Corporate sustainability reporting is gradually becoming mandatory across the globe.

But what do companies need to include in their climate disclosures?

To be effective, companies need to be reporting in a consistent manner, so that comparisons can be made across companies in different countries and industries.

Investors are particularly pushing for this, calling for high-quality, transparent, reliable, and comparable reporting by companies on environmental matters.

So, this is why there are various bodies working on defining global standards for corporate climate disclosure – frameworks governing what companies should be including in their reporting. The most notable of these, currently, is the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations.

Even if sustainability reporting isn’t mandatory for your business yet, it’s highly likely that it will be in the next few years. And it’s also likely that your government will use standards like the TCFD to build their own legislation and regulations on corporate sustainability reporting – so it’s worth understanding what’s expected within these standards to know how this will impact your current corporate reporting cycle. Some companies are also choosing to adopt these standards voluntarily, to gain competitive advantage as investors, customers, and stakeholders increasingly demand climate disclosure.

So, in this article we’ll cover:

- The Task Force on Climate-Related Financial Disclosures (TCFD)

- The International Sustainability Standards Board (ISSB)

- An overview of the landscape of other climate disclosure standards

- Advice on how to get prepared for and started with sustainability reporting.

For an overview of current and upcoming corporate climate disclosure regulations across the world, head to our legislation overview blog – we keep it up to date with all the latest on sustainability-related legislation for businesses.

The Task Force on Climate-Related Financial Disclosures (TCFD)

The Task Force on Climate-Related Financial Disclosures (TCFD) was set up by the Financial Stability Board (FSB) to develop ‘a comprehensive global baseline of high-quality sustainability disclosure standards’.

In 2020 they published their recommendations for effective climate disclosure.

The recommendations have had a big influence on global disclosure recommendations and requirements since then.

For instance, the UK’s Sustainability Disclosure Requirements and the proposed SEC rule change in the USA are both using the recommendations of the TCFD to build their own legislation.

And many influential investment firms have also adopted the framework in their evaluation of investments, including BNP Paribas, BlackRock, and Aviva.

