Incoming climate disclosure regulations across the world will make it a legal obligation for companies to report on their environmental impact and improvements – supporting the transition to a low carbon economy.

This will affect all businesses across all industries.

For those in the finance and payments sector – an already highly-regulated sector – there are particular implications to think about.

That’s what we’ll explore in this article.

Plus, we’ve also included a list of actions to help you prepare for mandatory climate disclosure regulations – because it’s always a good idea to be ahead of the game when it comes to legislation.

Learn about existing and upcoming climate disclosure regulations

This year, countries across the world are rapidly advancing on climate disclosure regulations for businesses.

This was inevitable for a few reasons:

- The impacts of climate change become more and more disruptive (extreme weather events causing major global supply chain issues, for example)

- Increasing pressure for countries to decarbonise their economy to meet climate targets – and governments needing businesses to play their part.

- Rising demand from investors demanding sustainability reporting because they’re seeing reduced risk and increased returns from sustainable investments.

So, what existing climate disclosure regulations are already out there?

1. Global standards for climate disclosure

Firstly, there’s been a push to standardise what’s included in climate disclosure — for clearer and more consistent reporting across different countries and companies:

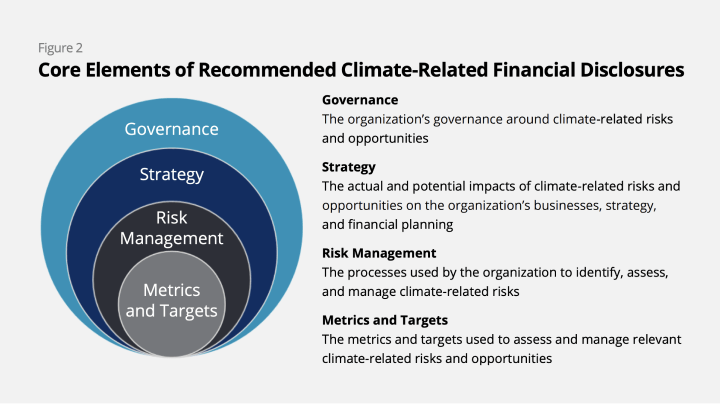

- Task Force on Climate-Related Financial Disclosures (TCFD): published recommendations for effective disclosure in 2020, aiming to create ‘a comprehensive global baseline of high-quality sustainability disclosure standards to meet investors’ information needs’. The TCFD was created by the Financial Stability Board (FSB), which contains members from all G20 countries, and so this has had a big influence on global disclosure recommendations and requirements since then.

- International Sustainability Standards Board (ISSB): a new international standard-setting board for climate disclosure and reporting which was announced in November 2021, aiming to provide investors with the information they need on sustainability-related risks and opportunities. This is yet to be finalised, but again is likely to have large influence on country-level regulations when the Board’s recommendations are in place.

These globally-recognised standards (particularly TCFD) have led more and more countries to start rolling out mandatory corporate climate disclosure regulations – forcing companies to report on their environmental impact and how they’re improving it.

2. Climate disclosure regulations already in place

The following regulations are already in place:

- In the UK mandatory disclosure requirements designed in-line with the TCFD recommendations were put in place from April 2022 for 1,300 of the largest companies and financial institutions in the country.

- The European Parliament agreed legislation in June 2022 which requires all large companies – around 50,000 in total – to submit climate-related reports from January 2024 onwards (reporting on 2023 activities). This will replace the current Non Financial Reporting Directive in the EU which has around 12,000 companies reporting.

- New legislation in India requires the 1,000 largest companies in the country (by market value) to report on sustainability from 2023 on.

- In New Zealand the government introduced legislation this year to make climate-related disclosures mandatory for publicly listed companies and large insurers, banks, and investment managers from 2023.

The US Security and Exchange Commission (SEC) also proposed rule changes in March 2022 which, if implemented (and this seems likely to happen), would also require all public companies registered in the US to disclose on climate-related activities.

For a full overview of current and upcoming corporate climate disclosure regulations across the world, head to our legislation overview blog – we keep it up to date with all the latest on sustainability-related legislation for businesses.

