Ex-post vs ex-ante vs pre-purchase carbon credits – what's the difference?

First things first: a carbon credit is a tradable unit representing 1 tonne of CO₂. Carbon credits are issued based on the amount of CO₂ a carbon project will reduce or remove, and the projects fund their work by selling these credits to individuals or businesses who buy them to compensate for their own emissions.

But, there are a few different types of carbon credits that can be issued:

- Ex-post

- Ex-ante

- Pre-purchase

Let’s take a look at what these different types mean, as well as the pros and cons of them for carbon buyers.

What are ex-post carbon credits?

Ex-post carbon credits are issued for emissions reductions or carbon removal that has already taken place.

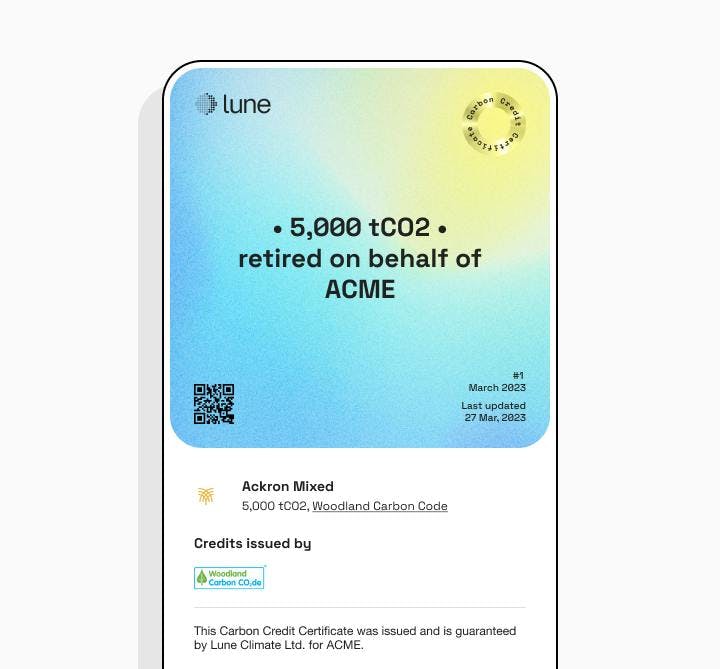

For example, in an afforestation or reforestation project, ex-post carbon credits would mean that the forest has already grown, and has removed and stored the planned amount of carbon emissions – like the credits sold by the Ackron Mixed UK afforestation project.

The main pros of buying ex-post carbon credits are that:

- The risk for the buyer is reduced, because the project has been a success, the carbon benefit has already taken place and has been verified as such by the entity issuing the carbon credits.

- Carbon credit retirement can happen instantly. Retirement happens once the carbon benefit the credit represents has taken place, which means that ex-post credits can be retired in the registry in the buyer’s name as soon as they are sold. In reality, retirement can still take days or weeks to occur because of legacy processes in the voluntary carbon market, which our instant retirements are changing.

However, it’s not always possible for carbon projects to offer ex-post carbon credits, which is where ex-ante credits come in.

What are ex-ante carbon credits?

Ex-ante carbon credits are issued for emissions reductions or carbon removal that will take place in the future.

For example, an afforestation or reforestation project could issue ex-ante carbon credits against the expected carbon benefit they have calculated, whilst their activities are in the early stages e.g. seedlings are planted and are starting to grow. The actual carbon benefit will occur later, once the seedlings have successfully grown into trees.

If you buy ex-ante carbon credits, you will still receive a carbon certificate to prove your purchase, but the credits will not be retired until the carbon benefit has actually taken place.

The main pros of buying ex-ante carbon credits are:

- Funding ongoing project activities. Projects sell ex-ante carbon credits to finance the ongoing work of the project, meaning that you are directly contributing to the success of the project as a carbon buyer. You’ll also be able to track the progress of the project through updates, which can be a great engagement tool for employees and customers.

Because the impact has not yet happened and been measured and verified, there is some risk attached to buying ex-ante carbon credits, as it’s possible that the project will fail to achieve its expected impact and be unable to deliver on your purchase.

So, it’s extra important to ensure that the carbon project you’re buying ex-ante carbon credits from is high-quality, with a robust methodology and a rigorous approach to both initially estimating their carbon benefit and ongoing MRV to check that the estimates are accurate as the project is in operation.

Take a look at our carbon project evaluation guide for more guidance on this.

What are pre-purchase carbon credits?