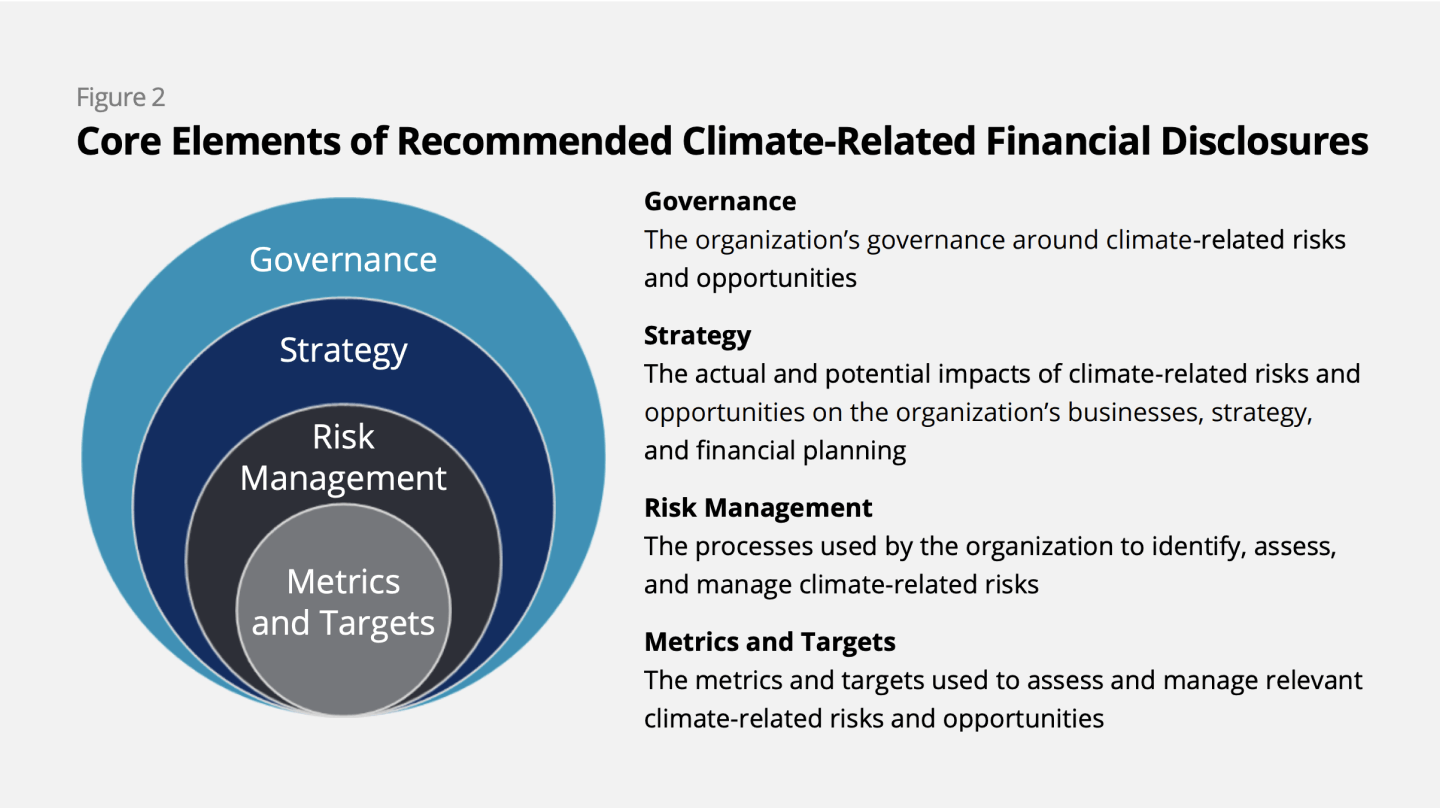

In terms of what should be included in sustainability reporting, the TCFD recommends 4 key areas of climate disclosure:

- Governance – how the company is bringing climate risk and opportunity into their governance and management. This could include relevant roles and responsibilities, KPIs and incentives relating to environmental performance etc

- Strategy – how the company is bringing climate risk and opportunity into their business plan and strategy to mitigate the risk and access the opportunities.

- Risk management – how the company is identifying and managing climate risk, and how this fits into their existing risk management processes.

- Metrics and targets – how the company is measuring and monitoring the climate risk and opportunities facing them, including setting goals and targets and actively moving towards them.

Within these 4 areas, the TCFD recommends 11 disclosures:

Governance:

- Describe the board’s oversight of climate-related risks and opportunities.

- Describe management’s role in assessing and managing climate-related risks and opportunities.

Strategy:

- Describe the climate-related risks and opportunities the organisation has identified over the short, medium, and long term.

- Describe the impact of climate-related risks and opportunities on the organisation’s business, strategy, and financial planning.

- Describe the resilience of the organisation’s strategy, taking into consideration different climate-related scenarios, including under a 2°C or lower scenario.

Risk management:

- Describe the organisation’s processes for identifying and assessing climate-related risks.

- Describe the organisation’s processes for managing climate-related risks.

- Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organisation’s overall risk management.

Metrics and targets:

- Disclose the metrics used by the organisation to assess climate-related risks and opportunities in line with its strategy and risk management process.

- Disclose Scope 1, Scope 2, and if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks.

- Describe the targets used by the organisation to manage climate-related risks and opportunities and performance against targets.

And the TCFD also outline 7 principles for effective, high-quality disclosure:

- Disclosure should represent relevant information

- Disclosure should be specific and complete

- Disclosure should be clear, balanced, and understandable

- Disclosure should be consistent over time

- Disclosure should be comparable among companies within a sector industry or portfolio

- Disclosure should be reliable, verifiable, and objective

- Disclosure should be provided on a timely basis.

The International Sustainability Standards Board (ISSB)

The International Sustainability Standards Board (ISSB) was determined as a need during COP26 in 2021 – an international standard-setting board for climate disclosure and reporting. It has since been developed by the International Financial Reporting Standards (IFRS).