What are the implications of climate disclosure regulations for payments companies?

As countries roll out mandatory corporate climate reporting, there’s been a particular push on the finance and payments sector.

You may notice that some of the regulations listed above specifically include banks and financial institutions in the first batch of companies being made to report on climate.

Further, we’ve also seen many initiatives aiming to engage the sector with sustainability – such as the Net-Zero Banking Alliance which now has signatories from 23 countries, and the Green Finance Institute which aims to create financial solutions for a low carbon economy through collaboration within the sector.

Why is that?

Well, the financial and payments sector naturally have large influence over how money is spent and invested in the entire global economy, which means there’s a hugely important role for the sector to play as we transition away from an economy built on fossil fuels and towards the green and just economy of the future. That’s why we’re seeing rising scrutiny in the space, so far this has particularly focused on how banks are investing their money – such as the recent revelations around HSBC’s ‘sustainable finance’ which is actually funding mines, pipelines, and oil rigs – but we can expect scrutiny to increase across the sector as a whole as regulations are rolled out.

The emphasis on the sector in discussions around climate regulation reflects this, with governments recognising the need to align the financial sector with climate targets.

In addition to this, payments companies typically:

- Already face regulatory pressure: the payments industry is a highly-regulated one, from payments security to anti-money laundering to data protection. New climate regulations will add to this existing regulatory burden, and so payments companies have a particular need to prepare.

- Act as suppliers for other businesses: many payments companies operate in the B2B space, providing payments services to other companies across a variety of industries. This means that they will experience additional pressure from their business customers, who are being asked to report on and improve their own sustainability, and start looking to their suppliers for sustainable solutions.

All of this means that those operating in the finance and payments industry will be expected to disclose on climate impact, risks, opportunities, and actions – if they aren’t already doing so.

It’s easy to see this as a problem – there’s no denying that there is legal risk to address – but it’s also a major opportunity.

We’ve already highlighted that investors are seeing increased return from sustainable investments. At the same time, consumer demand for sustainable products and services is now sky-high, including demand for green payments options. There's an opportunity to fulfil this demand in every industry – but given we’ve already seen that finance and payments have an outsized influence, there’s a particular opportunity for sustainable finance and payments solutions.

Already we’re seeing major players in the industry differentiate through sustainability, such as Stripe developing Stripe Climate and Mastercard launching their carbon calculator.

The next climate leader in the payments space could be your company.

How can payment companies prepare for climate disclosure requirements?

The best time to act on climate disclosure is right now.

Even if your company isn’t yet included in those required to fulfil mandatory climate disclosure requirements in the countries you operate in, it’s a good idea to get ahead of the game. Requirements are highly likely to continue being rolled out to encompass all sizes of businesses – plus if you want to take advantage of the commercial opportunity we’ve outlined above, you need to act quickly to stay ahead of your competition.

There are plenty of actions to get started with to put you in good stead for the changes:

- Get to know the TCFD recommendations on climate reporting (covered in this article) – they’re currently the most accepted and used standard for how companies should disclose on climate, so once you are subject to mandatory climate disclosure it’s likely to be under guidelines similar to the TCFD recommendations, meaning they’re a great place to start to understand what you’ll be required to include in reporting.

- Calculate your existing carbon emissions to understand your starting point and identify areas for improvement.

- Set rigorous targets and KPIs to reduce emissions as much as possible, always using a respected framework such as Science Based Targets.

- Buy high-quality offsets to compensate for emissions you’re unable to reduce (or that will need long-term work to reduce).

- Identify climate risks to your business, and put mitigation measures in place – climate should definitely be part of your risk management process.

- Explore climate opportunities in your industry – how could your business respond to climate change beyond your own carbon footprint? For instance, in the payments industry that may be exploring how to offer consumers and/or businesses a ‘green’ payments alternative.

Starting with developing an impactful sustainability strategy which lays out how you will approach sustainability at your company and how it aligns with your overall goals and vision 00is the way to go – including all of the above actions. This will help to ensure you have a clear plan which everyone at the company is on board with and understands how their role contributes – which is a great place to start from to make a real impact on climate as a business.

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.