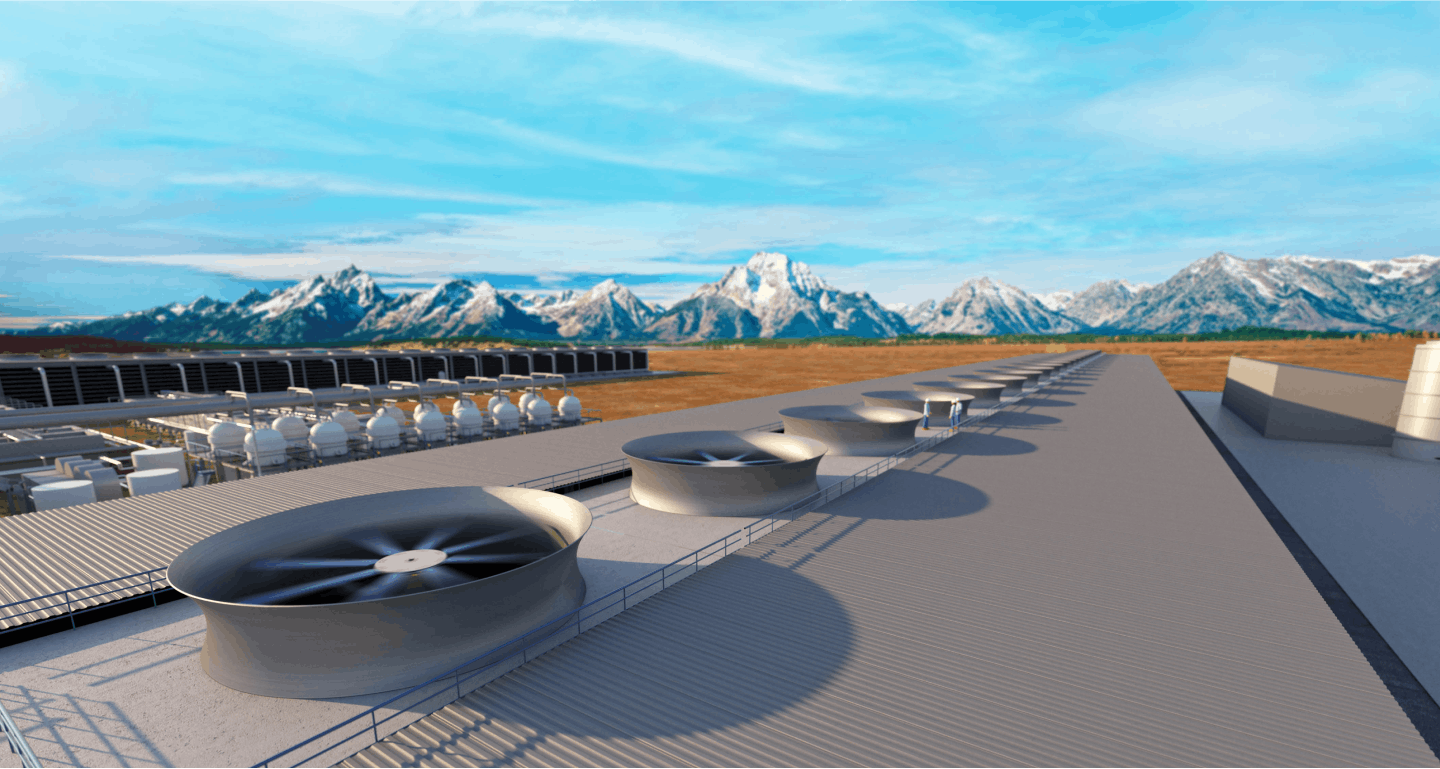

Pre-purchase carbon credits are sold today, but are not actually yet issued. This essentially represents a promise from an early-stage carbon project that they will issue carbon credits in the future, once the project is up and running – often the only way to buy carbon removals today.

For example, a Direct Air Capture (DAC) project could sell pre-purchase carbon credits whilst in the process of designing or constructing their DAC plant, and issue the credits when the plant is operational and carbon removal is taking place.

That’s exactly what Lune project 1PointFive is doing, pre-selling carbon credits for a DAC plant that is currently in construction, with the credits due to be issued in 2025 once the plant is fully operational.

The main pros of buying pre-purchase carbon credits are:

- Funding vital, early-stage projects. Projects pre-selling carbon credits are reliant on the funding from these sales to implement their project, meaning you are instrumental in their success as a carbon buyer. This includes the majority of innovative technological carbon removal projects (like DAC) – which have incredible potential to scale up and remove vast amounts of CO2 (which we desperately need), but require funding now in order to reach that potential.

As with ex-ante carbon credits, there is some risk involved in this, because the carbon benefit of the project has not yet been measured and verified – in many cases the project is not even yet operational. So, as before, it’s important to be extra careful in evaluating the quality of the project before you commit to buying carbon credits.

Ex-post vs ex-ante vs pre-purchase: which should you opt for as a carbon buyer?

As you can see, there are pros and cons to ex-post, ex-ante, and pre-purchase carbon credits. So should you prioritise one type of credit over the others?

The answer is that all these types of carbon credits have a hugely important role to play.