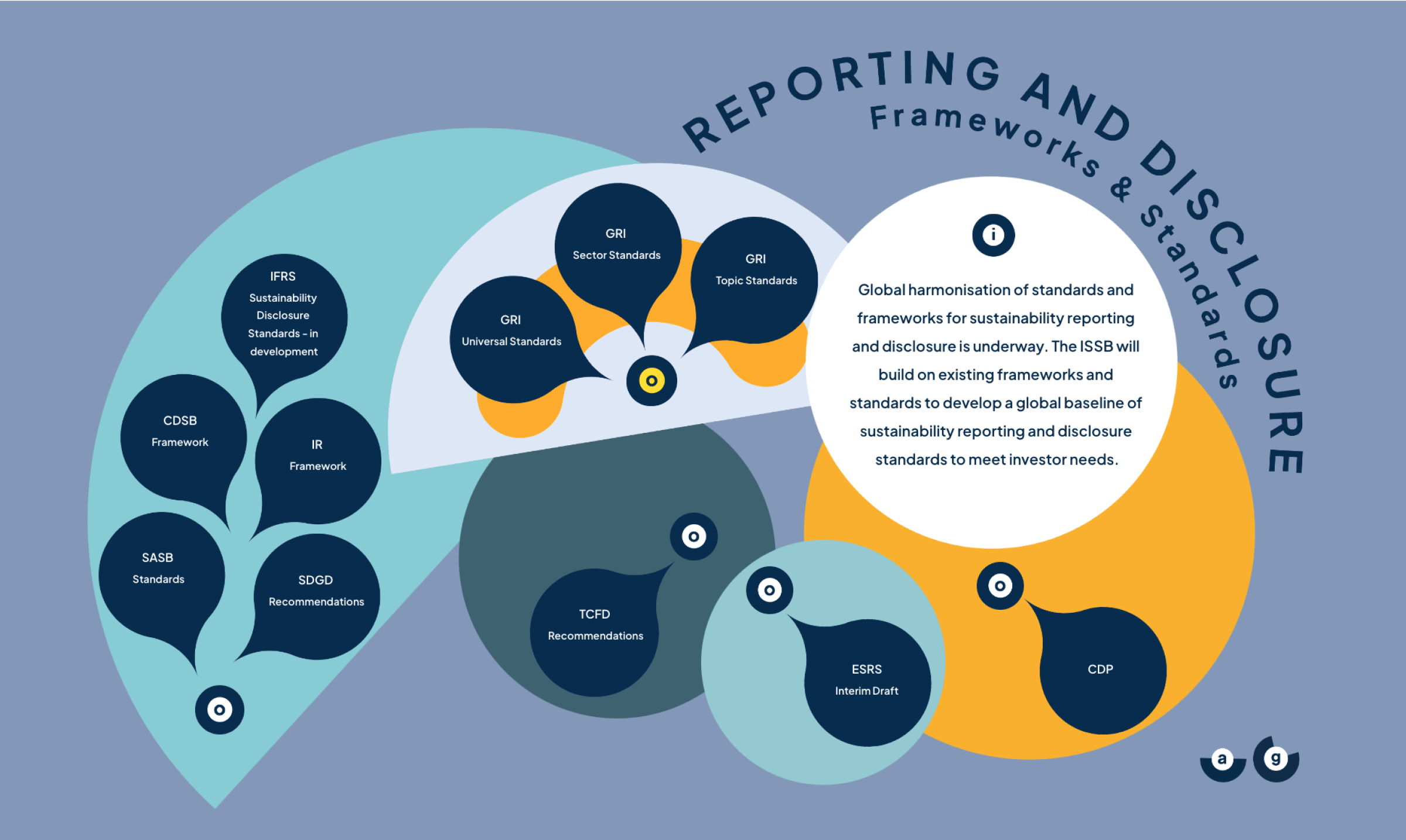

Its aim is to create a comprehensive global baseline of high-quality sustainability disclosure standards, building on the work of the TCFD.

Essentially, the group acknowledged that there are currently several sustainability standards, frameworks, and metrics out there which is causing confusion both for companies trying to report on sustainability, and for those trying to interpret the reports.

And, importantly, one of their core aims is to bring sustainability reporting within the normal financial reporting cycle of a business – so that sustainability reporting is not a standalone activity, but becomes part of a company’s core reporting and governance processes.

If successful, the newly created ISSB standard will become the core globally accepted standard for corporate climate disclosure.

In March 2022 the Board released the drafts of two Standards for public consultation. These were:

IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information Exposure Draft

This draft standard focuses on the disclosure of information on sustainability-related risks and opportunities.

