sustainability

Climate risk = business risk = investment risk.

Fundamentally, successful investments come down to risk and reward: mitigating risk in order to maximise reward. And it’s why the UK Sustainable Investment and Finance Association (UKSIF) list the following as the reasons to become a member:

- To profit from companies and activities that avoid causing harm

- Investments that are more likely to perform well over the long-term

- To reduce the financial risk of poor environmental, social and corporate governance (ESG) behaviours.

It’s becoming blatantly obvious that climate change is now a major risk for every kind of business. In turn, that causes a major issue for investors, who need to maintain the health and long-term viability of their portfolios.

In fact, an Economist Intelligence Unit study estimated that the total value at risk to the global stock of manageable assets by 2100 due to climate change is between $4.2 trillion and $43 trillion – so the risk at play is huge.

At the same time, evidence is flooding in that sustainable investing has the potential to bring higher returns too.

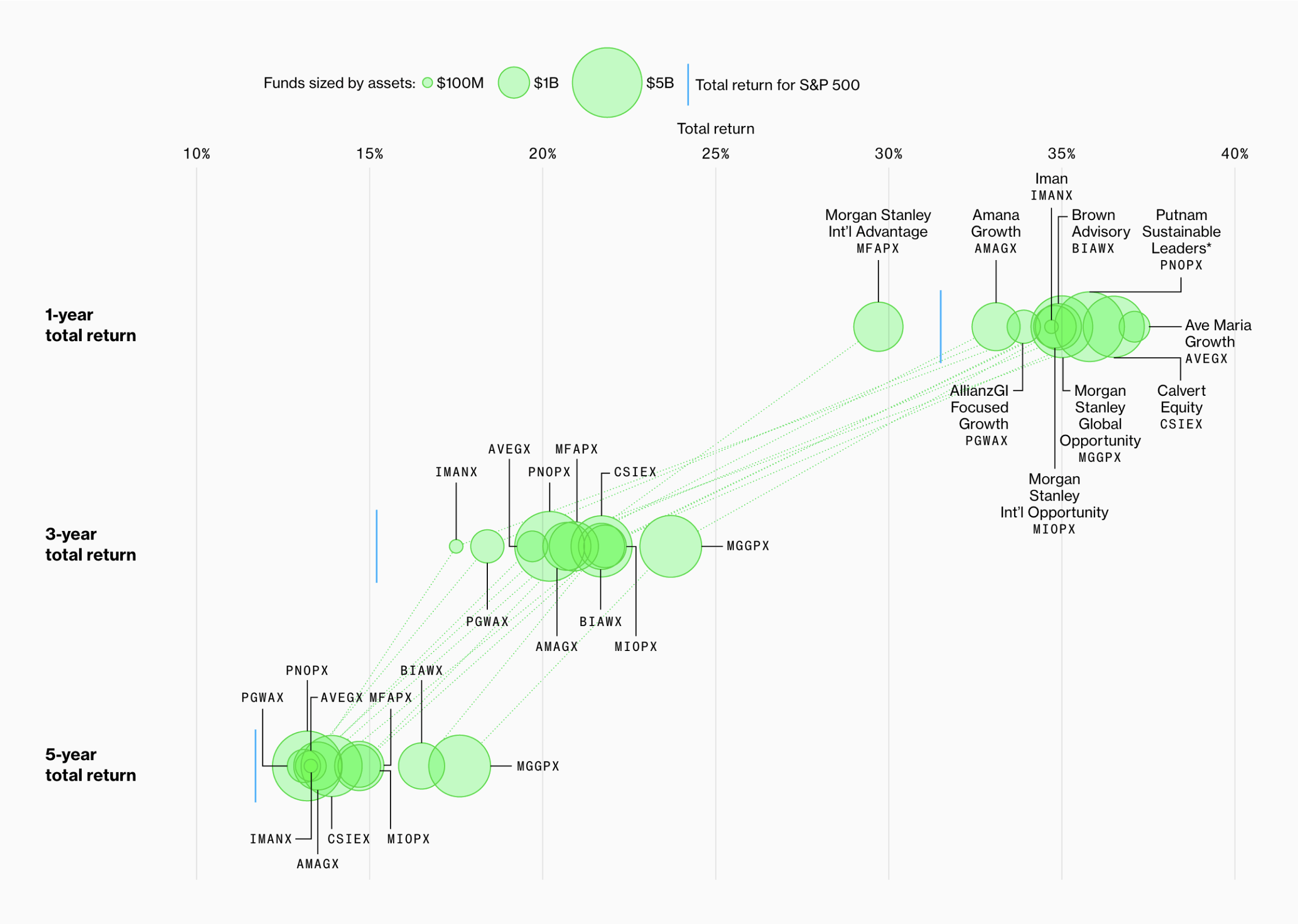

A study by Bloomberg, for instance, found that 9 of the biggest ESG funds in the US outperformed traditional funds, with gains of more than 35%, compared with 31.5% by traditional funds.

Bloomberg, The Biggest ESG Funds Are Beating the Market, January 2020

Bloomberg, The Biggest ESG Funds Are Beating the Market, January 2020And research by the Enacting Purpose Initiative has predicted that over the next 15 years we’ll see companies with a greater sense of purpose earning 9% higher total shareholder return, with 10% higher growth.

The most comprehensive research on the value of sustainable investment so far is a review study published in the Journal of Sustainable Finance & Investment, which used two methods to analyse over 2,000 existing studies on ESG investing and found that 90% of studies since 1990 have found a positive correlation between ESG and financial performance – suggesting an incredibly strong relationship between sustainability and investment returns.

So there’s clear incentive for investors to prioritise sustainability – to de-risk their portfolio whilst also building value for the long-term. It’s a no-brainer, which explains the steep growth in PRI signatories we saw at the beginning of this article.

But how exactly are investors bringing sustainability into their evaluation process – what are they looking for from companies?

Sustainability reporting: what investors want to see

Of course, to evaluate companies on this basis, investors need information on their environmental and social impact.

If you have existing investors, expect them to start demanding ESG or sustainability disclosure to be included as part of your standard reporting. If you’re looking for investment, expect that investors will opt for climate positive companies first, wanting to see evidence that sustainability considerations are at the core of a company.

What information do they want to see from companies?

In basic terms they’re looking for annual insights into a company’s own environmental impact and their plans to reduce this impact, as well as how the company is creating sustainable value via their business strategy and goals.

The specific information investors want to see, and how they want it to be delivered, can vary – as it stands investors have been using a variety of methods to evaluate investments based on sustainability.

But with incoming legislation and regulations on corporate climate disclosure being enforced in many countries, standardised frameworks are being developed to help investors and companies approach this.

So what does all this mean for your business?

Our main message is that in order to comply with requests and expectations from existing and potential investors, businesses need to start including ESG reporting in their annual reports.

Essentially, that means:

- Putting a comprehensive sustainability strategy in place which brings climate impact into the core of the company

- Incorporating climate disclosure into your company’s annual reports, to report on the progress of this sustainability strategy.

For guidance on developing a sustainability strategy which will make real, tangible impact, take a look at our previous article: Why 9 out of 10 sustainability strategies make no difference to the planet (and how to make sure yours does).

Of course, it’s also worth reaching out to any existing investors in your company and/or any new investors you’re hoping to raise funds from to see what their sustainability reporting expectations are too.

Subscribe for the latest insights into driving climate positivity

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.