Ex-post carbon credits offer guaranteed, measurable, verified carbon benefit, which reassures carbon buyers that their purchase is having the desired impact – especially important if carbon credits are used to offset your own emissions.

But, ex-ante and (especially) pre-purchase carbon credits offer vital funding to ongoing and early-stage carbon projects with vast potential, including carbon removal projects which we desperately need to see scale up successfully.

So, our suggestion?

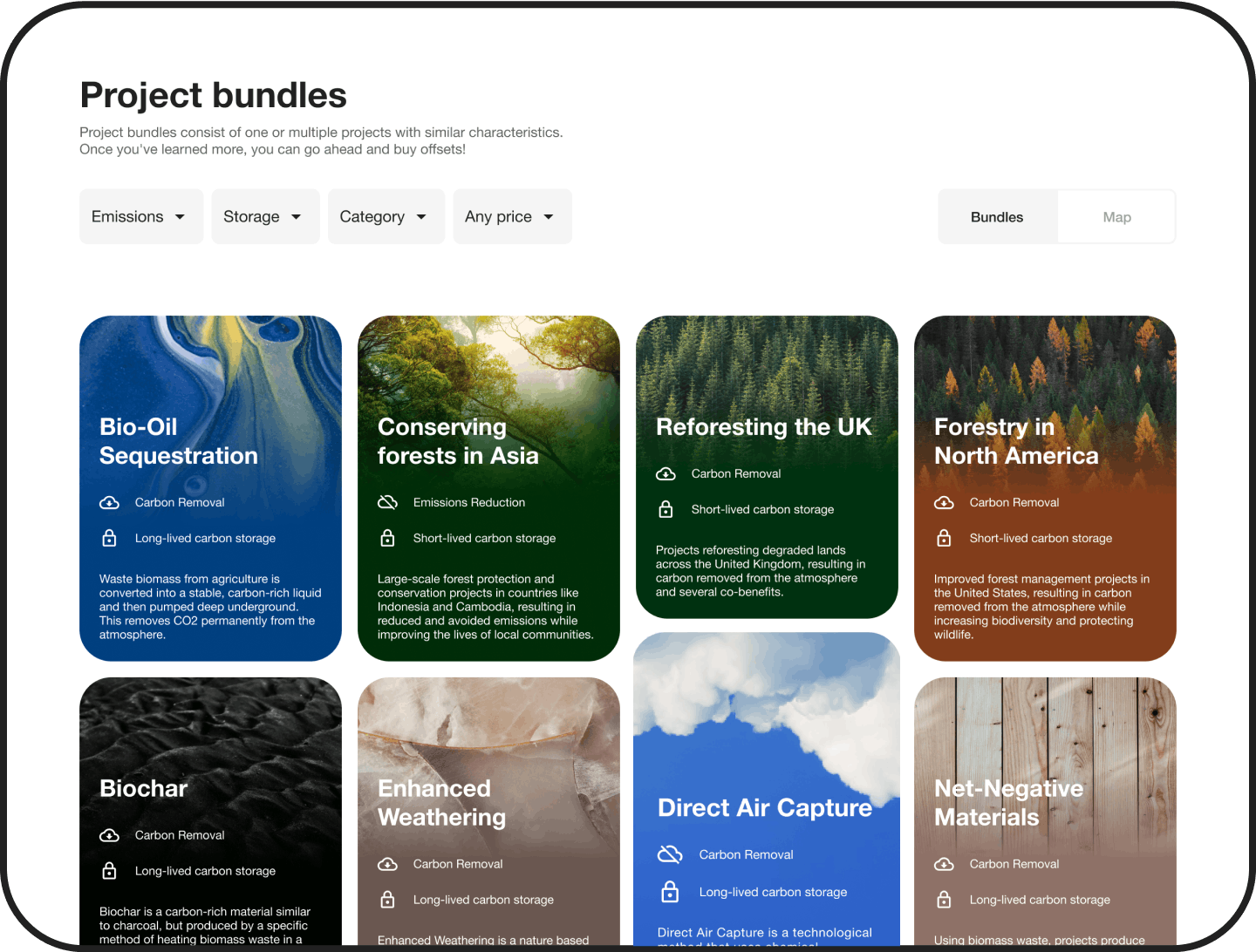

Build a carbon offsetting portfolio that incorporates ex-post, ex-ante, and pre-purchase carbon credits across a few different carbon projects. This will help to balance the pros and cons we’ve outlined here – de-risking your carbon credit purchases.

If the idea of a portfolio approach appeals, we can help you create the right portfolio – whether it’s bespoke to your company, or aligns with best practice such as the Oxford Offsetting Principles.

To get started, sign up to the Lune dashboard.

Readers also liked

Readers also liked

Subscribe for emissions intelligence insights

Get the latest updates in the world of carbon tracking, accounting, reporting, and offsetting direct to your inbox.