A few key points to note within the draft are:

- It will require companies to report on sustainability-related risks and opportunities both for the business itself, and across its entire value chain including supply and distribution channels.

- The structure of what should be reported sticks to the structure defined within the TCFD recommendations of: Governance, Strategy, Risk Management, and Metrics and Targets.

- It requires that a company’s sustainability disclosures form part of general financial reporting and be published at the same time.

IFRS S2 Climate-related Disclosures Exposure Draft

This draft standard focuses on reporting standards for identifying, measuring, and reporting the climate impact of a business.

A few key points to note within the draft are:

- It acknowledges that the mandatory disclosure of Scope 3 emissions and intensity will be particularly challenging for businesses.

- It requires that joint ventures, associates, unconsolidated entities, and affiliates report their emissions separately.

- It requires scenario analysis aligned to the Paris Agreement goals – likely requiring building models and sourcing data.

The ISSB is now revising these based on feedback from the consultation period, with a planned release date for Q2 2023 – and more to follow.

Once any final standard is released we’ll update this post with the details – and you can sign up to our monthly newsletter to be notified.

Other notable standards for sustainability reporting

We mentioned earlier that the landscape on standards and frameworks for effective sustainability reporting is a broad one – and it is. There are many legacy frameworks and initiatives out there, some of which remain influential.

We’d recommend focusing on the TCFD and ISSB as they’re the standards that are currently creating the path forward for global standards.

But, to give a flavour of what’s out there, some of the other standards include:

- GRI (Global Reporting Initiative): the GRI standards formed the foundations of sustainability reporting across the world, with general standards and sector specific standards across environmental, social, and economic disclosures.

- SASB (Sustainability Accounting Standards Board): the SASB is an independent organisation based in the US, with industry specific standards for ESG impacts of companies across 77 different sectors.

- GHG Protocol (Greenhouse Gas Protocol) Corporate Standard: guidance for companies accounting and reporting their carbon footprint across Scopes 1, 2, and 3.

- CDP (Carbon Disclosure Project): an open database of environmental disclosure information from companies across the world, aiming to increase transparency, measure overall corporate action, and encourage further action. They also offer guidance and frameworks for companies looking to disclosure through the project.

If you’re interested in exploring the whole landscape of different standards, frameworks, and guidance for corporate sustainability reporting, then take a look at the ‘climate disclosure microsite’ by Chapter Zero and The Hughes Hall Centre for Climate Engagement. It visually summarises the key players within climate disclosure standards.

How to get prepared for corporate sustainability reporting

Even if your company isn’t yet included in those required to fulfil mandatory climate disclosure requirements in the countries you operate in, it’s a good idea to get ahead of the game. Requirements are highly likely to continue being rolled out to encompass all sizes of businesses – plus if you want to take advantage of the commercial opportunity we’ve outlined above, you need to act quickly to stay ahead of your competition.

There are plenty of actions to get started with to put you in good stead for the changes:

- Get to know the TCFD recommendations on climate disclosure – they’re currently the most accepted and used standard for how companies should disclose on climate, so once you are subject to mandatory climate disclosure it’s likely to be under guidelines similar to the TCFD recommendations, meaning they’re a great place to start to understand what you’ll be required to include in reporting. They also have a set of example company disclosures.

- Calculate your existing carbon emissions to understand your starting point and identify areas for improvement.

- Set rigorous targets and KPIs to reduce emissions as much as possible, always using a respected framework such as Science Based Targets.

- Buy high-quality offsets to compensate for emissions you’re unable to reduce (or that will need long-term work to reduce).

- Identify climate risks to your business, and put mitigation measures in place – climate should definitely be part of your risk management process.

- Explore climate opportunities in your industry – how could your business respond to climate change beyond your own carbon footprint? For instance, in the payments industry that may be exploring how to offer consumers and/or businesses a ‘green’ payments alternative.

- Start with developing an impactful sustainability strategy which lays out how you will approach sustainability at your company and how it aligns with your overall goals and vision is the way to go – including all of the above actions.

Want support? We can help with calculating your emissions, high-quality offsetting, and exploring opportunities for embedding climate impact within your product – get in touch.

Subscribe for the latest insights into driving climate positivity

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.